| 84,714…

That’s the total number of tech employees laid off during January’s mass exodus, according to TechCrunch.

After a brutal, tech-driven bear market in 2022, some of the biggest companies around were ready to do anything to help their bottom lines.

Amazon laid off 18,000…

Alphabet added 12,000 layoffs…

Microsoft cut 10,000 of its workforce…

And that’s just three of the worst offenders in that single brutal month. By the end of October, the tech sector had let go of more than 240,000 employees!

Tech layoffs (and layoffs in general) were a major theme of 2023.

As the Federal Reserve hiked interest rates, sustainable growth became much harder to achieve. Companies were just looking to survive — and that meant job cuts.

That’s when using a system like Green Zone Power Ratings is a massive benefit.

In seconds, you can learn if these companies are hacking and slashing their workforce away for the right reason.

Let’s get into it…

| Oil is in high demand, but the supply is low and under threat. Putin could cut crude-output at any time. And Arab nations can place more oil embargos on America over our support of Israel. This oil shortage has created a new bull market in energy. Which Adam O’Dell’s research shows could grow into $10 trillion market over the next 10 years. Starting with this tiny oil stock with the potential to surge by January 31, 2024. Click here to see all the details. |

SPOT Slashes While millions shared their Spotify Wrapped — their most-played artists, songs and podcasts of the year — around social media earlier this week, the leading music streaming service announced it was cutting 1,500 jobs, or 17% of its total workforce.

That brings 2023’s total up to roughly 2,300 layoffs for Spotify.

Spotify CEO Daniel Ek summed it up nicely in his email to staff announcing the layoffs: “Economic growth has slowed dramatically and capital has become more expensive.”

Investors took the news well, sending shares 7% higher on Monday. But what’s next?

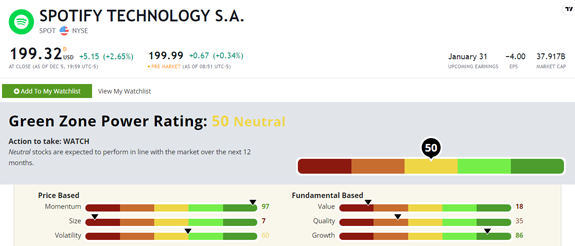

For some insights there, let’s see how Spotify Technology SA (NYSE: SPOT) stacks up in Adam O’Dell’s proprietary Green Zone Power Ratings system.  (Click here to view larger image.) SPOT rates a “Neutral” 50 out of 100 in Adam’s system. Neutral stocks are expected to perform in line with the broader market over the next 12 months.

Like other tech stocks we’ve highlighted in Stock Power Daily, Spotify rates poorly on Value and Size. This is a $37 billion company that investors are not afraid to pour capital into.

That’s exactly why it rates an 86 on Growth and an incredible 97 on Momentum. Year to date, the stock is up an incredible 143%!

Green Zone Power Ratings says this is one to watch right now, but I’d keep a close eye on it. I could easily see SPOT’s rating improving, and it’s clear that investors like the company. The Worst Offender Amazon.com Inc. (Nasdaq: AMZN) showed more than 27,000 employees the door in 2023.

Of course, that’s only 1.7% of a workforce that’s 1.5 million strong.

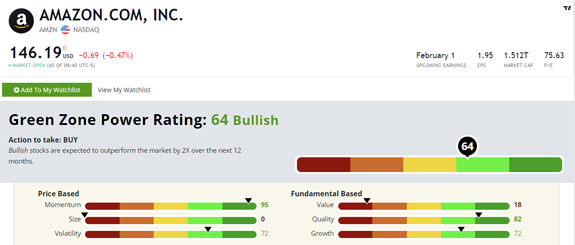

Investors in Amazon stock are OK with the news as well it seems. Shares are up 70% year to date, and AMZN now rates a “Bullish” 64 out of 100 in Green Zone Power Ratings.  (Click here to view larger image.) There’s that low rating on Size and Value again … but it’s paired with strong ratings on Momentum, Volatility, Growth AND Quality.

That last one is big. Stocks that boast high Quality ratings are built to last. These are the companies with strong balance sheets that can weather uncertain market conditions.

Amazon boasted $11 billion in operating income for the third quarter, 343% higher than a year ago! Its net profit margin also grew 205% year over year. Those are just some of the reasons why it rates an 82 on Quality.

While AMZN isn’t in the top echelon of stocks rated by Green Zone Power Ratings, it still looks like a solid investment in our system. Bullish-rated stocks are set to outperform the broader market by 2X over the next 12 months.

Tech layoffs were a major economic theme this year. Companies are cutting back after overextending during 2020’s epic bull market.

And Green Zone Power Ratings helps us figure out which stocks look better now for it.

Of course, if you’re looking for top-rated stocks, along with guidance on the best times to buy and sell, Adam has you covered.

He’s using his system to find high-conviction stock recommendations for his Green Zone Fortunes subscribers each month. To find out how you can follow his guidance, click here.

Chad Stone

Managing Editor, Money & Markets

Check Out More From Stock Power Daily:

| From our Partners at Banyan Hill Publishing. After a series of banking collapses hit mainstream media, the surge in bitcoin's (BTC) price has raised eyebrows. In fact, many are recognizing BTC as one solution with its 70% growth rate seen so far this year; yet another crypto could have much more potential and disrupt global finance within our lifetime! With investment already pouring in from PayPal and Square plus Mark Cuban and billionaires Elon Musk and Ray Dalio on board too ... there may be serious opportunities out there today if you know where to look — learn how you can get started with only $20 here now before it's too late! | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | |

Post a Comment

Post a Comment