| Following a loss to the Chicago Bears in 2006, former Arizona Cardinals coach Dennis Green enshrined himself in quotable lore.

In the post-game press conference, a reporter asked Green why the Bears won despite a laundry list of on-field errors.

What proceeded was a profanity-laced tirade that yielded one of the most memorable quotes in history:

They were who we thought they were…

Green was notably upset with the way his team couldn’t capitalize on the Bears’ poor performance — Chicago quarterback Rex Grossman completed less than 50% of his passes and was intercepted four times.

I bring this up because last week the Organization of Petroleum Exporting Countries (OPEC) did exactly what we thought they would do regarding oil production.

And yet, the impact of this decision is set to be a catalyst for one of 2024’s biggest mega trends. More Oil Production Cuts Ahead On Thursday, the 13 members of OPEC and 10 other oil-producing countries — in total make up OPEC+ — agreed to cut global oil production to the tune of 1 million barrels of oil per day.

It’s on top of the 1 million barrels Saudi Arabia itself agreed cut in June.

To put that in perspective, the U.S. consumed about 20 million barrels of oil per day between gasoline and other products in 2022 — about 6 million barrels come from foreign countries.

This is important for reasons I laid out last week.

Because of weaker demand and an oil supply surplus, the price of oil fell under $75 a barrel recently. Chief producers like Saudi Arabia were losing money. Goldman Sachs projects Saudi Arabia needs oil to be around $88 a barrel to break even.

West Texas Intermediate crude oil prices had already started to climb before the meeting, as investors bet on OPEC’s decision. And the price spiked to just over $79 following OPEC’s announcement.

| From our Partners at Banyan Hill Publishing. Billionaires Jeff Bezos and Bill Gates are investing in AI energy. This AI-created energy is being hailed as the most exciting human discovery since fire. Here’s how to invest alongside them. |

Investors Can Beat OPEC+ As I mentioned last week, OPEC’s decision is a catalyst for the next bullish move in oil.

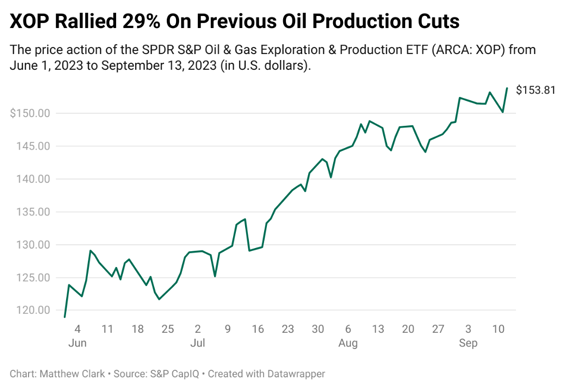

We can look back to when Saudi Arabia announced voluntary production cuts in June:  (Click here to view larger image.) From June to September, the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP) jumped 29%!

With Saudi Arabia trimming its oil production, countries like the U.S. and China had to get their oil somewhere else. The U.S. was the best bet.

Now that 23 countries agreed on production cuts, there is a smaller pool of countries oil can come from — the U.S. is, again, an obvious choice.

OPEC+ did what we all thought they would do.

And now it’s time to seize on that opportunity.

There will be many different ways to invest in this new catalyst. My friend and colleague Adam O’Dell has your back.

He has pinpointed a tiny $20 oil stock that is primed to be a massive player in the growing $10 trillion oil industry.

And with OPEC’s latest move, you will want to jump into this stock immediately to capitalize as oil prices rise.

For details and access to Adam’s No. 1 oil stock recommendation today, click here.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

Check Out More From Stock Power Daily:

|

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | |

Post a Comment

Post a Comment