| Editor’s Note: Matt mentioned he was going to talk about a different stock today, but this situation with Silicon Valley Bank was too big to delay. Read on to see why. |  | Peter Lynch is one of those institutional investors who, when he speaks, everyone listens.

He popularized the GARP (growth at a reasonable price) stock investment strategy.

Lynch was a big proponent of investing in what you know.

He said one thing that should resonate with every investor:“If you don’t study companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.”

There’s a lot of truth to that.

But the concept of the exchange-traded fund (ETF) conflicts with Lynch’s argument.

ETFs made it so that the everyday investor could invest in a basket of stocks based on sectors, industries or trends.

I’m not saying ETFs are bad or don’t make good investments.

But there are risks because there’s no guarantee every stock in a fund is a good investment.

SVB Financial Group (Nasdaq: SIVB)’s crash last week is a perfect example.

The chart below shows SIVB’s crash, but I want to focus on the green line that you may be wondering about.

It all ties back to Stock Power Ratings. Click here to continue reading.  (Click here to view larger image.)

| Billionaires are taking advantage of market turmoil by investing heavily into my favorite “fear-to-fortune” stock. It’s a secret used by investors like Warren Buffett, David Tepper and Sir John Templeton to become filthy rich.

How it works is simple… |

The Peso Is Set to Flip Mexico's Narrative Mexico's president is trying to make changes to the country's electoral process.

Protests are mounting that the changes are anti-democratic.

The country’s violent drug cartels are also in the headlines after four Americans were kidnapped and two of them killed.

It seems like news from Mexico is always negative.

An exception is news about the country's currency.

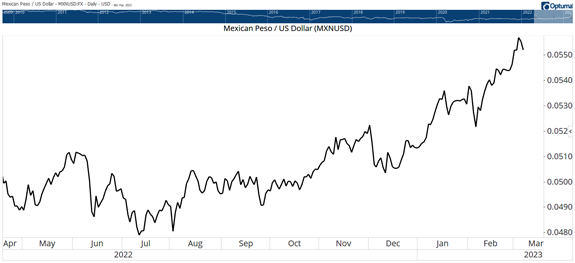

The peso is among the best-performing currencies this year and recently reached a five-year high.  (Click here to view larger image.) Longer term, the peso is still more than 30% below its 2011 high. But the rally offers signs of hope.

It's possible the country could benefit from America's shift away from China.

NAFTA allows manufacturers to move there at a low cost and low wages make the country attractive.

Bottom line: The peso could be signaling better news will soon be coming from Mexico.

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment