| Neurological diseases like Parkinson's and dementia are some of the most difficult to treat. While we've come a long way, our understanding pales in comparison with most deteriorative biological diseases. We know how to treat and prevent heart disease. But when it comes to the brain, we're still in the dark ages. While it's true there are hundreds, if not thousands, of companies trying to tackle today's problems, Inhibikase Therapeutics, Inc. (NASDAQ: IKT) has a unique solution to the problem. Rather than trying to reimagine the problem, they focus on reengineering, taking what works elsewhere and applying it to their research and development. And for traders, there's plenty of price action around these promotions. Inhibikase Therapeutics, Inc. (NASDAQ: IKT) - 1-month trading range: $0.5200 - $0.9345

- Typical average daily volume: ~320,000

- Float: 22.67 million

Inhibikase Therapeutics' Business Not all drugs are spun from thin air. Inhibikase starts with currently marketed or clinically evaluated small molecule drugs that target Central Nervous System (CNS) or non-CNS diseases. Then, they use the preexisting chemical entities as a template to pursue clinically validated targets to create products that treat neurodegenerative diseases. Essentially, they take current drugs and make them better.

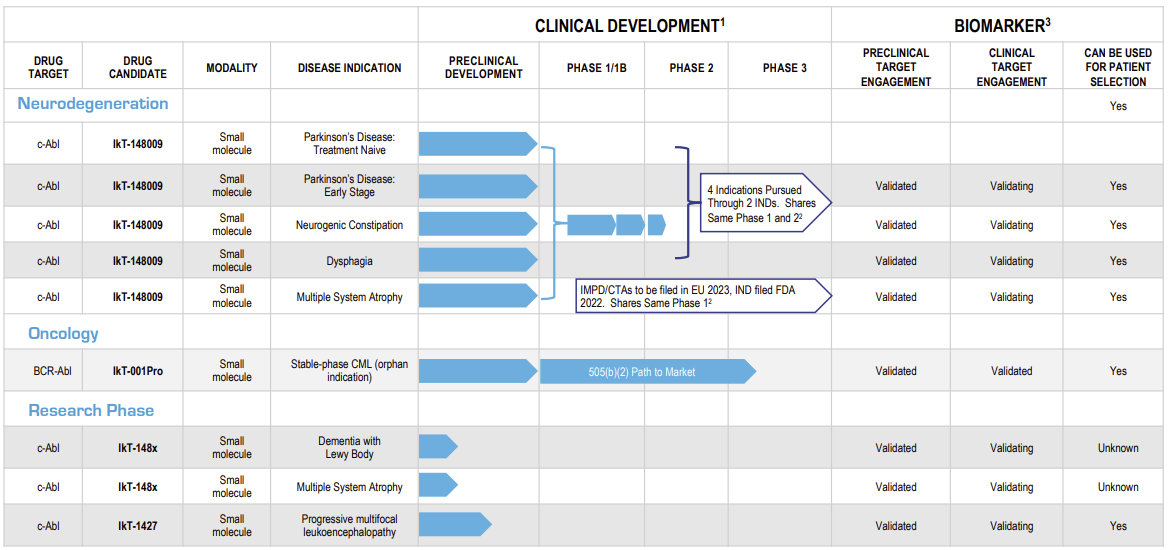

Source: Inhibikase Website The company's trademarked Re-engineering Approach with Metabolism Preserved (RAMP™) is the secret sauce that helps them develop these novel drugs. For neurological diseases, the company focuses on developing a new class of protein kinase inhibitors for CNS diseases sensitive to the treatment. In 2021, the company commenced its clinical trials for its IkT-148009, a small molecule Abelson Tyrosine Kinase inhibitor, which it believes can treat Parkinson's and the gastrointestinal it causes. The company's current pipeline includes some exciting updates: On March 8, the FDA lifted its full clinical hold on Inhibikase's IkT-148009 for Multiple System Atrophy, allowing them to continue with Phase II clinical trials. Phase II evaluates the safety, tolerability, and efficacy of the drug. It's worth noting the stock jumped 35% overnight on the news, although it closed near the days lows. Nonetheless, that day saw nearly 2 million shares traded. However, when the FDA lifted its hold on the general Parkinson's trials on January 25, the stock, which had already jumped almost 30% in the two days prior, popped another 26% on nearly 9 million shares of volume, bringing the total gains to almost 65% over three trading days. To be fair, shares quickly retreated and gave up all the gains within another two days. Phase IIa began screening patients in Q1 of this year. While the focus is mainly on neurodegenerative diseases, Inhibiakse also has Orphan Drug Designation (limited use case) from the FDA and is currently in Phase III trials which is expected to be completed in the first half of 2023. Promoter Activity I came across two promoters delivering campaigns for IKT. Both laid out the following as catalysts: - FDA ruling to lift its hold on the Phase II trial for Multiple System Atrophy

- Low float

- Parkinson's treatment market size will hit over $12 billion within a decade

- Strong partnerships with leading research institutions.

The FDA ruling paves the way for the company to continue its progress. After all, when the hold was announced, shares dropped by almost 50% the following day. And when the hold was lifted, shares ran hard. Much of the price action will depend on the results from the studies, which should leak out over the next 6-12 months. Now, I wouldn't call the stock low-float with 22.67 million shares. But it's not heavy either. Let's just go with medium rare. The market size for Parkinson's treatments is huge. However, that's nothing new, and the company still needs to get its drugs approved. Collaborations between IKT and leading institutions such as the National Institutes of Health (NIH), the University of California, and the Michael J. Fox Foundation certainly add credibility to the company. But, again, it's nothing that hasn't been known for quite a while. So, let's talk about one of our favorite topics - money. Both promoters were hired from 3/2/2023 - 3/17/2023 for a whopping $175,000 each. That's a lot of money and a lengthy promotion - one of the costliest and longest I've covered to date. Straight to the Facts Given the length of the promotion, any news released during this period is likely going to get a lot of eyeballs. That could quickly translate into a lot of interest in the stock. While I said many of the other stocks I've covered should be on watchlists for months, this one I would keep a close eye on this through the 17th. Always at your service, Baron Von Stocks P.S. Want instant STOCK alerts on the HOTTEST awareness stocks? Join our free sms list here >> |

Post a Comment

Post a Comment