- Fear of missing out (FOMO) happens every day to the casual investor.

- While Adam and I caution against investing based on FOMO, sometimes opportunities present themselves.

- Today’s Power Stock dropped a big earnings report and is “Bullish” in Green Zone Power Ratings.

| It’s easy for the casual investor to get caught up in what’s trending on mainstream media.

In most cases, my advice is to steer clear.

Just because a stock makes a headline, doesn’t mean it’s worth buying.

And even if you know 50 people who have invested in the same stock, it doesn’t mean you should clear out your savings and do the exact same thing.

Adam O’Dell and I would rather look for profit where no one else is. That’s when you find the stocks waiting to take off.

But I’m going to follow the crowd today.

That’s because I want to use Adam’s Green Zone Power Ratings system and show you a company that’s popular (sometimes for the wrong reasons) … has made headlines … and is worth keeping an eye on for the future.

| From our Partners at Banyan Hill Publishing. Because of Statute 26-7704 — a nearly forgotten law enacted by Ronald Reagan — $17.9 billion in MLP Checks will be paid out to patriotic American investors this year. Click here to see how. |

Social Media Giants Dominate Recent Headlines Last week, Elon Musk hit the top of the fold when he arbitrarily rebranded Twitter to “X.”

Not sure anyone really knows why, but it happened.

And then, on Wednesday, fellow social media giant Meta Platforms Inc. (Nasdaq: META) hit the headlines after blowing the doors off earnings expectations.

A significant bump in ad revenue led the Facebook parent to beat analysts’ expectations in both earnings and revenue.

As a result, META stock popped almost 7% higher in trading Thursday.

Now, I’ve cautioned you before about trading on earnings or emotions … and under normal circumstances, this would be one of those times.

But I wanted to check and see how Meta rated on our Green Zone Power Ratings system.

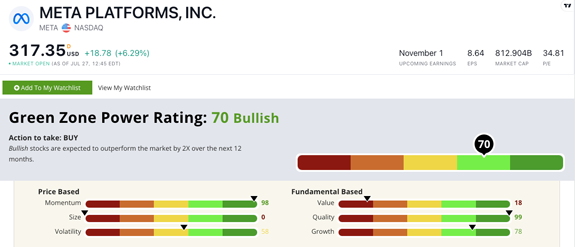

The rating and the direction were both very surprising to me. Meta Was Bullish Even Before Earnings Meta rates 70 overall on our Green Zone Power Ratings system. That means we are “Bullish” on the stock and expect it to outperform the broader market by 2X over the next 12 months.  (Click here to view larger image.) META earns a 99 on our Quality metric thanks to posting a gross margin of 87.3% and an operating margin of 28.1% — both stronger than the internet and data services industry averages.

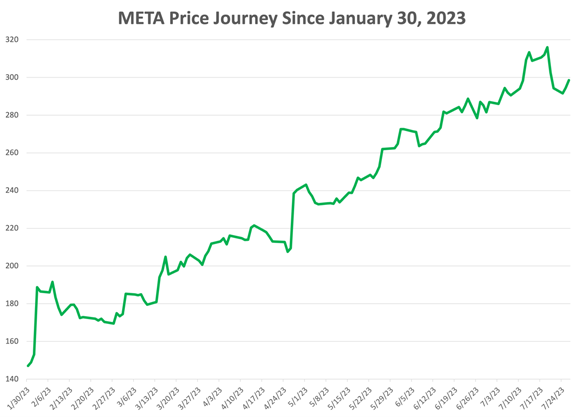

The stock is also killing it on Momentum. In the last six months, META has climbed more than 108% with little volatility. That’s why it scores a 98 on our Momentum factor.

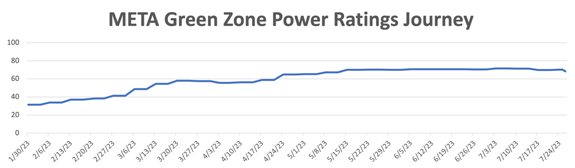

You can see that move in the chart below, but the second chart shows you what I really found out about META:  (Click here to view larger image.)  (Click here to view larger image.) It shows how the stock has been rated on our Green Zone Power Ratings system over that same time.

While META has benefited from the investing herd jumping on any tech stock they can find, the stock didn’t actually reach a “Bullish” rating until late April.

With some of the volatility behind it, and buoyed by impressive earnings, META has positioned itself to keep climbing on our Green Zone Power Ratings system.

I’m not recommending you rush out and buy META stock. While it’s “Bullish” in the Green Zone Power Ratings, there are plenty of better buys that rate even higher (I aim for stocks rated 85 and above).

But I think META is certainly worth watching to see where it goes from here.

If it does cross above that 85 threshold, rest assured, I will be right back here to tell you about it.

Stay Tuned: Going Live With Wednesday Windfalls Tomorrow, Adam is going to walk you through an exciting change to his premium options trading services, Max Profit Alert and Wednesday Windfalls.

And it’s all about you!

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment