| Dear Loyal Reader, I have to admit, we’re spoiled. In the past year or so, we realized just how much we enjoy low interest rates.

After all, low rates made it possible to buy larger homes. And we got to splurge on cars and other big-ticket items.

But we weren’t the only ones taking advantage of 5,000-year lows in interest rates.

Companies issued low-cost debt to expand … private equity firms relied on cheap money to fund acquisitions … and venture capital firms funded countless startups, many of which weren’t viable at higher rates.

| From our Partners at Monument Traders Alliance. New research proves that trading one ticker every week has had the ability to produce extraordinary gains...

Including a rare 2,614% in under 11 days.

See this groundbreaking new discovery for yourself. SHOW ME ONE TICKER PAYOUTS |

Investing During a Time of Cheap Money As investors, we benefited from publicly traded companies using low-cost debt to fund share buybacks.

With higher rates, buyback activity in the first quarter fell more than 21% compared to the same quarter a year ago (see the most recent data here).

The 20 largest companies account for almost half of the buybacks. These companies have solid balance sheets and access to the lowest available interest rates.

Buybacks increase the value of stocks. That’s because they increase earnings per share (EPS) by reducing the value of the denominator in that calculation. The effect has been small. But with fewer buybacks, many companies are struggling to report higher EPS.

Cheap money also allowed companies to invest heavily. To determine whether an investment makes sense, companies compare the expected returns of the project to their cost of financing. If a company expects to earn 4% a year on an expansion, it makes sense to do that if financing costs are less than 4% a year.

Low rates made many projects attractive. Former Federal Reserve Chair Ben Bernanke explained how far this process could go: …If the real interest rate were expected to be negative indefinitely, almost any investment is profitable. For example, at a negative (or even zero) interest rate, it would pay to level the Rocky Mountains to save even the small amount of fuel expended by trains and cars that currently must climb steep grades.

With rates rising, fewer projects will be funded. That can also reduce earnings growth in the long run.

| Take a look at this image of the Bloomberg Billionaires Index…

The four men circled here have a combined net worth of over $600 billion.

And right now, they have ONE thing in common.

They’re all throwing their weight behind a new technology I call “Imperium.”

Musk says Imperium is “amazing” … Gates says it will be “one of the most powerful technologies of the 21st century” … and Bezos and Zuckerberg are invested to the tune of billions of dollars combined.

Want to know why?

Click here to discover why the world’s richest men are piling into Imperium… |

The State of Interest Rates Of course, concerns about higher rates aren’t important if rates quickly fall. But that doesn’t seem likely.

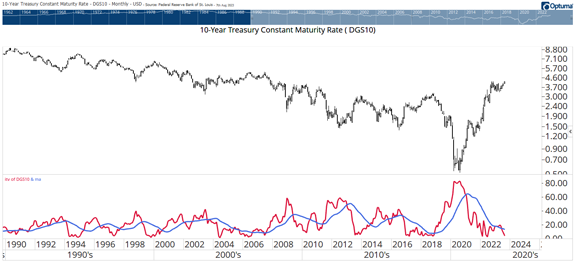

The chart below shows monthly values of 10-year Treasury rates. This is a benchmark for long-term interest rates. Mortgage rates, for example, show a high correlation to 10-year rates. Rates Are at the Beginning of an Uptrend  (Click here to view larger image.) The indicator at the bottom of the chart measures volatility. It rises when rates fall and declines when rates rise. The blue line is the moving average of the indicator. It highlights transitions in the trend.

In June, the indicator fell below its moving average. This tells us that rates are at the beginning of an uptrend.

The pandemic crash in rates distorted the scale of the chart. The current reading of the indicator looks low but is still rather high. It would need to fall more than 80% to reach a new low. That shows there is significant upside potential in interest rates.

Rates are really at a normal level right now. They are higher than the rate of inflation, and they should be. When rates are below inflation as they were in recent years, investors are losing money. That can’t last long, and it didn’t.

In time, markets and consumers will adapt to normal rates. The last few years were an aberration that will be missed. But we can still function and profit with rates at higher levels, and we’re likely to get that chance for the next few years.

This is just the new normal…

Until next time,

Michael Carr

Senior Technical Analyst, Money & Markets P.S. If you’re looking for stocks that are performing well in this new normal, you should check out what my colleague and fellow CMT Adam O’Dell has on offer in his premium Green Zone Fortunes stock research service.

Like me, Adam is always on the hunt for what’s working now, and he’s created a well-diversified model portfolio full of stocks that should thrive from here. For more information, click here.

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment