| In 2004, Geico unveiled what would become a very popular advertising campaign.

Ads featured Neanderthals with the premise being that using the company’s website was: “So easy, a caveman could do it.”

The campaign was so successful that, in 2008, the caveman was voted America’s favorite advertising icon and earned a spot on the Advertising Week Walk of Fame.

I bring this up because we can apply that slogan to the investing world.

But today, I’ll show you that just because it’s easy doesn’t mean it always works — and how our proprietary Green Zone Power Ratings system can help. The Ease of Index Fund Investing One of the easiest ways to get into investing is through index funds.

Index fund investing involves buying shares of a mutual fund or exchange-traded fund (ETF) that tracks a particular market index. There are different types of funds, like: - The S&P 500 Index (NYSE: SPY).

- The Nasdaq 100 Index (Nasdaq: QQQ).

- The Russell 2000 Index (NYSE: IWM).

- The Dow Jones Industrial Average Index (NYSE: DIA).

Investing in these funds requires little financial knowledge, provides diversification and is a low-cost way to invest in the stock market.

But there are drawbacks. Just to name a few: - Composition: You have no control over what stocks make up these funds. You may not think Apple Inc. (Nasdaq: AAPL) is a good stock, but it will still make up a big part of QQQ.

- Downside protection: These funds are geared to track broader market performance. If the index crashes, the fund moves down and there is no way to guard against those pullbacks.

- Market-beating gains: You’re looking for big gains, but you won’t find them in these funds. In fact, index fund gains are typically equal to or could even lag the broader market they track.

So while index fund investing is “so easy, a caveman can do it,” it’s not necessarily the best way to invest your entire portfolio.

That’s where our Green Zone Power Ratings system comes into the fold.

Low-Rated Stocks Hinder QQQ Performance To explain how our Green Zone Power Ratings system can best the performance of an index fund, I’ll look at the Invesco QQQ Trust (Nasdaq: QQQ).

This fund tracks the performance of the Nasdaq 100 index.

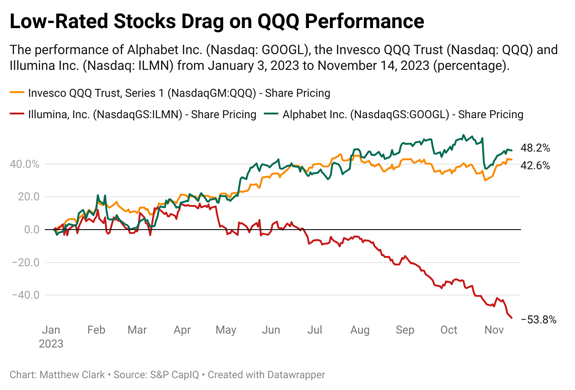

I pulled a top-rated stock from QQQ — in this case, Alphabet Inc. (Nasdaq: GOOGL) — and a low-rated stock — Illumina Inc. (Nasdaq: ILMN). I tracked the performance of all three since the start of 2023.

Here’s what I found:  (Click here to view larger image.) QQQ (the orange line in the chart above), has moved up an impressive 42.6% year to date.

What I found interesting was how the two other stocks performed. GOOGL (the green line) — rated an 84 overall on our Green Zone Power Ratings system — is up 48.2% while ILMN (the red line) — rated 0 overall — is down 53.8%.

This tells me three things: - The Green Zone Power Ratings system does an excellent job showing us what stocks to buy and what stocks to avoid. In this case, GOOGL’s high rating tells us it is one to buy (and it’s up 48% on the year), while ILMN’s low rating says it is one to avoid.

- ILMN’s massive decline has dragged on QQQ’s performance, limiting its gains.

- Our system shows GOOGL would’ve given you higher returns than if you just bought QQQ.

Bottom line: While investing in index funds is “so easy, a caveman can do it,” you are at the mercy of fund managers when it comes to gains.

Being able to target the individual stocks that are boosting a fund’s performance can yield even bigger gains.

My friend and colleague, Mike Carr, has devised a way to do just that through a newly developed strategy.

He’s taken the guesswork out of finding the right stock at the right time for maximum return potential.

To find out more about this groundbreaking methodology, click here.

Stay Tuned: Are These Stocks a Buy? Tomorrow, Chad is going to look at a couple of stocks that investors are pouring money into now that inflation seems to finally be cooling.

These stocks may be ripping higher, but what does Green Zone Power Ratings say? Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment