| Managing Editor’s Note: Matt’s been hitting on the energy sector hard this week, but there’s a good chance he hasn’t talked about a stock that’s within your own portfolio. If you want to know how a certain ticker rates, go here, look for the “Get Stock Rating” button and search for a ticker. Then email us at StockPower@MoneyandMarkets.com and tell us how it stacks up if you’d like!

— Chad Stone

- The global demand for oil and natural gas isn’t going away anytime soon.

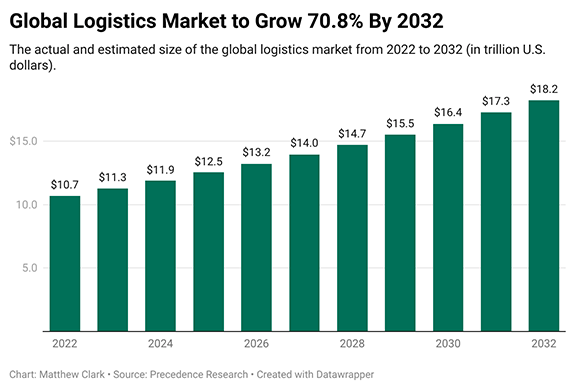

- The value of the logistics market globally is estimated to reach $18.2 trillion by 2032.

- Today’s Power Stock is an international provider in the transportation of refined petroleum products and rates a 96 on our proprietary system.

|  | The world’s thirst for oil and natural gas continues to grow. The International Energy Agency just increased its forecast for oil demand by 200,000 barrels per day in 2023 alone!

After the fallout with Russia’s invasion of Ukraine, Europe still needs exports from the Middle East and the U.S. to satisfy its need for these commodities (as I mentioned in depth in my piece earlier this week).

The most reliable way to move oil from one point to another is via ship.

And that’s where another lucrative trend comes in.

Logistics — aka efficiently moving goods and services from one point to another — is an integral part of the oil and gas supply chain.

And the logistics market is growing at a rapid pace. Waterway transportation was the fastest-growing segment in 2022.

Precedence Research found the global logistics market worth $10.7 trillion in 2022. It forecasts that value to rocket up more than 70% by 2032:  (Click here to view larger image.) And increased demand for waterway transportation will lead that charge.

I’ve found a way we can profit from these trends using our incredible and proprietary Stock Power Ratings system.

Click here to see what company is in prime position for these mega trends now.

| From our Partners at Trend Trader Daily 40 years ago Ronald Reagan implemented a radical new idea...

Which led directly to the rise of one of the most profitable investments of the decade. And now, starting as soon as March 31st, 2023, Reagan’s idea could be rolled out in full force once

again...

Leading to what could be the most profitable investment of the century.

Just click here now for the full story. |

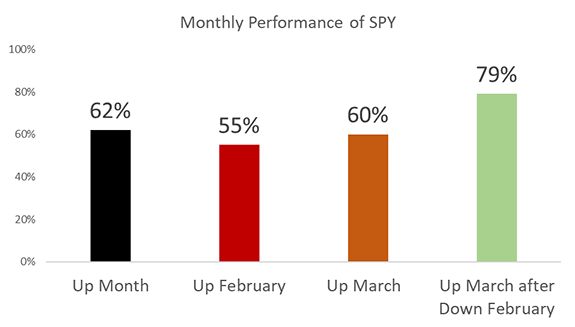

After a Down February... The SPDR S&P 500 ETF (NYSE: SPY) fell about 2.5% last month.

A monthly loss in the fund is kind of unusual. A little more than one in three months is a loser. But it may be a good thing…

Over the past 30 years, SPY delivered gains over a one-month period 62% of the time. For some reason, February is one of the weakest months, delivering gains just 55% of the time. March is also slightly less bullish than average with gains 60% of the time.

But history says this March could be a winner.

After a losing February, March has ended higher 79% of the time.

Unfortunately, March has also been a down month 75% of the time during bear markets.

Bottom line: The data in the chart below isn't tradable, but it does tell us to expect higher-than-average volatility this month. That environment can be difficult for long-term investors to suffer through, but short-term traders should be excited about the prospects.  (Click here to view larger image.)

Check Out the Latest From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment