- Steel companies are shifting focus as demand fizzles.

- Aluminum consumption is growing at a rapid pace.

- Today’s 97-rated metals producer is well-positioned for this new aluminum boom.

|  | A former U.S. industry giant recently pushed back…

U.S. Steel Corp. (NYSE: X) rebuffed a buyout deal from fellow former giants Cleveland-Cliffs Inc. (NYSE: CLF) worth north of $7.2 billion.

Back in 1901, U.S. Steel became one of the first $1 billion businesses when 10 companies combined to form the juggernaut.

But the steel industry in the U.S. has stalled out in recent years. Exports of U.S. semifinished and finished steel products dropped 51.4% from 2012 to 2020.

While the steel industry’s heyday may have passed, today I’m going to look at another metal industry that’s poised for a breakout.

It’s opening the door for languishing steel manufacturers to refocus and target new growth.

And I’ll use Adam O’Dell’s proprietary Green Zone Power Ratings system to identify a big player that’s doing just that … while paying its investors a decent dividend as well.

| Take a look at this image of the Bloomberg Billionaires Index…

The four men circled here have a combined net worth of over $600 billion.

And right now, they have ONE thing in common.

They’re all throwing their weight behind a new technology I call “Imperium.”

Musk says Imperium is “amazing” … Gates says it will be “one of the most powerful technologies of the 21st century” … and Bezos and Zuckerberg are invested to the tune of billions of dollars combined.

Want to know why?

Click here to discover why the world’s richest men are piling into Imperium… |

Aluminum’s Resurgence When you think of aluminum, the first image that comes to mind is likely the can of soda you just finished.

But it’s used for much more … like window frames and critical aircraft parts.

Aluminum is nontoxic, highly malleable and very strong when combined with other metals like copper and silicon.

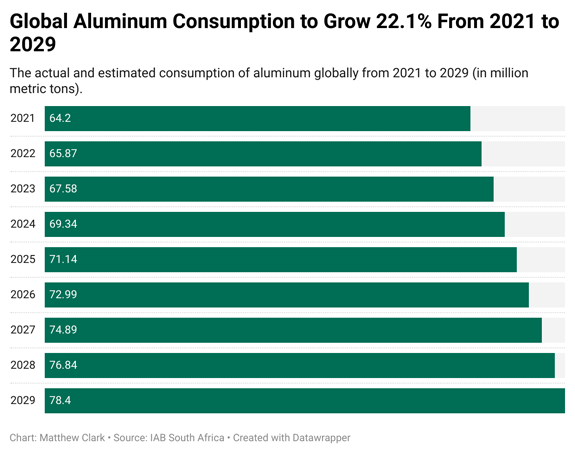

And the need for aluminum is only going higher:  (Click here to view larger image.) In 2021, the world consumed 64.2 million metric tons of aluminum. IAB South Africa expects that figure to jump to 78.4 million metric tons by 2029 — a 22.1% increase.

The U.S. was the fourth-highest exporter of aluminum in the world in 2021 — behind China, Germany and Canada.

What’s more, S&P Global projects the price of one pound of aluminum will hit $1.36 by 2028 … up from just $0.76 in 2020.

With consumption and price on the rise, companies in aluminum production are poised to increase revenue and profits in the coming years … all good news for investors.

Using our Green Zone Power Ratings system, I found a highly-rated stock in the industry that also pays a strong dividend. Reliance Steel Is a “Strong Bullish” Play on the Trend While it’s not as old as U.S. Steel, Reliance Steel & Aluminum Co. (NYSE: RS) has been around since 1939.

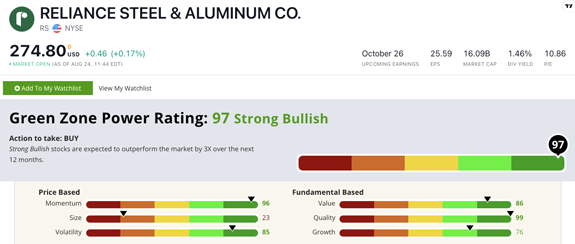

It produces products made from aluminum, brass, copper, titanium and, yes, steel.  (Click here to view larger image.) RS rates 97 out of 100 on our Green Zone Power Ratings system. We’re “Strong Bullish” on the stock and expect it to outperform the broader market by 3X over the next 12 months.

The stock earns its highest mark on Quality (99). Its 20.9% return on equity is four times higher than the metal products industry. And its 10% net margin is five times higher than the peer average. You can see why it rates in the top 1% of stocks on the Quality factor.

On our Momentum factor, RS earns a 96. Since June 1, the stock has gained more than 18% and is trading around 7% off its 52-week high. This tells me the stock has plenty of room to run.

As a cherry on top, RS pays a 1.46% forward dividend yield, which equals around $4 per year for each share they own.

A little extra income never hurts!

Bottom line: We need more aluminum every year … and that’s driving prices up.

This is great news for companies like RS. Higher demand and higher price means the potential for higher profits.

That’s what makes Reliance Steel & Aluminum a compelling stock to examine for your portfolio.

| From our Partners at Global Intelligence Letter. America has lost 100,000 farms in less than a decade (which helps explain the recent food shortages). Financial writer Jeff Opdyke says this is part of a much bigger problem… and these shortages will soon spread to gas, diesel, medicine, and even money. Click here to learn why… |

Stay Tuned: Watch Out for Dividend Traps Tomorrow, Adam has a warning about high-yielding dividend stocks. He’ll show you how to use Green Zone Power Ratings to sidestep these stocks that look like good buys at first glance.

The Money & Markets team is also releasing its new book tomorrow, so keep your eyes on your inbox.

Endless Income: 50 Secrets for a Happier, Richer Life is chock-full of ways that you can generate new streams of income. Ideas like: - How to collect $510 or more a month … for life … simply for “insuring” a part of your nest egg.

- Three simple words you can use to put 40% more money in your pocket for retirement.

- How you can boost your 401(k) or IRA as much as 194% in eight years by being FIRE’d…

You can secure a copy of this new book after its release tomorrow. We’ll have all the details in future editions of Stock Power Daily.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment