Our Top SPD Pick Is Flying High!  | Data has become big business.

It used to be that data collection was about government agencies illegally diving into our emails looking for nefarious activities. Today, it’s grown well beyond that.

All kinds of businesses, from health care to retail to tech, collect as much of your data as they can. Your age… your search history… even your location.

And they use it for everything: marketing, fraud prevention, even improving their decision-making.

I recently read an essay that found we create 328.7 million terabytes of data every day around the world. A terabyte, if you’re unfamiliar, is 1,000 gigabytes… or the equivalent of 500 feature-length high-definition movies.

This volume of data is like digital gold to a wide range of companies … not the least of which are companies that build data storage devices.

Today, I’m going to show you the trend of the data storage market worldwide and highlight a recommendation I made in October using the Green Zone Power Rating system.

I hope you followed it then… Because now, it’s the best-performing stock we’ve recommended since we started Stock Power Daily a year ago! Data Storage Market Boom It’s true that data collected from you by any number of companies is sold 10 times over. Remember, I said data was like digital gold.

But those 328.77 million terabytes of data have to go somewhere. In other words, we need a way to store all this data.

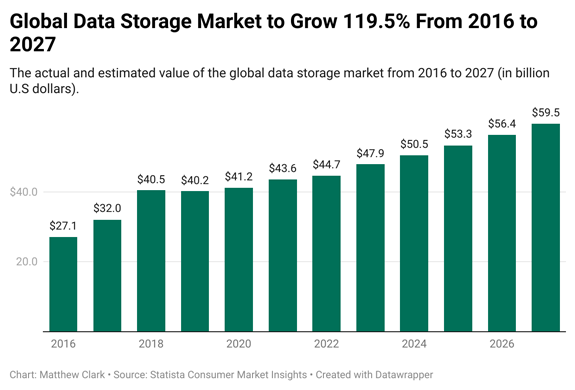

And because of that, the global data storage market is growing fast:  (Click here to view larger image.) According to Statista Consumer Market Insights, the value of the data storage market worldwide was $27.1 billion in 2016.

That will grow to $59.5 billion by 2027 … a 120% increase!

So, there’s not only money to be made in selling data, but storing it too.

That leads me to a company I told you about in October. It’s the best-performing stock of all the ones I’ve recommended to you over the last year…

| Billionaires are taking advantage of market turmoil by investing heavily into my favorite “fear-to-fortune” stock. It’s a secret used by investors like Warren Buffett, David Tepper and Sir John Templeton to become filthy rich. How it works is simple… |

SMCI Continues to Outperform When I first told you about Super Micro Computer Inc. (Nasdaq: SMCI) in October 2022, I wanted to lean into its strength for edge computing and Internet of Things devices.

But with the world churning out data at a breakneck pace, I believe the company can be a global leader in data storage as well.

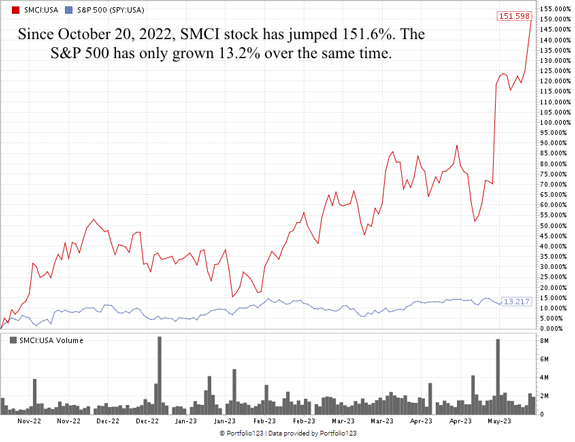

Since I mentioned it, SMCI has certainly not disappointed anyone who took my recommendation:  (Click here to view larger image.) As you can see, since October 2022, the stock has continued to show the “maximum momentum” we love to see in stocks by rising 152%.

That blows the doors off the broader S&P 500 … which is only up 13% over the same time.

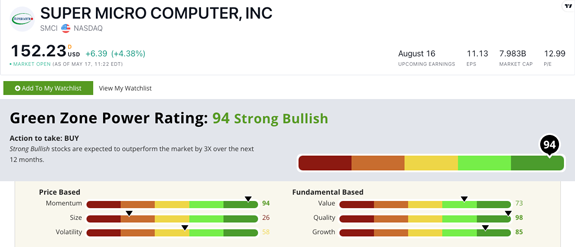

What’s even better is SMCI still carries a great rating on our proprietary Green Zone Power Ratings system:  (Click here to view larger image.) SMCI Green Zone Power Rating in May 2023.

It scores a “Strong Bullish” 94 out of 100. That means we expect the stock to outperform the broader market by 3x over the next 12 months.

SMCI rates high on our quality metric (98) with double-digit returns on assets, equity and investment … all beating the average negative returns of its computer hardware sector cousins.

The stock’s impressive expansion over the last several months shows why it scores a 94 on our momentum factor.

Bottom line: SMCI was a great stock when I first told you about it in October 2022. It’s still a great stock today.

Leadership in the burgeoning data storage market means there is still more room for this stock to run. And it’s “Strong Bullish” rating on our Green Zone Power Ratings system backs that up.

That makes it a great addition to your portfolio. Stay Tuned: Adam’s Take on the Banking Crisis Tomorrow, Adam O’Dell will share his latest research on the banking crisis. You’ll want to tune in for this one, because some surprising names have popped up, and you might even be a depositor…

Until next time.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment