| Traders will be busy this afternoon, to say the least.

Federal Reserve officials will wrap up their two-day meeting and release their decision on interest rates at 2 p.m. Eastern today. Futures markets are pricing in a 0.25% increase.

It’s almost certain the Fed will do just that. After all, Chair Jerome Powell consistently delivers exactly what the market expects.

A half-hour after the interest rate decision is announced, Powell will take the stage for a press conference. And unlike the interest rate move, there’s nothing predictable about this part of the day.

Sometimes Powell makes comments that boost stocks. Other times, his words sent stocks lower. Today, he’s speaking as stocks face technical headwinds.

As a technical analyst, I focus on price action. I, along with my colleagues, use chart patterns and indicators to forecast price moves.

Right now, there are at least four reasons to expect a market decline after Powell delivers his unpredictable message…

| From our Partners at Banyan Hill Publishing. Amidst a sea of skeptics, predicting a dead end for crypto during its crash in 2018, Ian King saw the potential of resurgence and encouraged investors to stay strong. Little did they know his call would lead them on an incredible journey — with gains as high as 18,325% over 12 months! Now he's seen something bigger than bitcoin ... claiming this coin has the power to create 20 times more millionaires by 2023. Don't miss out on your chance for life-changing returns — follow Ian's No. 1 crypto recommendation today! |

4 Signs a Market Decline Is Imminent 1. Stock market averages are overbought.

Prices have moved up “too far, too fast.” The SPDR S&P 500 ETF Trust (NYSE: SPY) gained more than 4% in the two weeks before its most recent high.

Gains of that size are unusual. They happen an average of five times a year. And a pullback starts the following week more than half the time.

Stock prices have a long-term upward bias. They go up more often than they go down. Signals showing prices fall more than 50% of the time are rare. That makes this signal important and worth watching.

2. SPY reached its upside target.

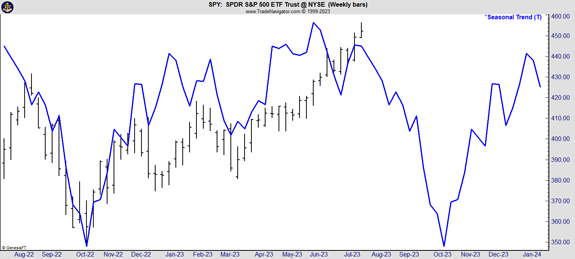

The chart of SPY below shows that the exchange-traded fund met its price target (the dashed line) last Thursday. This line was calculated based on the uptrend that began in June.

Declines lasting at least a few weeks follow this signal about 65% of the time. The S&Peaked  (Click here to view larger image.) 3. Momentum turned down.

Momentum indicators measure how fast prices move. Traders look at dozens of these indicators. One of them is at the bottom of the chart we just looked at above.

Analysts expect changes in momentum to lead to price reversals.

Now, we can think of these indicators like a runner charging up a hill. Nearing the top of the hill, they’re likely to slow down. This allows them to catch their breath after working so hard to move up the hill. The slowdown in momentum precedes the reversal to the downside of the hill.

The indicator in the chart — which illustrates my hills analogy pretty well — compares how prices moved in the last week to their movement over the past month. It peaked last week and now seems to be headed lower. This is another reliable indicator that prices are likely to pull back or at least move in a narrow range for a few weeks.

A narrow range, kind of like what you can see in early May, is possible. However, that’s unlikely.

Traders will react to today’s news from the Fed. That could be the catalyst for a multiweek trend.

And then after today’s close, we’ll get earnings from Meta Platforms Inc. (Nasdaq: META). Amazon.com Inc. (Nasdaq: AMZN) reports after tomorrow’s close. Both Big Tech companies’ announcements move markets.

Economic news could also drive a big move. The first estimate of gross domestic product growth in the second quarter is due before the open tomorrow. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures Index, is set for Friday morning.

With momentum pointing down, news stories are more likely to spark a sell-off.

4. Seasonals turned bearish.

The last indicator pointing to a market reversal has to do with seasonality.

Seasonal trends are found based on how prices moved in previous years. Throughout the year, there are some periods when stocks tend to rise and others when stocks tend to fall. The seasonal trend in SPY peaked last week and future projections head lower until October. It’s shown as the blue line in the chart below. The S&P’s Bearish Future  (Click here to view larger image.) Like any indicator, seasonals are wrong sometimes. But they are still useful. We are at the beginning of this year’s strongest seasonal downtrend. It’s another reason to expect a pullback in stocks soon.

| From our Partners at Banyan Hill Publishing.  |

Preparing for a Pullback in the Trade Room Markets can move up despite all these headwinds. That’s why it’s important to wait for the reversal before taking positions. When the pullback does come, it might be short-lived. Or it could be the beginning of another bear market.

We’ll be considering whether prices are likely to move up day to day in my Trade Room. Tomorrow morning’s session will start with a look at how the market is reacting to the news from the Fed and Meta.

Specifically, we’ll look for a potential opportunity to trade Amazon ahead of its earnings announcement.

Matt Clark and I look at news and trading opportunities in the room every day that the market is open. You can find us there at 9:30 a.m. Eastern.

We follow a variety of short-term trading strategies that are all based on price action. When prices are more likely to fall than rise, we trade put options. And to benefit from expected rallies, we trade call options.

While we started the week with a bearish bias, we always follow our strategy signals — not our opinions. We’ll trade positions as signals develop, and we’ll focus on the short term to avoid being caught on the wrong side of major trends.

I invite you to join us in the daily Trade Room. To learn how to access it, just click here.

Until next time,

Michael Carr

Senior Technical Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment