Editor’s Note: This week, we’re casting a special spotlight on Mike Carr in a mini takeover of Money & Markets Daily. Mike’s gearing up to unveil his latest trading edge and can’t wait for you to learn how it can benefit you.

Without giving away all the details, we’ve asked him to share some of his insights before his big summit tomorrow. We hope you enjoy getting an early peek of what’s to come! |

Better Than Finding the Next NVIDIA |

Money & Markets Daily,

Many investors are looking for the next big thing. They want the next NVIDIA or Tesla.

Finding the next big winner might be nice … but will it really grow your wealth?

Catching those large gains comes with a price. It requires holding through large drawdowns. NVIDIA has fallen at least 50% 10 times in the past 25 years. Tesla has had nine 50% drawdowns in 15 years.

To achieve long-term gains, you have to accept large losses that can persist for years.

Most of us lose faith in the company in real-time. We sell after watching the stock drop and trade at lower levels. It’s only in hindsight that we can see NVIDIA would dominate the artificial intelligence chip market. Just three years ago, we didn’t even know there was a large market for AI chips.

The challenges of holding through multiyear losses — even when you know the future looks bright — make long-term investing difficult.

That’s why I want to make sure you know about another, lower-risk approach to trading that can deliver massive profits…

| Mike Carr has been leveraging a powerful, little-known pattern in the markets. He calls it ‘the box trade.’ It doesn’t require stocks to move up or down, to profit…

And yet it had the power to grow an account 199% over the last year — with a win rate of 95%. Now, on April 25, at 1 p.m. ET, he’s showing how to harness this pattern…

Discover the full details at this link here. |

Build Wealth With Short-Term Trading

Sure, you’d like to find a stock that doubles in a year. That's the dream for most investors. But it’s much easier to find 50 trades that gain 2% in a year. If you can do that, you could earn 169% in a year by compounding those small gains into the next 2% winner.

The reason many investors ignore short-term trading is that they don’t consider how those short-term gains grow into large gains.

That’s a shame since short-term gains can be safer than targeting the next NVIDIA.

A Google search for “the next NVIDIA” yields 70,700 results. Of course, many of these search results will point to losers. Many of the losers will cost investors more than 50% of their investment.

With short-term trading, we can find positions that offer a high probability of success.

Win at the Game of Probabilities

Many investors fail to realize that short-term trading can be more quantitative … we don't have to rely on our gut instinct. We have models that allow us to precisely determine the probability a trade will succeed over the next two or three days.

We also have models that offer longer-term probabilities. Thinking about the weather shows us the problem with that.

When we look at weather forecasts, we expect the outlook for the next couple of days to be fairly accurate. Most of us don’t have confidence in forecasts for next week or next month.

We see just too many variables in the weather to believe anyone knows with certainty what will happen next year.

Stock prices are similar, with countless variables affecting how they move. This means short-term models will be more accurate than long-term models.

I applied this knowledge to create a reliable and profitable strategy.

Here, I’m using a model with a one-year win rate of 95%. Gains are small, generally less than 5% per trade. And holding periods for these trades are short — just one to three days.

The returns may not seem like much per trade, but this is actually the sweet spot for modeling the market. Compounded over a year, these gains can deliver a significant return … potentially over 150%.

I’ll be sharing how my Accelerated Income System has the power to fast-track your account’s growth in a special broadcast tomorrow at 1 p.m. ET. This is your last chance to make sure you're on the list for this free event.

Just go here to be one of the first to see my latest research.

Until next time,

Michael Carr

Editor, Money & Markets Daily

| From our Partners at Banyan Hill Publishing. He predicted Black Monday, the dot-com boom and the Great Recession. He's also been recognized as Barron's #1 money manager and Wall Street's #1 market timer seven years in a row.

In this must-see interview, he reveals a little-known AI firm founded by two of Silicon Valley's most secretive billionaires. It's primed to dominate a $22.1 trillion-a-year boom. This is a rare opportunity to invest before this firm's valuation potentially soars 2,500% in the coming years and 5,000% within a decade. (Full Story) |

Wait for a Pullback in Gold

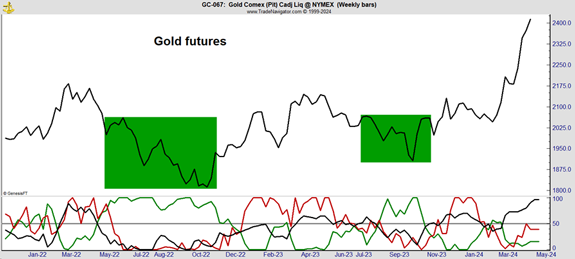

Gold prices have raced ahead in the past few weeks and seem to be ahead of themselves. The chart below is based on action in the futures markets and shows who is buying gold.

In this market, hedgers — the miners or users of gold like jewelry companies — must report their positions to regulators. That's the green line at the bottom. Hedge funds also report, and they're the red line at the bottom. All other trades are individuals, the black line at the bottom. The latest rally has been driven by individuals as hedgers sold.

The best time to buy gold is when the hedgers are buying, shown by the green boxes in the chart. This indicator tells us there should be a better buying opportunity within the next few weeks.

— Mike Carr, Chief Market Technician, Money & Markets

The Best Time to Buy Gold

(Click here to view larger image.)

Check Out More From Money & Markets Daily:

Post a Comment

Post a Comment