| It’s been quite a week…

We’re gearing up to unleash Adam O’Dell’s brand-new elite stock research service, Infinite Momentum Alert.

The more I learn about Adam’s new system, the more I’m excited for you to get a chance to see it in action next week.

It is, bar none, the most promising investment strategy I’ve seen across the entire financial advisory business.

Adam’s system promises the ability to outperform the S&P 500 by 300-to-1 over the long haul, by trading just 10 minutes per month.

Results like that are only possible because it’s backed by the Green Zone Power Ratings system… Adam’s trend-and-momentum algorithm that powers Max Profit Alert, and the freedom and efficiency that artificial intelligence technology grants us.

I highly encourage you to sign up for his free presentation so you can get all the details straight from him. It’s slated for 1 p.m. Eastern time on Tuesday, September 19.

If you make the great decision to join, Adam will kick things off by sending you the first 10 stocks to own for the first four weeks of his system.

But we’re not leaving you in the lurch until then.

Adam touched on something key in Stock Power Daily earlier this week while laying out the thesis of his Infinite Momentum strategy.

I’m talking about the Momentum, Value and Quality factors…

These three factors are critical to Adam’s new system.

But avoiding poor stocks is just as important as finding great ones. So today, I did some digging and uncovered a stock that rates a lousy 1 on all three of those critical factors – making it utterly un-investable on any timeframe.

Sell this stock… short it… trade put options on it. But for the love of God, don’t ever buy it. It’s one for the garbage heap.

| From our Partners at Banyan Hill Publishing. Because of Statute 26-7704 — a nearly forgotten law enacted by Ronald Reagan — $17.9 billion in MLP Checks will be paid out to patriotic American investors this year. Click here to see how. |

One of the Worst… Before I proceed any further, I want to make one thing clear: Momentum, Value and Quality are only one piece of Adam’s Infinite Momentum strategy. There’s a lot more going on behind the scenes, and I’ll let him give you the full rundown on Tuesday.

But we can still use those three factors to do our own stock sleuthing when considering new stocks for our portfolios. If I saw a stock that rated poorly on any of those factors — or worse, all three — I’d know that was a stock to steer clear of.

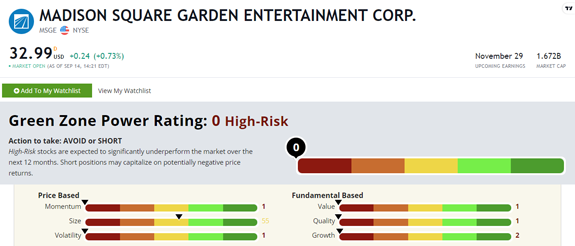

Let’s put that into practice with a stock that you may recognize: Madison Square Garden Entertainment Corp. (NYSE: MSGE).

(Click here to view larger image.) With a 0 out of 100 overall rating, this stock is about as bad as it gets. “High-Risk” stocks like these are slated to vastly underperform the broader market over the next 12 months.

Back in 2020, Madison Square Garden Entertainment Corp. was spun off from MSG’s sports assets. It operates the Theater at Madison Square Gardens, Radio City Music Hall, the Beacon Theater and a few other large halls across the U.S.

While seeing a show at one of these iconic venues is on my bucket list, investing in MSGE’s stock is not!

| Our CEO is making a big move… He's put 100% of his IRA into Adam O'Dell's brilliant new AI-driven system — Infinite Momentum. We've already invested $5 million in this technology … tested it against 24 years of data … and witnessed its power to beat the market by 300-to-1. Now, on September 19, Adam proves it once and for all — and shows how you can reap the windfall. Details here... |

It rates a 1 on Momentum, Value AND Quality.

The stock price has fallen 42% over the last year. Investing in the broad S&P 500 would have netted you a 14% gain over the same time frame.

Looking closer at the Value factor, MSGE hasn’t actually registered any positive earnings, sales or cash flow, so its price-to metrics are nonexistent.

Its last quarterly statement revealed a -$0.47 earnings per share as well as a -$1.36 book value per share.

And finally, a deeper dive on Quality shows a similar story. The company has negative returns on assets, equity and investments along with no gross, net or operating margin.

That means it has no quality ratios of record.

Its last quarterly return on assets was -$6.65 with a net margin of -16.6%. Tack on an operating margin of -17.4% ... thanks to -$25.7 million in operating income.

Let’s just say there’s a lot of red in MSGE’s balance sheet.

Overall this is just one of the worst stocks out there, based on Green Zone Power Ratings.

And it’s a clear indication of a stock that isn’t likely to show up as a buy in Adam’s upcoming Infinite Momentum Alert anytime soon…

If you want to find out why Adam believes this could be his “magnum opus,” and how he’s boiled down a complex algorithm into a simple stock trading strategy that involves 10 stock tickers and 10 minutes of trade management each month, click here.

Get ready for Tuesday! You don’t want to miss it…

Until next time,

Chad Stone

Managing Editor, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment