| Earnings season is in full swing again.

Big banks — not named Goldman Sachs — injected the market with even more positive sentiment, pushing the Dow Jones to its longest daily winning streak since 2020.

And then Netflix showed that while its password crackdown is forcing freeloaders’ hands, revenue for the second quarter was still lower than expected. Shares sank 8% Thursday morning in response.

Now, I don’t think investing right before or after a company reports is the best move. It’s risky, and I’d rather wait for the dust to settle and see a consistent trend in a stock’s price before putting my hard-earned cash to work.

Thankfully, that’s what Adam O’Dell’s proprietary Green Zone Power Ratings system is all about.

He created it to project a stock’s performance over the next 12 months or longer — not the big swings we may see around a company’s quarterly call.

So … why even talk about earnings?

Because it’s a great starting point for doing your own stock research using Adam’s system. The earnings calendar hands us a shortlist of stocks to research for new opportunities.

Let’s practice this with companies reporting next week that I'm familiar with — and you probably are too.

Glancing through that calendar, I quickly landed on two stocks: one that’s “Bullish” and another that’s “Bearish.” You can do the same by going to our homepage and typing a ticker or company name into the search bar.

Here’s what I found… Don’t Bid on This “Bearish” Stock I started with eBay Inc. (Nasdaq: EBAY). The popular e-commerce and online auction platform is slated to release earnings on Wednesday.

Browsing eBay is one of my favorite pastimes. Whether I’m looking for a part for Ol’ Reliable (aka my 2007 Honda) on eBay Motors, or if I’m just curious about what random collectibles in my house are going for at auction, it’s a fantastic site.

But Green Zone Power Ratings is waving a red flag on eBay stock right now.

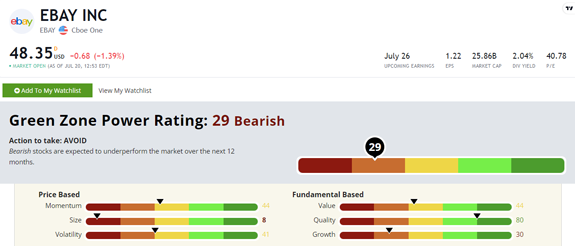

EBAY stock rates a “Bearish” 29 out of 100, which means it is set to underperform the broader market over the next 12 months.  (Click here to view larger image.) This is a massive company with a $25 billion market cap. Its 8 rating on the Size factor means it’s in the top 8% of stocks in the system based on market cap. Don’t expect a small-cap bump on EBAY stock.

And its middling 44 on Momentum means it’s an average gainer. It has increased its share price by 14% in 2023 (less than the S&P 500’s 18% gain), but that’s much lower than the broader Nasdaq’s blistering 36% gain.

With five of six factors rated 44 or lower, Green Zone Power Ratings says EBAY stock is one to avoid as 2023 rolls on.

| New AI-powered stock rating system — that isolates stocks with the highest probability of producing the biggest gains — just released details on the top-rated stocks... Details here… |

The Best of Big Tech? The Big Tech rally has been the story of 2023. Of course, if you read Adam’s story from earlier this week, there could be some speed bumps ahead for the stars of the Nasdaq.

Thinking on this, I ran the Magnificent Seven through Green Zone Power Ratings and found out the company whose product I’m writing this story with right now is the best of the bunch.

I’m talking about Microsoft Corp. (Nasdaq: MSFT) of course!

It’s been a lucrative year for MSFT due to the rise of artificial intelligence (AI) and its partial ownership of OpenAI, the company behind ChatGPT. After the revolutionary AI chatbot was released to the masses in November 2022, it gained 100 million active monthly users two months later.

And that’s reflected in MSFT’s 45% gain since January 1.

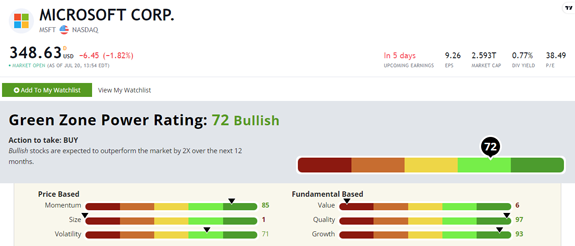

Let’s see what Green Zone Power Ratings says…  (Click here to view larger image.) Microsoft rates a “Bullish” 72 out of 100. It’s set to 2X the broader market over the next year!

It does get dinged on the Value factor with a 6 rating there. As Adam mentioned earlier this week, this is one of seven stocks that are driving most of this year’s outperformance. And investors are OK paying a premium for those gains.

But it rates in the green on four of the factors, including an 85 on Momentum (45% year-to-date gains!), a 93 on Growth and a 97 on Quality.

I’m curious if Microsoft’s earnings call on Tuesday will sound the alarm anywhere — it has hit some snares in its ongoing quest to acquire Activision Blizzard.

But Green Zone Power Ratings shows a bright future for MSFT stock.

That’s it from me this week. If you’re curious about how any other stocks look before they drop quarterly numbers during this critical summer earnings season, all you have to do is go here and search for a ticker.

Until next time,

Chad Stone

Managing Editor, Money & Markets P.S. I highlighted two stocks in this week’s update, but what if you had access to every “Bearish” or “High-Risk” stock in Adam’s system?

I’m talking about almost 2,000 stocks slated to underperform (even if we’re in a new bull market) — and he updates this Blacklist every Monday.

If that sounds intriguing, click here to see how to gain access.

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment