The Green Zone Cure for "Analysis Paralysis"  | Imagine someone presents you with a database that shows you how more than 6,000 stocks are expected to perform in the coming months. What would you look up first?

Maybe you start plugging in companies you’ve had your eye on. Or you start looking at holdings in your portfolio to see how they stack up.

Of course, you might also get “analysis paralysis”, leaving you unable to figure out where to even start.

This is something we’ve been debating in the Money & Markets offices, as we try to make Adam O’Dell’s Green Zone Power Ratings system your go-to tool to find great stocks to buy.

It can be overwhelming, as you look at the search bar and consider the possibilities… Especially if you’re new to investing.

So allow me to rip a page out of investing legend Peter Lynch’s playbook and simply suggest going with what you know.

Brands you prefer. Products you buy. Services you use. Even your hobbies, interests, or talents can help you start your search. By starting with what you’re familiar with, you at least aren’t in total investing darkness.

To learn how to look up stocks in our system, click here. But let me show you what I mean by using what I know…

| From our Partners at Stansberry Research. The man Jim Cramer said he would never bet against is calling for a historic shakeup in the U.S. stock market. He called the 2020 crash and 2022 bear market. Now he says the next 90 days will determine your financial life for a decade. It doesn't matter if you have money in stocks right now, or are waiting on the sidelines. The short period we're about to enter changes everything. Prepare here. |

2 Plays on Panthers in the Playoffs The Florida Panthers are in the middle of an incredible and unexpected playoff run.

I’m already in hockey heaven after watching them topple the Boston Bruins and Toronto Maple Leafs in the first two rounds. I, like most others, thought they were toast after going down three games to one against Boston.

But this is why we watch sports. It’s better drama than anything else you’ll find on TV.

If I could buy Florida Panthers stock, I would — no matter how it rated. But like most sports teams, it’s not a publicly traded company.

It is still investable, though… just not directly.

After a few minutes of research, I landed on two stocks that hold the rights to broadcasting Panthers games on TV: Bally’s Corp. (NYSE: BALY) and Sinclair Broadcast Group Inc. (Nasdaq: SBGI). Bally’s owns the naming rights for Sinclair’s regional sports networks (owned by its own subsidiary, Diamond Sports Group), so both company’s stand to gain from more eyeballs on Panthers games.

With those tickers in hand, I turned to the Green Zone Power Ratings system…

Turns out, BALY stock rates a “Bearish” 23 out of 100. SBGI rates a much more solid 58 out of 100.

That bearish score on BALY knocked it off my shortlist immediately. Bearish stocks within our system are slated to underperform the broader market from here.

Sinclair, though, is one to watch…  (Click here to view larger image.) SBGI’s Green Zone Power Ratings in May 2023. The company’s fundamental factors — value, quality, and growth — are all firmly in the green. It’s the technical, price-based factors Momentum, Size, and Volatility that hold it back.

Recent news also doesn’t help. Sinclair’s regional sports arm has filed for bankruptcy as the entire sports broadcasting world tries to figure out the best way to capitalize on cord cutters.

SBGI’s low momentum and high volatility can be explained by its stock performance over the last year. It’s lost 33% of its value — and it hasn’t been a smooth ride down.  (Click here to view larger image.) I’ll be interested to see how SBGI’s stock rating changes as its regional sports debacle develops. It’s a well-diversified TV broadcast company with businesses across multiple industries. We’ll just have to see if its regional sports efforts were a bad bet.

Speaking of “regional”… that’s been in the headlines for a different reason, lately… A Regional Bank (It’s in the Name!) Regional banks have been in the spotlight for all the wrong reasons in the first half of 2023. Three banks have already shut their doors, and more banks are feeling pressure as they contend with slower demand due to higher borrowing costs.

Regions Financial Corp. (NYSE: RF) is my bank of choice. I’ve had an account with them for almost 20 years now, and I’ve never had a bad experience.

Of course, my personal experience isn’t enough to go on when considering RF stock as an investment.

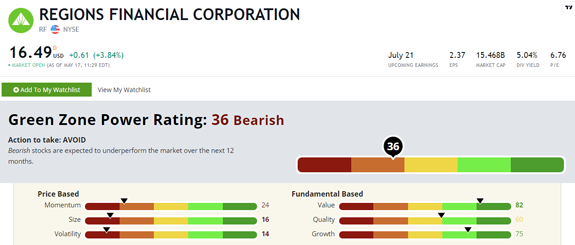

That’s where Green Zone Power Ratings comes in … and it’s not pretty right now. Regions sports a bearish 36 out of 100 rating.  (Click here to view larger image.) RF’s Green Zone Power Ratings in May 2023. The bottom has fallen out for Regions stock this year as investors mull the ongoing regional banking mini-crisis. It’s down more than 23% year to date, which explains its 24 rating on the momentum factor.

Regions did post solid revenue of $1.8 billion in the first quarter, an 11% gain year-over-year. Net income also grew 11% to $612 million.

These are strong growth numbers as banks continue to rake in profits with higher-interest lending.

But the broader banking situation threatens that growth. And our system is showing RF is a stock to avoid while the situation develops. The Best Green Zone Power Stocks I just showed you how I was able to get a quick snapshot of three different stocks using our incredible Green Zone Power Ratings system.

Adam developed this tool so that you can do the same!

Of course, you may just want to know what to buy and skip all legwork. That’s totally valid… And Adam has you covered there too.

By joining his premium Green Zone Fortunes service, you’ll gain access to a model portfolio full of Adam’s highest-conviction stock recommendations.

His subscribers are sitting on open gains of up to 86% … 127% … and even 157% since 2020. And his March 2023 recommendation is already up 34%!

Adam uses Green Zone Power Ratings as part of the process in finding these market-crushing stocks. And you can gain access to his insights for around $4 per month! Click here to find out how.

Until next time…

Regards,

Chad Stone

Managing Editor, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment