| Despite some bumps in the road, it’s been a strong year for the stock market.

All three major indexes climbed higher out of the gate, followed by a downturn into March. Stocks rose again into summer, traded flat, sank through October and are now ripping higher again as inflation seemingly cools.

Year to date, all three indexes are in the black: - Nasdaq 100 ETF (QQQ): +44%.

- S&P 500 ETF (SPY): +17%.

- Dow Jones Industrial Average ETF (DIA): +5%.

In the last three weeks alone, all three funds are up between 6% and almost 11%.

Logic suggests the recent upturn in the market would lead to a positive swing in broader market sentiment.

Today, I’m going to share some research that suggests bullish sentiment in the market isn’t where you might think.

Investors Are Still on the Fence The American Association of Independent Investors (AAII), is a nonprofit corporation that aims to help individuals manage their assets using education and research.

Every week, the AAII performs an investor sentiment survey of its members to gauge investors’ mood toward the market.

Investors indicate whether they are “bullish,” “bearish” or “neutral” on the future of the market.

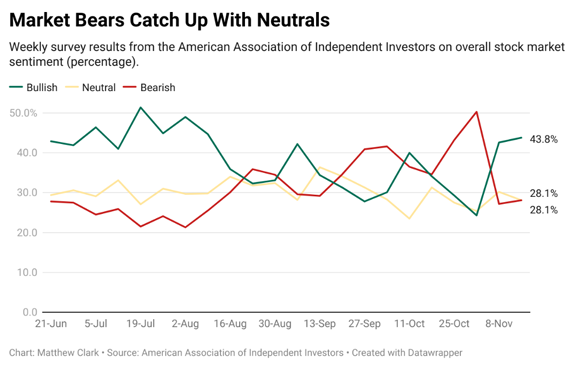

Here are the results of the survey dating back to June 2023:  (Click here to view larger image.) A positive reading of the Consumer Price Index, the closely tracked inflation indicator, pushed more investors into the bullish category at the beginning of November.

The percentage of market bulls is back where it was in June but still lower than it was in July.

More investors remain bearish on the market than in June, July and into August.

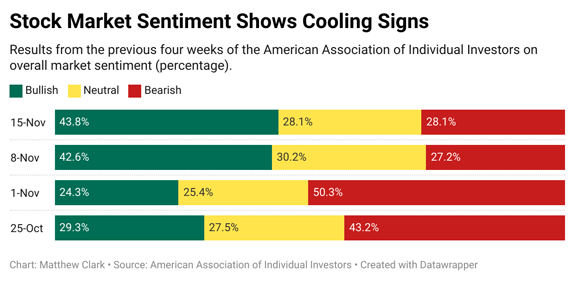

Drilling down to the last four weeks paints an interesting picture:  (Click here to view larger image.) After a jump in bullish sentiment following the most recent CPI report, the following week’s survey was telling.

Bullish sentiment went up around 100 basis points. But curious enough, bearish sentiment went up by the same amount.

Bearish and neutral investors still outnumber bulls, despite the latest market run-up.

What this tells me is, while positive sentiment is up, there’s still not an overwhelming amount of confidence in the market. Quarterly Reports Shed Light on Sentiment Stocks rise and fall based on quarterly earnings reports.

A great report can send a stock higher, while bad or even lackluster earnings and sales can send a stock south in a hurry.

According to FactSet, more than 80% of S&P 500 companies have reported third-quarter 2023 earnings and 82% of those companies have beat analyst estimates.

The average stock price of those companies has increased 0.8% two days before through two days after earnings calls.

However, companies reporting weaker earnings have triggered average sell-offs of 5.2% during the same time period.

Investors are hammering stocks with weaker earnings and not overly rewarding stocks that come in above earnings estimates.

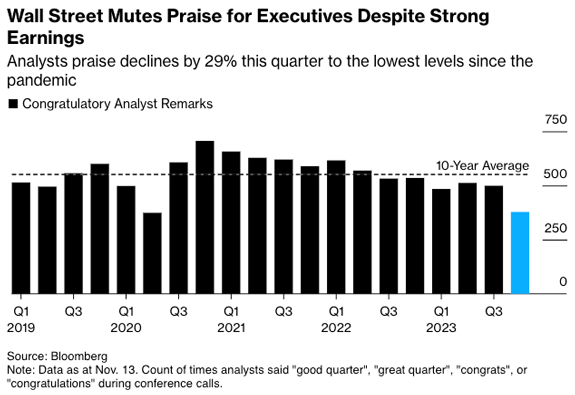

Plus, analysis by Bloomberg shows analysts are not serving up “atta boy” compliments to companies after strong quarters as much as before:  (Click here to view larger image.) This data, coupled with the AAII sentiment survey results, leads me to believe there is a significant amount of concern for investors heading into 2024.

Outside factors like a looming presidential election, inflation uncertainty, global conflict and signs of weakening consumer demand are causing headwinds in market sentiment.

So while the market is climbing higher, investors remain on the fence about their expectations for the next year.

Of course, my colleague Mike Carr can operate in any market conditions.

And his brand-new strategy aims to find the No. 1 Nasdaq stock to trade each month — no matter what the broader market is doing.

If you want to see how, click here.

| From our Partners at Banyan Hill Publishing. In an eye-opening interview, renowned tech expert Ian King revealed details on AI energy, a new form of energy created by artificial intelligence. He believes this could blossom into a $40 trillion industry within a decade. Click here to watch it now. |

Stay Tuned: What’s Next for the Housing Market Tomorrow, Adam O’Dell is going to take a closer look at the housing market now that mortgage rates are cooling again.

He has reason to believe a certain market segment is becoming one of 2024’s biggest market mega trends.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment