| You might think we live in a special time. We can shop using our phones and get anything delivered to our houses on the same day even.

But consumers were doing that 100 years ago. They could even get a house delivered. For decades, Sears sold home kits in its catalog.

Many of us forget that before the internet, there was the Sears catalog. The first issue was published in 1887. Business took off after 1896 when the Post Office expanded routes to include Rural Free Delivery so it could reach customers in even the most remote locations.  Source: Amazon.com. Catalogs ran hundreds of pages and brought the store to the consumer.

By 1929, Sears was America’s second-largest retailer, right behind the Great Atlantic & Pacific Tea Company.

But this was just the start…

The company wanted to be more than a store, so management created Allstate Insurance in 1931. Agents were in Sears stores two years later.

By the 1980s, the company operated Dean Witter for investments and Coldwell Banker for Real Estate.

Seeing the importance of technology, Sears launched online content provider Prodigy in 1984. The Discover credit card followed the next year. By then, Sears was the largest retailer in the nation, but it was stretching itself thin…

Walmart then took Sears’ retail crown in 1990.

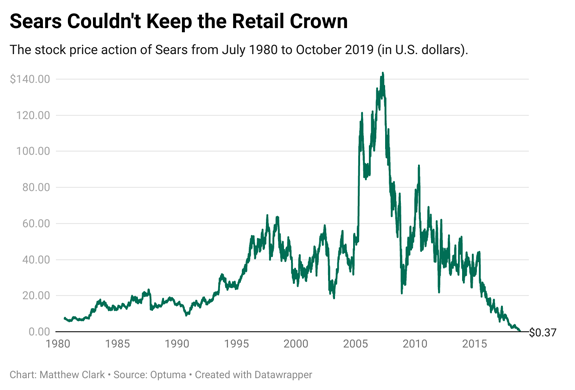

And while investors enjoyed an incredible run for Sears stock, it all fell apart after the financial crisis of the mid-2000s.

Once a staple widows-and-orphans stock, it was worthless by 2018. You can see its decline in the chart below:  (Click here to view larger image.) This is an interesting history. But it’s also a warning to complacent investors.

Three of the top five retailers in 1985 (Sears, Kmart and American Stores) are now defunct. Safeway and Kroger are the only ones left standing.

Will Today’s Behemoths Survive? Some investors are certain Amazon and Walmart will dominate retail for decades. They might. But it’s likely the leaderboard will look different 40 years from now.

Retail is just one industry that’s been disrupted in the past few decades. The auto industry has been through minivan and SUV booms that no one saw coming in 1985 when station wagons were still the choice for families.

Of course, technology has undergone dramatic changes since the 1980s when Prodigy, CompuServe and AOL were the leaders of online access.

These are long-term changes. We can argue with the benefit of hindsight that we would have seen these changes coming in real time. Maybe you could have. But managers involved in the businesses didn’t see them in time to survive.

We may also be able to spot which stocks will win in the next big shift, but that’s also hard to do. Even the experts at GM were fooled by Lordstown Motors, an electric vehicle start-up they staked that failed to deliver expected results.

The good news is that benefitting from changes isn’t impossible. It requires the right mindset — understanding that things change in the business world and in the stock market.

And those shifts aren’t usually sudden. There are often signs that emerge ahead of time that offer vital clues. You just have to know where to look…

For example, investors might be able to spot deterioration in a company’s financial statement. They may see the stock’s trend reverse. There are almost always signals that the stock should be sold.

On the other hand, there are also changes in financials or momentum before stocks soar higher.

But spotting these changes is challenging and time-consuming. It requires sifting through SEC filings or performing complex calculations to find stock-price signals.

Fortunately, there’s an alternative. The Money & Markets proprietary Green Zone Power Ratings system captures information about financials and price action in a single number. It uses three technical factors and three fundamental ones to configure a specific score for each stock.

Stocks with high ratings have historically beaten the market by 2X or 3X. Lower ratings indicate potential problems ahead.

This can help you determine which companies have the potential to soar and become the new industry leaders, and which could be moving rapidly toward extinction. If you’re curious about a stock’s potential, click here to go to the Money & Markets homepage and start looking up stocks to see how they rate in today’s market.

Figuring out which stocks to buy and which to avoid doesn’t have to be so tough.

In fact, my colleague Adam O’Dell, the man behind Green Zone Power Ratings, has just curated a massive list of stocks that are flashing a sell alert right now.

And he’s going to release that list — along with a handful of stocks that do rate well for the current market — later today. Watch your inbox for information on how to gain access.

Until next time,

Michael Carr

Senior Technical Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment