| When I was in the market for a new car three years ago, I looked hard at an electric vehicle (EV).

I wanted to get out of the gas-guzzling sports car I was driving and into something more fuel-efficient.

Naturally, EVs were part of the equation.

The problems I found were: - Charging locations around me were few and far between at the time.

- But the bigger problem was that the cost of EVs was just too high … even with tax credits.

I went another route and found something that wasn’t quite as efficient, but it suited my needs.

Now the EV market is surging. And automakers are slashing prices on new vehicles to entice customers amid high inflation.

As an investor, you want to know if this mega trend is one to buy into.

I’m going to share what I found out about investing in EV-related companies using our Stock Power Ratings system in a bit.

But first…

Click here to see why EVs will soon dominate the auto market.

| From our Partners at Banyan Hill Publishing. It has a code name within the walls of Apple’s Cupertino headquarters — “Project Titan.” Supposedly one of Steve Jobs’ final projects … a new electric vehicle (EV) that would do for the automotive world what the iPhone did for personal devices. The next generation of EVs, including Project Titan, will get their power from a battery the size of your iPhone.

Click HERE for the full story. |

The Bad Thing About Value  | Yesterday, I told you about how value investing delivers strong long-term returns — and that’s a good thing.

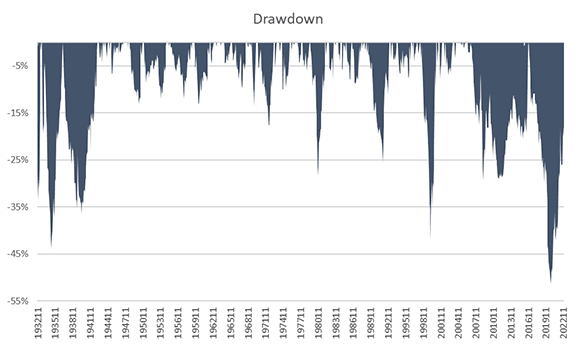

But today, I want to highlight the other side of the strategy. That’s the fact that there are large, long-term drawdowns associated with this investing style.

Tomorrow, I will look at the ugliest aspect of value investing, which is the reason I don’t think it’s the best approach for most investors.

Drawdowns are a euphemism for losses. It’s the amount your account loses, or draws down, from a high. And I believe it’s the most important measure of risk.

Drawdowns measure the percentage loss from an account high. We can easily convert this to dollars. A 50% drawdown in your $100,000 retirement nest egg is a loss of $50,000.

The reason I believe it’s the most important risk metric is because it allows you to see how much your life could change in a bear market.

That 50% loss, no matter what your account balance is, would adversely impact your life if it occurs within a few years of retirement.

I’m using “adversely impact” as a euphemism for “devastate” since it sounds better. The truth is a large loss near retirement will change your life.

You may not retire on time.

You may not get a long-planned vacation.

You may not have money to help your children or grandchildren.

The risks are too high for me to consider. That’s why I look at drawdown. And the chart of value drawdowns is bad. You can see that, over the last three years, value investing experienced its worst loss since the 1930s.

(Click here to view larger image.) This is based on data from Dr. Ken French. He co-authored many articles with Nobel Prize-winning economist Dr. Eugene Fama (you may recognize this name from my colleague Adam O’Dell’s own research).

It’s the longest and most accurate data available for analyzing value.

Since 2000, value has experienced frequent large drawdowns. You might have just half or three-quarters of the money you planned on for retirement if you stuck to value investing throughout that stretch.

While that’s bad, tomorrow, I’ll show why value is ugly.

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment