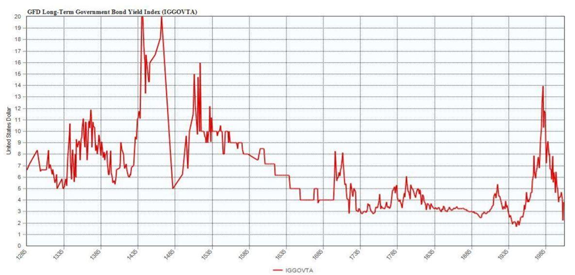

| The first half of the 1980s was a unique time for American investors. Government debt offered double-digit yields. That’s the only time this happened in our nation’s history. And it may have been the only time since 1550 when yields like that were available.

In the 13th century, Italian banks led the financial world. The balance of power shifted between Venice and Genoa during this time, but Italy remained the global financial capital until 1606.

That’s also when the Netherlands was exploring the world and developing stable financial markets. In addition to government bonds, traders were actively buying and selling stocks and options on stocks in the 17th century.

Britain ruled the oceans and financial markets from 1700 to 1914. During World War I, the U.S. assumed both roles to a degree.

The Global Financial Data chart below from shows yields on bonds issued by the world’s leading financial power since 1250. Double-digit yields existed for less than seven of the past 475 years. Double-Digit Yields: A Thing of the Past  (Click here to view larger image.) Despite their rarity, some investors have anchored their expectations on that return. Some investors bought 30-year government bonds yielding 15% in 1981.

Many wished they hadn’t missed this opportunity. Yields have been below 10% since 1986 and are unlikely to breach that level in the future.

Low yields can lead to mistakes. Investors may reach for unsustainable yields, or they may lock in their income for 30 years with government bonds. They may even buy junk bonds to generate more income.

These decisions might work out. But they are often mistakes.

| The energy crisis doesn’t look like it’s going away anytime soon. But tech expert Adam O’Dell has found a little-known company that has developed new tech to access the largest energy source on Earth … a source that could produce 5X as much power as the largest oil field … in just one year. There’s still time to get in early. Click here for the full story. |

Risk of Inflation Buying 30-year bonds ignores the risk that inflation is likely to rise at some point in the next three decades. Income won’t keep pace with inflation when that happens.

Eventually, inflation falls. But that doesn’t mean prices fall. Even when inflation falls, there is still a loss in what the income can buy.

Now, you might consider buying junk bond funds. These can deliver surprising results. Junk bonds track the stock market, and they rise in bull markets.

However, stocks rise more. And junk bonds fall in bear markets. The declines are usually worse for junk bonds than stocks. Investors get income, but it comes at a cost. Selective timing and what to buy is critical to success in junk bonds.

So far, I’ve identified problems with trying to obtain income through 30-year bonds and junk bonds. Now let’s look at a solution… Build an Income Ladder A bond ladder is an often-overlooked opportunity. Bond ladders consist of fixed income investments with different maturities.

For example, consider a $5,000 investment. To create a ladder, you’d buy five $1,000 bonds. One bond matures in one year. Another in two years. A third in three years. The fourth in four years. The last one matures in five years. Strictly speaking, the one-year investment is a bill. The others are notes. But the idea is more important than the terminology.

| From our Partners at Banyan Hill Publishing. After a series of banking collapses hit mainstream media, the surge in bitcoin's (BTC) price has raised eyebrows. In fact, many are recognizing BTC as one solution with its 70% growth rate seen so far this year; yet another crypto could have much more potential and disrupt global finance within our lifetime! With investment already pouring in from PayPal and Square plus Mark Cuban and billionaires Elon Musk and Ray Dalio on board too ... there may be serious opportunities out there today if you know where to look — learn how you can get started with only $20 here now before it's too late! |

This setup avoids the problem of locking in income when yields are rising. It also reduces the risk that yields will be very low when your bond matures. With securities maturing every year, you should generate steady income. You might also beat the market.

Crestmont Research tracks the performance of ladders over different time frames. Let’s say you bought long-term bonds when rates were above 10% in 1981.

A five-year ladder would have provided income averaging 5.7% a year. Buying a single five-year bond every year during that time would have provided 4.6% a year.

A 10-year ladder delivering 6.7% also beat the buy-and-hold return of 5.1%. Longer-term ladders also beat their benchmarks.

In the future, bond ladders can minimize the pain that fixed income investors experience when interest rates rise. The ladder adapts to changes in rates and could deliver higher incomes than a buy-and-hold investment in the long run.

If rates fall, an event that seems unlikely but is certainly possible, a ladder can still deliver significant income. The longer-term holdings lock in relatively high yields. This offsets the lower income of new bond positions.

Ladders are also a great place for savings. A one-year ladder could hold 12 Treasury bills with one maturing every month. That provides access to emergency funds quickly.

This is a versatile tool that could be part of your Endless Income strategy.

Stay tuned for Tuesday, August 29, when you’ll be able to receive a collection of income secrets in the book Endless Income: 50 Secrets for a Happier, Richer Life when you join Green Zone Fortunes risk-free.

The tips, tools and secrets in Endless Income unlock unexpected streams of extra money that many Main Street retirees don’t even know exist — that you’ll soon have a chance to learn.

Until next time,

Michael Carr

Senior Technical Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment