- After the recent collapse, bank stocks look rough.

- A deep dive into our Stock Power Ratings system shows you that certain bank stocks are not good investments.

- Today’s Stock to Avoid is a massive $145.6 billion bank that rates a “Bearish” 22 out of 100 on our proprietary system.

| Silicon Valley Bank’s collapse last week hammered financial institutions large and small.

Since last Wednesday through Monday: - The SPDR S&P Bank ETF (NYSE: KBE), an exchange-traded fund that holds larger U.S. banks, lost 20%.

- The SPDR S&P Regional Banking ETF (NYSE: KRE), a similar regional bank fund, fell 23%.

Many bank stocks posted a solid recovery on Tuesday after the government quelled bank-run fears. But this situation put the industry under the spotlight for all the wrong reasons.

And it’s created a significant headwind in the banking industry which means several bank stocks of all sizes are ones to avoid.

I started screening stocks through Stock Power Ratings, and one big name stuck out to me: Wells Fargo & Co. (NYSE: WFC).

Let’s see why…

| From our Partners at Stansberry Research. Investor who predicted the last market crash says ‘if you think things are returning to "normal" in the markets, you’re in for a big surprise.

More here. |

The Good Thing About Value Clint Eastwood must be a value investor. He understands that things can be good, bad and ugly.

I can’t think of a better description of value investing, a strategy that involves targeting companies with strong fundamentals and trading at a fair price.

Just like Clint, I’ll start with the good aspects of value. I’ll cover the bad and ugly later this week.

The good is what everyone knows about this strategy. It’s probably the most popular style of investing — at least when popularity is measured by how many people claim to invest this way.

Value investing has a long history. It dates back to at least 1934 when Ben Graham published his book, Security Analysis. Graham taught Warren Buffett decades after that and Buffett made his fortune using the principles Graham laid out.

And now the masses want to be like Buffett. That’s for good reason at first glance.

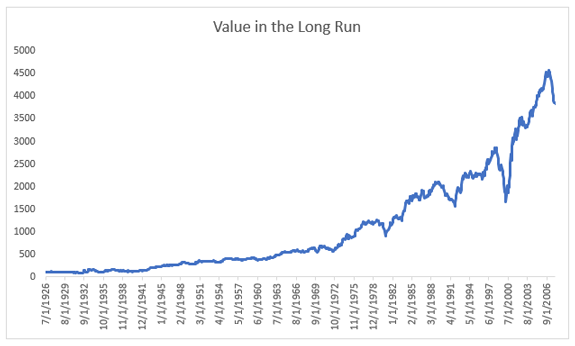

Long-term returns for the strategy are strong. According to one proponent of value: Over the past 50 years, from 1968-2020, stocks in all three of Graham’s categories outperformed the S&P 500. Against an annual average rise in the market index of 10.3%, the bottom 20% by [price-to-earnings ratio] rose by 14.6%, the bottom 20% by [price-to-book value] by 13.9%, and the top 20% by dividend yield by 12.4%.

This sounds great.

The chart below shows data for value from 1926 through 2007. The uptrend is interrupted by occasional downdrafts.

This chart ends in 2007. And I’ll tell you why when I discuss the bad tomorrow.

(Click here to view larger image.)

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment