Sorry if you thought Bob Iger's return would right Disney's ship.

But the stock remains in the toilet while the broader markets are on a tear. |  | Their recent movies haven't done much to help the company.

"Snow White and The Seven Dwarfs" triggered a Twitter backlash.

While "Indiana Jones 5" brought in $302 million at the Box Office…

Barely breaking even with the production budget.

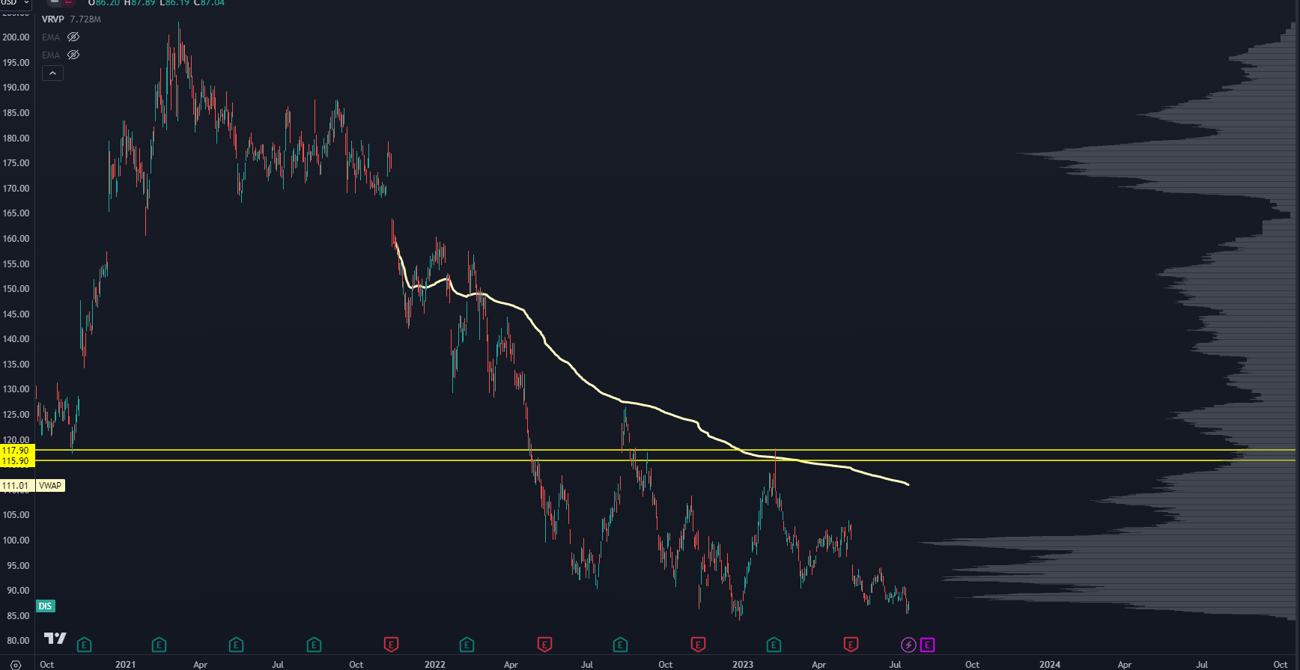

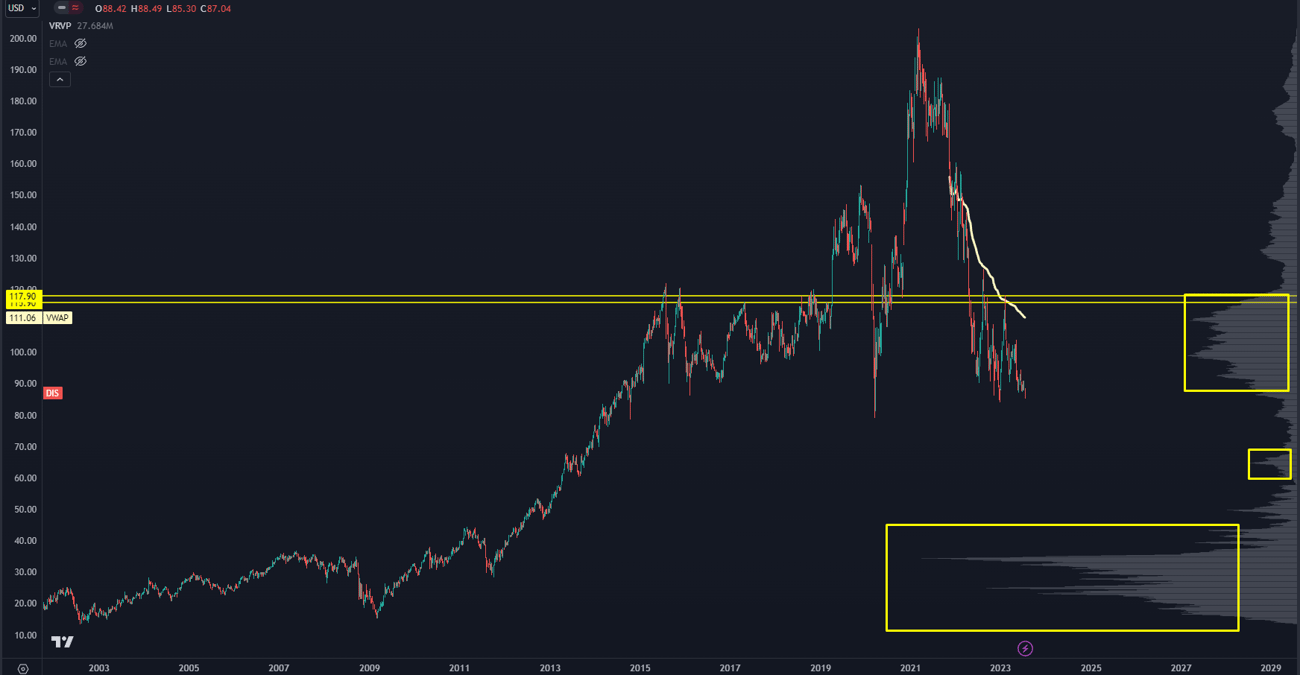

Today, my roadmap shows the stock heading back to 2020 lows.

|  | It may eventually return from the dead, but its downward trend over the past year should send a clear signal to CEOs looking to trade consumer loyalty for woke nonsense. | | | Recommended Link

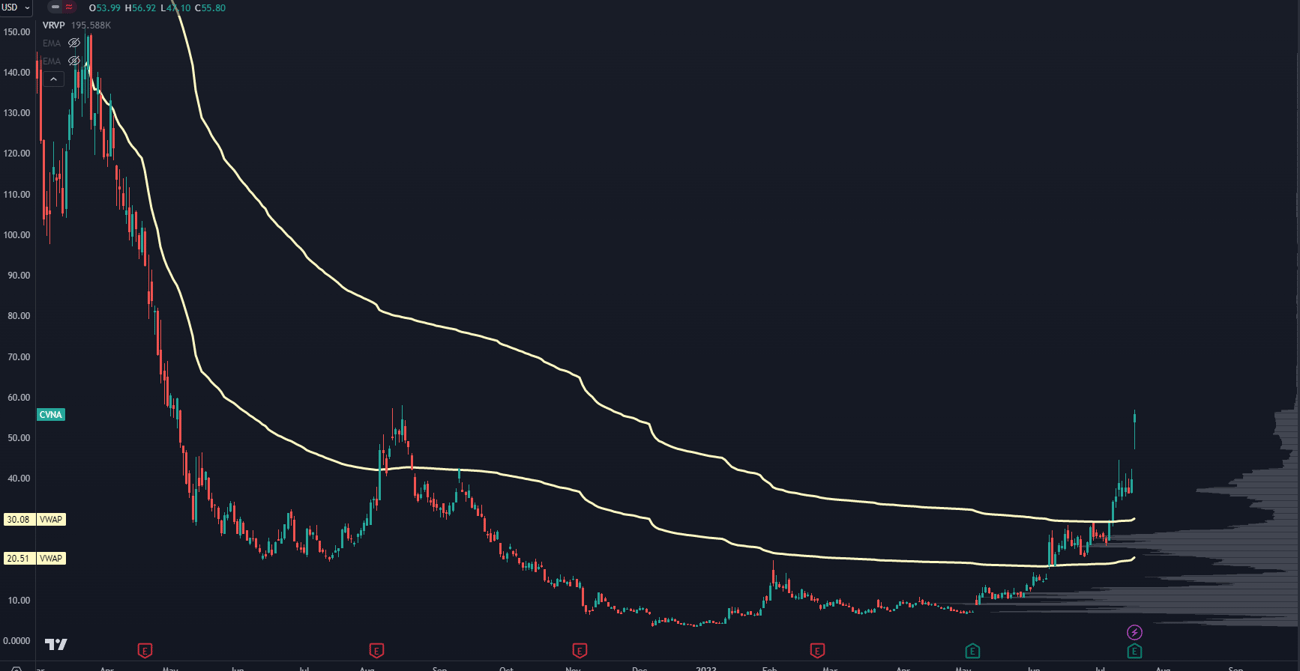

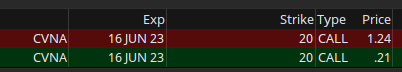

MSA tool for steady income growth. | | | Speaking of returning from the dead, look at this chart of Carvana. |  | For two years, shares of the online used-car retailer were priced into single digits because the company had to borrow to keep the business alive.

Then they announced a debt restructuring deal, and the stock gained 40% yesterday.

I had decent gains on the first push, but I would've made 3X more money on those Carvana calls if I had maintained exposure until after yesterday's market bell. |  | Anyway, the bottom line is that when you see a garbage stock run hard like this…

It means the market is getting a little bubbly, and we're due for a massive exhale.

Knowing what to focus on may seem overwhelming as Wall Street braces for the Fed's big announcement next Tuesday. But it doesn't have to be that way.

If you're unsure how to maximize the upside of next week's new opportunities…

I'm hosting a LIVE 3-Day Trading Roadmap Workshop at 10 am ET on Tuesday where you can watch us play the markets with real money and leverage our lucrative positions for substantial gains.

It should be fun, so if you'd like to see my trading approach in action and potentially pocket some extra cash hanging out with me, I would be happy to have you.

Click here to join me in leveraging "hidden profit zones" next Tuesday.

Talk soon,

Steve Place | | | In Case You Missed It

1. This really grinds my gears.

2. Backdoor to big energy profits in Q3.

3. Groundfloor advantage in biotech.

|

|

|

|

Post a Comment

Post a Comment