- Airbnb has changed the vacation rental industry.

- New York City is cracking down on the market with new regulations.

- Here’s how ABNB stock rates as the rental market evolves.

|  | My wife and I love to take a break from the hustle and bustle of daily life.

Living in South Florida, we have the opportunity to take short trips to the beach, faraway eateries and even Walt Disney World (which my wife loves).

The challenge is finding a place to stay on short notice…

One time, we booked a stay in Orlando for a weekend Disney getaway and it was a disaster.

It ended up being a shared apartment, which wasn’t a big deal. Except we had a curfew because of their baby.

We couldn’t use the kitchen or the living room. We were confined to our bedroom.

It wasn’t the best experience, but at least it was cheap!

Today, I’m going to use Adam O’Dell’s proprietary Green Zone Power Ratings system to tell you about a stock that helps vacationers find cheap places to stay on short notice.

The results might surprise you as much as our stay in Orlando surprised us. The Short-Term Rental Reckoning This week, New York City is doing something that will crimp the short-term rental market.

The city is enforcing a 2022 law requiring short-term rental platforms to register with the city. Hosts will have to stay in the same unit they are renting and cap reservations at just two people.

Thousands of short-term rentals in one of the most popular tourist towns will simply vanish.

And that spells trouble for the online marketplace that started the short-term rental trend, Airbnb Inc. (Nasdaq: ABNB).

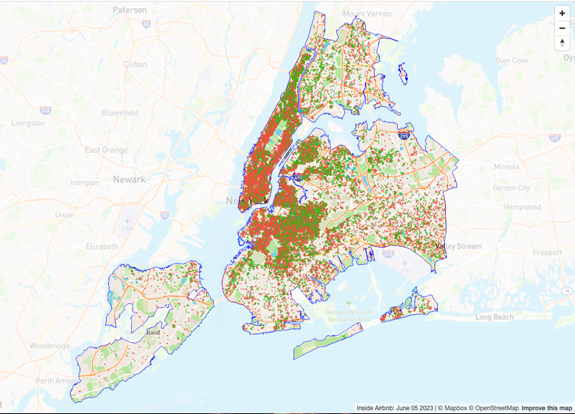

In the second quarter of 2023, ABNB reported 115.1 million nights and experiences booked — an 11% increase from the same quarter a year ago. Airbnb Has Taken Over New York City  (Click here to view larger image.) Inside Airbnb estimates there are more than 40,000 Airbnb listings in NYC. Of those, more than 18,000 are private rooms (green plots in the map above) … which would not be allowed under the new law.

While Airbnb’s reach is global, these NYC restrictions will hurt the company relying on those bookings as part of its $2.5 billion in quarterly revenue.

| It proves why AI has been called the biggest new industry of the 21st century. And could be worth a staggering $80 trillion over the next ten years. And Chief Investment Strategist Adam O’Dell saw it coming a long time ago. He labeled the fastest-growing sector of the artificial intelligence industry as “x.AI” a whole 15 months before the world’s richest man announced his newest AI-based company by the same name. Now, and for a limited time, Adam is sharing all the details on his favorite AI stocks right now. |

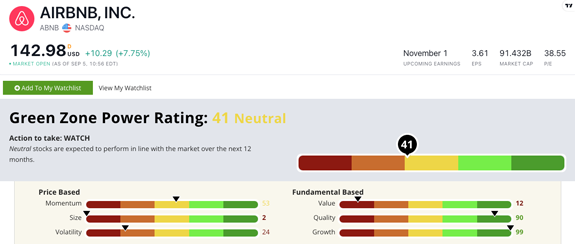

We’re Barely “Neutral” on Airbnb Stock Airbnb Inc. (Nasdaq: ABNB) rates 41 out of 100 on our Green Zone Power Ratings system. This means we are “Neutral” on the stock and expect it to perform in line with the broader market over the next 12 months. That’s also the lowest score a stock can get before dipping into “Bearish” underperformance. Anything 40 and below is set to underperform from here.  (Click here to view larger image.) While the company did get a boost with the announcement of its listing on the S&P 500 last week, the New York City law is going to put a damper on future earnings. And what happens if other cities follow NYC’s lead? San Francisco and Berlin have passed softer restrictions already.

ABNB earns a 99 on our Growth factor thanks to a one-year sales growth rate of 40.2% and an earnings-per-share growth rate of 587%!

It earns a 90 on Quality with a gross margin double the hospitality services industry average and an operating margin six times higher than its peer average.

However, its recent stock price run-up has made ABNB overvalued. It earns a 12 on our Value factor with a price-to-sales ratio nearly eight times higher than the industry average. Its price-to-book value is also five times higher.

Bottom line: Airbnb gives vacationers like me and my wife less-expensive options when we want to get away.

But NYC’s new short-term rental rules mean those impressive margins are at risk.

That’s a compelling reason to sit on the sidelines with Airbnb stock. Stay Tuned: Are You Ready for Some Football? The NFL season kicks off later today when the defending champion Kansas City Chiefs host the Detroit Lions, a team that has never once hoisted the Vince Lombardi trophy…

Our managing editor, Chad Stone, is going to explore the Green Zone Power Ratings of some of the biggest names broadcasting the games to see if they are potential buys.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets P.S. Airbnb stock is right on the edge of falling into “Bearish” territory of Adam’s Green Zone Power Ratings system. Bearish and “High-Risk” stocks in the system are due to underperform the broader market over the next 12 months. And if you want a full list of all the stocks that fall into these two categories, Adam has you covered. Click here to see how to gain access to his Blacklist.

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment