The "Building & Loan" Is No More  | I’ll go out on a limb and assume you’ve seen, or at least heard of, It’s a Wonderful Life. It was basically required viewing for any American kid who grew up in the last 70 years.

The film resonates whether you celebrate Christmas… Have ever felt the pressures of everyday life mounting…

Or if you bank at a small, regional, mom-and-pop operation and are worried if your money is safe.

In the film, lead character George Bailey goes through the ringer a few times as the owner of the local Building & Loan. One particularly bad episode has half the town knocking at his door to withdraw their savings, after rumors spread about the bank’s solvency.

George, of course, doesn’t have their money. Like virtually every banker, he’s lent it out to generate a return that helps him stay in business. Through charm and quick thinking, he’s able to rally them into accepting a just the savings they immediately need now, lest they risk losing it all for good.

It’s a Wonderful Life never claimed to be a grounded, realistic film. It’s an inspiring piece about the value of community and reflecting on the impact you make on it.

But if there’s one idea you should not take form it, it’s that the regional bank around the corner will take drastic, self-sacrificing measures to protect your savings.

In fact, if you do business at such a place, you may soon find yourself as one of the distressed crowd huddled outside the branch. Only for you, there’s no George Bailey waiting to open the doors and compromise.

Regional banks are in serious trouble right now. And the reasons why go all the way back to March 2020, a period of time we’re still very much feeling the impacts of.

Today, I want to shed some light on the troubles facing the regional banking industry. More than that, I want to share my plan to prepare my readers for what I believe is coming… and share a way to profit as this trend plays out.

| From our Partners at Banyan Hill Publishing. After a series of banking collapses hit mainstream media, the surge in bitcoin's (BTC) price has raised eyebrows. In fact, many are recognizing BTC as one solution with its 70% growth rate seen so far this year; yet another crypto could have much more potential and disrupt global finance within our lifetime! With investment already pouring in from PayPal and Square plus Mark Cuban and billionaires Elon Musk and Ray Dalio on board too ... there may be serious opportunities out there today if you know where to look — learn how you can get started with only $20 here now before it's too late! |

Empty Offices Make Empty Coffers Right now, commercial real estate owners are facing the headache of their lives. And even that is nothing compared to what their lenders face.

The shutdowns in March 2020, in response to the worsening COVID pandemic, emptied out office space across the United States. Office-space leasers had to suck it up and pay their bills throughout the remote-first shift. But now, with COVID mostly in the rear view, remote work has become much more the norm than it ever was before.

Soon, office leases are set to expire. Many business owners can’t wait to get out of them, or at least downsize to a more appropriate space. Suffice to say, CRE owners will struggle to find new tenants… and afford their loan payments.

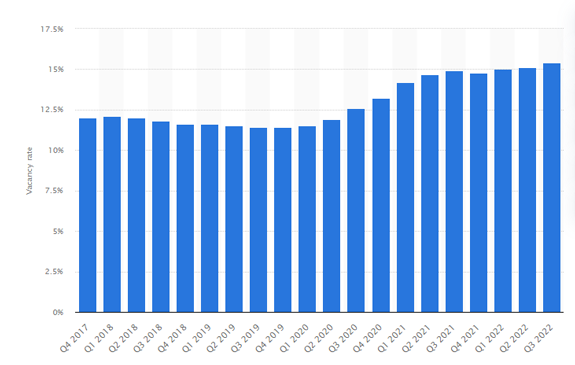

This chart from Statista sums up the issue. It shows that U.S. office vacancy rates are a) over 15%, the highest rate in over five years b) higher than they were at the peak of pandemic shutdowns and c) rising. U.S. Office Vacancies, Quarterly 2017-2022  (Click here to view larger image.) Source: Statista This has naturally weighed on the value of commercial property. The average price per square foot of Manhattan commercial property, for example – one of the hardest-hit regions of this trend – is down 22.4% over the last year, and at its lowest level since 2012.

Amid all this is the steepest rise in interest rates since the 1980s, which has had a cascading effect on outstanding CRE loans – $1 trillion worth of them are up for refinancing over the next few years.

What does this have to do with regional banks? Too much.

A report from JPMorgan shows that small regional banks hold 4.4 times more exposure to U.S. commercial real estate loans than their larger peers. And a recent Citigroup analysis found that small-size lenders hold 70% of CRE loans.

Commercial real estate isn’t the sole focus of these banks, either. Many of them have individual banking services that everyday people use.

These banks will face liquidity problems as these CRE loans come due for refinancing. They may need to take possession of commercial property and have a tough time offloading it. That could impact their ability to meet withdrawals. And depositors are already sweating.

Right after Silicon Valley Banks’ problems were exposed in March, some $119 billion of midsize bank deposits were withdrawn for safer alternatives. These kneejerk reactions may prove to be correct in the long run.

If you find yourself in a position where you have money in a small or midsize regional bank, your greatest strength is in knowledge. Look up the bank and see how exposed it is to commercial real estate. If it’s an uncomfortable level, the simplest thing to do is consider moving your savings to a bigger bank. Large banks don’t hold anywhere near the level of risks that the smaller banks do right now.

Then, once your money is safe, I have another idea…

Profit on the Regional Bank Crisis John F. Kennedy popularized the idea that the Chinese word for “crisis” is made up of two characters: one meaning “danger” and the other meaning “opportunity.”

Linguists contest the accuracy of this, but the point stands. Often, dangerous situations can spell lucrative opportunities for shrewd investors.

Right now is one of those times.

Recently, in my options trading advisory Max Profit Alert, I recommended a put option trade that took direct advantage of the stresses in regional banking. Within just three weeks, we locked in a 75% profit on a third of the position.

As the crisis accelerates, I expect that to translate into even bigger gains for my subscribers.

Max Profit Alert is not currently open to new subscribers. But, in the coming weeks, I do plan on releasing new research on specific regional banks that I believe hold substantial risk and could provide interesting short trade opportunities.

To learn how you can get access to that research, stay tuned to Stock Power Daily. We’re looking to put it out about a month from now.

In the meantime, just keep a close eye on the commercial real estate slowdown and regional banking crisis. Taking steps now to ensure it won’t impact your wealth will help put you in position to profit immensely down the line.

Regards,

Adam O'Dell

Chief Investment Strategist, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment