| If only we all had a crystal ball to tell us the future.

Of course, it’s impossible to predict what’s going to happen tomorrow, next week, next month … or even 10 years from now.

I mention that because investors are always on the hunt for that perfect indicator.

That way we can get in and out of a stock at the right time for maximum profits.

There are all kinds of signals out there that relate to timing. Knowing if one is good or not is tricky.

But what if you’ve had one of the best hanging on your wall for ages now?

My friend and colleague Mike Carr has devised a system that uses seasonality (his “Apex Profit Calendar”) to find the best time to invest in different sectors of the market.

Our chief investment strategist, Adam O’Dell, expanded on that stock seasons idea as well. (If you missed that article, you can read it here).

Today, I’m going to dive into two specific sectors of the market, show when those sectors experience the largest gains and why.

| From our Partners at Banyan Hill Publishing. It’s not a recession, inflation or stock market crash — according to one expert: “Those are the least of our worries.”

There’s a looming event that he believes will be far worse. This event will ignite a crisis more dangerous than anything America has seen since the Great Depression. Yet no one is talking about it.

In this shocking new exposé, you will discover everything you need to know to sidestep the calamity. And perhaps even profit from it.

To watch it, free of charge, click here now. |

It’s Cold, but Food and Beverage Is Hot As Adam and Mike explained, human habit drives certain stocks’ performance during certain times of the year.

With the food and beverage sector, it’s a bit different.

Mike’s research found that food and beverage stocks tend to perform the best from February 15 to April 13 each year … and the reasons might surprise you.

One big reason why food and beverage stocks go up is because of higher demand.

There is no time when demand for both is higher than during the Super Bowl.

Everyone is having a party on Super Bowl Sunday — which is usually in February — and restaurants are packed.

You also have Valentine’s Day which is smack dab in the middle of the month. Reservations for two, anyone?

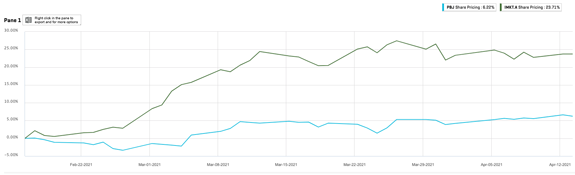

Look at this chart from 2021: IMKTA’s Impressive Profit Season  (Click here to view larger image.) This shows the movement of the Invesco Food & Beverage ETF (ARCA: PBJ) from February 15 to April 13 that year. The exchange-traded fund (ETF) (the blue line) moved up 6.2%.

But Mike’s system drills down even further than that, using our Green Zone Power Ratings system.

The highest-rated stock in that ETF during that time was Ingles Markets Inc. (Nasdaq: IMKTA). IMKTA (the green line) jumped 23.7% over the same time.

Here’s more proof that the Mike’s “Apex Profit Calendar” works: - Cal-Maine Foods Inc. (Nasdaq: CALM) stock gained 10.8% between those same dates in 2016.

- A year later, during the same time, Sanderson Farms Inc. (SAFM) went up 15.6%.

- Boston Beer Inc. (NYSE: SAM) increased nearly 11% between those same dates in 2018.

By combining his Apex Profit Calendar and the Green Zone Power Ratings system, Mike managed to identify the best stocks for the food and beverage sector’s profit season.

| From programing nuclear missiles in the Cold War to designing computer systems for the NSA … Michael Carr has seen it all. Now, this military hero wants to show you how he’s used the power of AI to find consistent monthly profit opportunities. Starting with his next trade this week. Click here to see all the details now. |

The Spring Homebuilder Boom Once the winter doldrums pass and temperatures warm up, another sector starts to gain steam.

Homebuilders come out of hibernation and nail guns start firing across the country.

When the weather gets warmer, it’s easier for construction projects to progress — you aren’t battling the cold, snow or freezing rain.

Spring is also a time when economic indicators, such as employment and consumer confidence, rise after slumbering through the winter months.

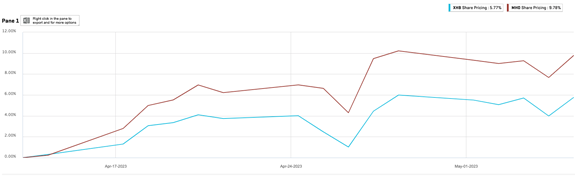

More job security and optimism about the economy leads to increased demand for homebuying and home construction during its own profit season (April 13 to May 6). MHO Outperforms Its Homebuilding Peers  (Click here to view larger image.) This year, the SPDR S&P Homebuilders ETF (ARCA: XHB) — the blue line in the chart above — experienced a 5.8% gain from April 13 to May 6 — right in the middle of springtime.

During the same time period, XHB gained 5.5% in 2021 and 11.8% in 2020.

The highest-rated stock in XHB from April to May 2023 was M/I Homes Inc. (NYSE: MHO) — the red line in the chart above. It climbed 9.2% ... moving with the ETF, but outperforming it by a decent margin.

And that’s not the only time it happened: - In 2022, Cavco Industries Inc. (Nasdaq: CVCO) went up 5.4% from April 13 to May 6.

- LGI Homes Inc. (Nasdaq: LGIH) jumped 8.7% from April to May in 2018.

Those are just two of the profit seasons Mike has identified for each year. He has 13 others that he’ll be targeting in the future of his Apex Alert premium stock trading service.

Bottom line: It’s true that no one has a crystal ball that accurately predicts the future.

But Mike’s Apex Profit Calendar gets close. It’s taking advantage of historical seasonal trends for consistent gains.

This is a unique opportunity to join him in his brand-new service, but it will only be available for a short time. We want to give his charter members the best shot at growing their wealth with Mike. And if you join now, you’ll be one of the first with a chance to execute his first trade right out of the gate.

To learn more about this key strategy, go HERE. You don’t want to miss out.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment