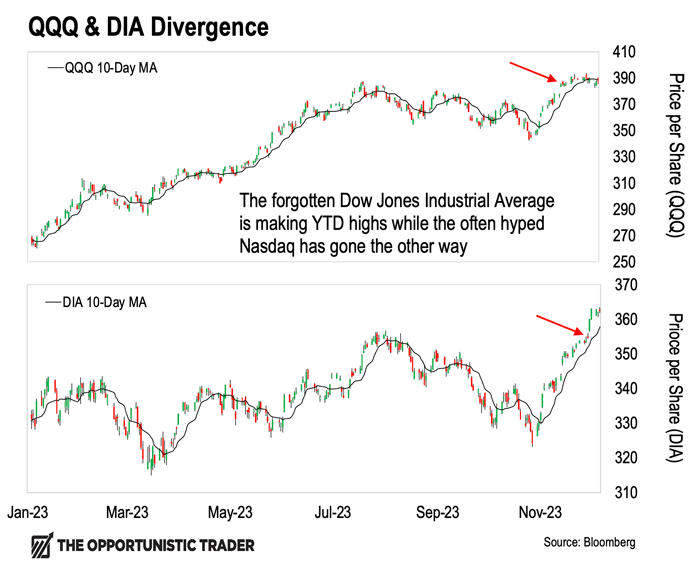

A Huge Market Rotation Is Already Underway By Larry Benedict, editor, One Ticker Trader Hey traders, Larry here with your December edition of One Ticker Trader. The end of 2023 is fast approaching. And what a year it’s been. The good news is that there’s still time to capture more gains ahead. We’ve seen massive moves since stocks bottomed in late October. And I think there’s a lot more to play out before this year is done. Last month, we switched from trading the S&P 500 to the Invesco QQQ Trust Series 1 (QQQ). And it’s fair to say things didn’t go our way. We made the switch to capture one of the most lackluster earnings I’d seen in Big Tech for some time. Cloud computing growth was slowing down – a key driver of Big Tech’s earnings growth (and their mega-cap valuations) these past five years. We anticipated that this would play negatively into QQQ, given that Big Tech makes up 43% of its holdings. When stocks are priced for growth and that growth disappears, that leaves them vulnerable to a correction. And I still think a correction is due. The market seems to be ignoring that the dozen or so interest rate rises we’ve seen have to slow the economy. That means slower growth. We don’t see this scenario changing. The huge drop in job openings (down 617,000 from October and its lowest level since March 2021) was further evidence of an economy slowing down. But as we saw, the market resisted any hint of a pullback last month. That’s why we rolled our puts to give us more time for the move to play out. Yet since we lost $2.93 on the rolled put, we'll need to make at least 63% on the one we have on our books to fully recoup the loss. We still believe that there is more to come from this trade. In fact, this month’s theme makes me even more certain of it. That’s why I want to continue holding our QQQ puts for the time being. As always, if there is any change, we’ll be sure to let you know immediately. Now let’s take a look at our new ticker for this month. In December, we’ll be trading the SPDR Dow Jones Industrial Average ETF Trust (DIA). Let’s check out why… Why We're Choosing This Trade If you’ve been with us at One Ticker Trader for a while, you may recall that we’ve traded DIA before. Last year in November, we made the same switch from QQQ to DIA. And it worked well, netting us three straight winners in a row. But while we traded DIA with great success, that’s not the reason we’re making the switch today… Instead, the reason comes back to the relationship between QQQ and DIA… On December 1, DIA made its year-to-date high. Yet while DIA was rallying, QQQ was lagging conspicuously behind. On a day when DIA rose 1.4%, QQQ was down 0.25%. This doesn’t happen very often. But it hasn’t just been a one-off divergence… In the six trading days up till then, this divergence happened four of those days, with DIA rallying while QQQ was falling. DIA is an index filled with old-name industrial stocks. So this its outperformance over the tech-heavy QQQ means something important is playing out. We’re seeing a massive rotation out of the mega-cap growth tech stocks into high dividend-paying stocks. Or more simply, it’s a switch from growth to value stocks. You can see this recent clear divergence in the chart of both DIA and QQQ below.

(Click here to expand image) The best way to see this divergence is with the 10-day Moving Average (MA, black line). As you can see, QQQ has flattened and rolled over while DIA continues to rally strongly. Although it might not seem obvious, consider the money flows required to generate such a strong divergence – especially given some of Big Tech’s trillion-dollar valuations. According to ETF Fund Flow data, from November 24–30, QQQ had $4.825 billion in net outflows while DIA had $158 million of net inflows. This move doesn’t bode well for QQQ. There have only been nine other times in the last two years where the spread between DIA and QQQ has been bigger than it is now. And what happened after the spread hit these levels wasn’t pretty… On average, QQQ ended up being 3.8% lower 50 days later. What’s more, three times, QQQ was down more than 11%. This rotation out of large-cap growth into dividend-paying value stocks is happening right in front of us. And it could be a turning point for the market. So for now, we’re going to keep our puts on QQQ… and look to open new positions in DIA. We anticipate there will be great opportunities to benefit from this divergence this month with DIA as well, so please stay tuned for our first trade alert, which will hit your inbox soon. Don’t forget that if you have any questions, please send them through to feedback@opportunistictrader.com Regards, Larry Benedict

Editor, One Ticker Trader Download the Opportunistic Trader Mobile App To make sure you don’t miss any alerts or updates, please download the free Opportunistic Trader Mobile App for iOS or Android. The app enables you to get notifications whenever we publish something new. Make sure push notifications are enabled through your phone settings to receive alerts from the app. You can also access all of your subscriptions and view portfolios. And if you use the app and find it valuable, consider leaving us a review on the App Store or Google Play page. | |

Post a Comment

Post a Comment