- Reliable technology depends on a strong infrastructure.

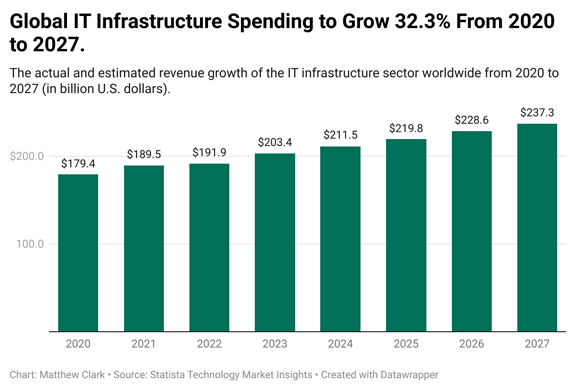

- Global spending on information tech (IT) infrastructure will reach $237.3 billion by 2027.

- Today’s Power Stock provides IT infrastructure hardware and services massive clients. And it rates an 87 on our proprietary system.

| The other day, I was streaming my favorite TV show and, all of the sudden, my internet went out.

Absolutely frustrating.

The last thing I wanted to do was call my internet provider and wait on hold for an hour.

Now, I know that this kind of thing is just a minor inconvenience in the grand scheme of things.

But when an outage occurs on a larger scale, businesses can lose thousands — or even millions — in revenue as the outage drags on.

That’s why companies spend millions to ensure their networks, internet and data processing run smoothly.

Better to spend millions now, than millions (or more) later.  (Click here to view larger image.) Data firm Statista projects global spending on IT infrastructure will reach $237.3 billion by 2027.

That’s a 24% increase over the next five years!

Using our Stock Power Ratings system, I’ve found the perfect stock to capitalize on this trend.

Click here to continue reading…

| From our Partners at Paradigm Press. Secret plan to destroy the markets?

This former government insider just went on LIVE camera and exposed the Federal Reserve for what it REALLY is…

An institution created in secret designed to rob you of your savings, and destroy your wealth.

And even though we all know these central bankers have blood on their hands (inflation, the Greenspan bubble, Ben Bernanke)…

No one, and I mean NO ONE expected this.

If what this insider says is correct, you may only have days to prepare.

Click here to see his shocking exposé. |

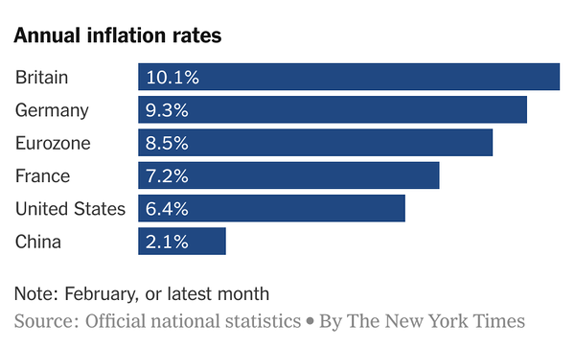

Inflation Is Everywhere  | Economist Milton Friedman famously said: “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

In the U.S., the money supply increased about 30% over two years as policymakers responded to the COVID-19 pandemic.

Output and productivity failed to keep pace with the expansion of the money supply, and the result was inflation.

But the U.S. dollar is not alone.

In the eurozone, the central bank increased the money supply by more than 25%. The result is shown in the table from The New York Times below.

Only China constrained inflation, but the quality of data from China is always questionable.

Now that Friedman has been proven right, we need to consider how to reign inflation in again. That takes time since the economy's ability to increase output is limited.

Bottom line: The Federal Reserve warned us that the battle against inflation will be painful. It will also be a global battle and our partners may not have the Fed’s same zeal which will only make the battle longer.

Check Out the Latest From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment