- While renewable energy has massive potential, fossil fuels aren’t going away anytime soon.

- A massive trend in liquid fuels is flying under the radar.

- Today’s Power Stock follows that trend and is one of the highest-rated stocks in Adam O’Dell’s Green Zone Power Ratings.

|  |

Conventional wisdom suggests renewable energy will become the primary power source of the world... At some point.

I’ll give you the fact that the future of clean energy is promising — everything from wind and solar farms to electric vehicles.

We all know it’s coming.

The fact of the matter is that its dominance won’t arrive tomorrow … next week … or even next year.

Our global dependence on oil and gas will remain for a long time to come.

One of the big reasons is time.

It’s going to take decades to implement the technology and infrastructure to become fully reliant on clean energy over fossil fuels.

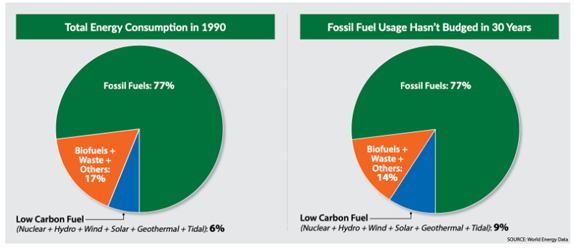

Need proof? Just look at this chart that our chief investment strategist, Adam O’Dell, featured in his July issue of Green Zone Fortunes.  (Click here to view larger image.) World Energy Data found that we used just as much fossil fuels in 2020 as we did in 1990. And renewable sources inched up from 6% of total consumption to just 9% over the same time frame. (If you want to see why Adam was referencing this chart for his latest Green Zone Fortunes recommendation, click here to learn how to access the issue.)

It’s clear that while the renewable market contains so much potential, oil and gas aren’t going away anytime soon.

Today, I’m going to examine a little-known trend in fossil fuels and use Adam‘s proprietary Green Zone Power Ratings system to pinpoint a “Strong Bullish” stock to take advantage.

| Warren Buffett, Ray Dalio and Goldman Sachs all agree. Now’s the time to bet BIG on oil. And Adam O’Dell just revealed the details on his No. 1 oil stock for 2023. An oil company he believes could hit 100% gains in the next 100 days. And beat the gains of Exxon, Marathon and Occidental. Click here to watch. |

Industrials Need Liquid Fuels The biggest consumer of fossil fuels globally is the industrial sector.

Plants around the world use massive amounts of oil, natural gas and coal to produce the items we use every day.

It has been ingrained in the industrial infrastructure for decades, and reversing that isn’t easy.

American automaker General Motors doesn’t expect its 100% renewable energy initiative to fully take hold until 2035 at the earliest.

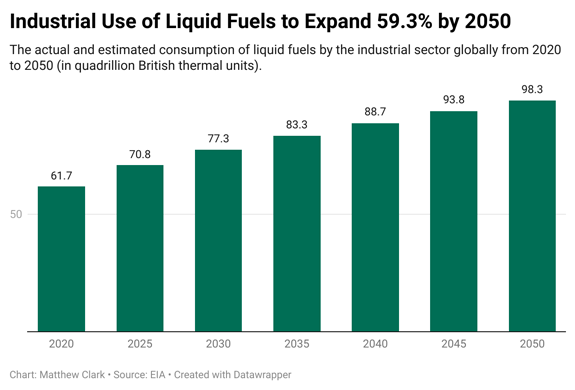

And you can see in the chart below that industrials are planning to expand the use of liquid fuels.  (Click here to view larger image.) In 2020, the global industrial sector used 61.7 quadrillion British thermal units of liquid fuels.

EIA expects that number to climb almost 60% to 98.3 quadrillion by 2050 — despite our best efforts to convert to clean energy.

Today’s Power Stock will take full advantage of this expanding trend in liquid fuel usage.

| From our Partners at True Market Insiders. The Mainstream Media… The Government… Major Financial Institutions… Have all turned their backs on YOU… Have you wondered why? A former Wall Street insider and millionaire money manager is unveiling the truth… View his 5-step protection plan here... |

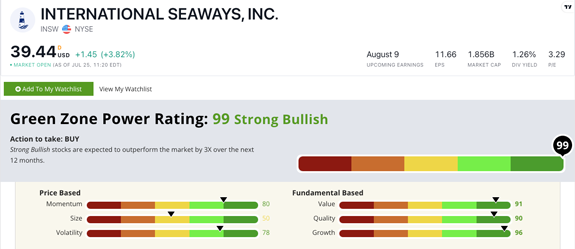

International Seaways Brings Oil and Gas to the World International Seaways Inc. (NYSE: INSW) rates 99 out of 100 on our Green Zone Power Ratings system. This means we are “Strong Bullish” on the stock and expect it to outperform the broader market by 3X over the next 12 months.  (Click here to view larger image.) It also means this stock rates in the top 1% of all stocks in Adam’s system.

INSW operates 75 vessels ranging in size from VLCC (up to 320,000 dead-weight tons) to Aframax (up to 80,000 dead-weight tons) that transport crude oil and other liquid fuels around the world.

Pro tip: This isn’t the first time we’ve mentioned INSW. Adam wrote about this company back in 2021 when it only rated 71 overall.

INSW earns its highest rating on Growth (96) due to its one-year annual sales growth rate of 214.8% and its earnings-per-share growth rate of 323.9%. That means it continues to be the carrier of choice to bring oil and gas to different parts of the world.

It gets a high mark on Value (91) thanks to a price-to-earnings ratio that’s 3X lower than its industry average.

On Quality, INSW earns a 90 because of a net margin of 54.6% compared to the industry average of only 5.6%.

Bottom line: The global dependence on oil and gas isn’t going away anytime soon.

It’s too engrained in our industrial infrastructure, meaning it will take decades for industries around the world to convert to complete reliance on clean energy.

So, oil and gas are going to be around for quite a while.

INSW is one of the most reliable carriers of oil and gas around the world. With its outstanding growth and strong value, it is certainly a stock worth looking at for your portfolio.

Of course, while today’s Power Stock has a lot of potential in the energy sector, if you want the best ways to follow what Adam is calling the “Oil Super Bull,” you need to check out his presentation.

This is a broad mega trend that is going to last for years (if not decades), and Adam is targeting energy stocks with 10X profit potential in a matter of years for his premium subscribers. One is already up more than 130% since he recommended it in September — and he believes it’s just getting started.

Click here to see how you can join him in 10X Stocks and start investing in his high-conviction recommendations now. Stay Tuned: Is Warren Buffett on the Right Oil Track? Tomorrow, Managing Editor Chad Stone is going to explore the Oracle of Omaha’s energy portfolio to see how it stacks up using Green Zone Power Ratings.

Until then…

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment