| Children are anxiously awaiting Santa’s return on Christmas. They’re preparing by being extra good.

After all, Santa’s watching...

They seem to forget that Santa was watching all year. By the time December comes, he’s checking his list. And he’s already decided who’s been naughty or nice.

Adults who trade also get excited about Christmas. At least those with money in the stock market do. They begin to anticipate the Santa Claus rally in December.

Some are a bit like children, expecting Santa to deliver gifts that exceed their already high expectations.

But the Santa Claus rally doesn’t mean prices go straight up in December. It means that historically, stock prices show a tendency to move higher in the second half of the final month of the year.

Is that the case again this year?

| See why Bill Gates, Mark Zuckerberg and Peter Theil are making huge bets on this breakthrough now. Details here. |

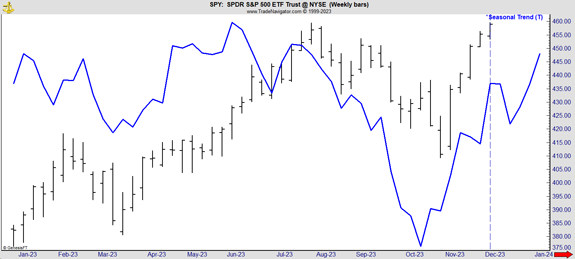

Profits or Coal for Wall Street? You can see the late-month expectation in the weekly chart of the SPDR S&P 500 ETF (NYSE: SPY) below. The blue line is the seasonal trend, and the dashed line shows where we are now. December’s Seasonal Trend  (Click here to view larger image.) The Santa Claus rally tends to start in the third week of the month. The first two weeks tend to be weak. We’re seeing this play out as major indexes trade lower to start December after November’s huge rally.

Over the first two weeks of December, the SPY has moved higher 56% of the time since 1993. Overall, the index has gained 62% of the time in a two-week period.

The track record isn’t screaming “bearish,” but it’s also not overly bullish. Now is an ideal time to act like children awaiting Santa’s arrival and prepare.

Investors should plan for the year-end rally and decide how they will take advantage of the short-term opportunity. That is, if it comes.

Although we get a Santa Claus rally 75% of the time, it’s even more important to be ready if there isn’t one.

You may have heard of the old saying: “If Santa Claus should fail to call, bears may come to Broad and Wall.”

That one is backed by testing. When we don’t get a Santa Claus rally, January has shown a small loss on average. Returns over the next year also tend to be below average.

The Santa Claus rally isn’t really an investment strategy. But it still gives us an idea of what to expect after December. If Santa delivers a lump of coal to Wall Street, we should prepare for turmoil in the upcoming year.

But we’ll be ready for that…

Until next time,

Michael Carr

Chief Market Technician, Money & Markets

| From our Partners at Banyan Hill Publishing. A looming financial event that one expert calls the “Middle-Class Massacre” will soon devastate millions of hardworking Americans.

When it strikes, and all his research proves it will strike in 2023, he predicts stocks will crash 50% ... real estate will be slashed in half ... unemployment will surge to record highs ... and the wealth of millions will be decimated as the biggest bubble in history bursts.

Go here for the full story… |

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | |

Post a Comment

Post a Comment