The 10-year Treasury yield is surging … the U.S. Dollar Index is breaking out … high oil prices don’t appear to be easing soon … are we in for a correction? … what size of a drop is possible Well, the Toxic Trifecta is back.

Will its return mean a correction in the market? And if so, how much of one?

For newer Digest readers, the Toxic Trifecta is the term we coined for the combination of the surging 10-year Treasury yield, the strengthening U.S. dollar, and soaring oil prices.

Together, these variables can create a formidable headwind for stock market gains. Bulls can shrug off the Trifecta (as they’re doing as I write Thursday early-afternoon), but the stronger it gets, the tougher that is to do.

Let’s walk through them. The 10-year Treasury yield has exploded thanks to inflation that refuses to go away A surging 10-year Treasury yield means a higher discount rate, which lowers stocks’ current valuations. That’s a drag on lofty market prices.

Also, a higher 10-year treasury yield entices some investors to pull their money out of stocks to benefit from this “risk free” higher yield, which also puts downward pressure on prices.

So, where is the 10-year Treasury yield today?

Well, while stock investors have been bidding up prices all year long in anticipation of loads of interest rate cuts, bond investors have been more cautious. They haven’t embraced the “multiple rate-cut” narrative.

We see this manifested through the 10-year Treasury yield rising all year (despite volatility), which was punctuated yesterday by its spike following the hotter-than-expected CPI print.  As I write Thursday afternoon, the 10-year Treasury yield is now back to 4.57%. This is a level not seen since mid-November when the S&P was trading around 4,450 – which is about 14% lower. ADVERTISEMENT  While the world has been obsessed with A.I. and ChatGPT… Jeff Bezos has quietly gone all in on a technology that’s going to prove to be FAR bigger. If you’ve never heard of “QaaS” technology you need to click here now. Next, the U.S. dollar continues to break out A strengthening U.S. dollar creates headwinds for international companies that generate significant revenues overseas (due to currency conversion). This hurts earnings, which weighs on stock prices.

In a moment, we’ll look at the U.S. Dollar Index. It’s a measure of the value of the U.S. dollar relative to the value of a basket of six major global currencies – the euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona.

Last week, we highlighted the Dollar Index, with this takeaway: [The Dollar Index] has recently climbed back to its February high. If it breaks this resistance level, then we’d likely see the dollar push toward its double-top from last fall. In the week since, the dollar has in fact broken resistance as it continues its upward march here in 2024, and it does appear headed back to last fall’s high. Here’s what that looks like:  Be careful about assuming this doesn’t affect your portfolio. Roughly 40% of the S&P’s revenues are generated outside U.S. borders. For the tech sector, that exposure jumps to nearly 60%. Finally, oil continues climbing, and higher prices appear likely The negative of a higher oil price is self-explanatory. It erodes the disposable income of shoppers while increasing the input costs of a huge array of companies – both of which are bad for earnings, and by extension, stock prices.

The price of West Texas Intermediate Crude (the U.S. benchmark for oil) has soared roughly 24% since mid-December. This is part of the reason why we’ve seen the resurgence of inflation in recent months.

As you can see below, oil is back in the mid-$80s. The last time it traded this high was late-October when the S&P traded at roughly 4,300, or about 17% lower.  The biggest risk presented by the Toxic Trifecta Theoretically, this climbing Toxic Trifecta should weigh on the price of the S&P 500. But that hasn’t happened. Instead, it was only a couple weeks ago that the S&P notched its all-time high.

Why?

Well, some of it has been due to earnings that came in stronger than expected for Q4 2023. But most of it has been due to bullish expectations of loads of interest rate cuts from the Federal Reserve this year.

Bulls have bid up the S&P based on what they expected was coming rather than what was already here.

This isn’t unusual – Wall Street always looks ahead, trying to price in coming market/economic conditions.

The problem this time around is that the data haven’t been playing nice here in 2024 – yesterday’s CPI report is one example. This means that the Fed, which is watching the data to validate the appropriateness of rate cuts, doesn’t have as strong of a case for cutting. And this leaves the S&P’s bid-up price suddenly looking a bit fragile.

Here’s one illustration… ADVERTISEMENT  A.I. is creeping into every aspect of our daily lives…

According to billion-dollar fund manager, Louis Navellier, it’s never been more important to A.I.-proof your wealth.

He lays out three simple steps to take ASAP in his latest video.

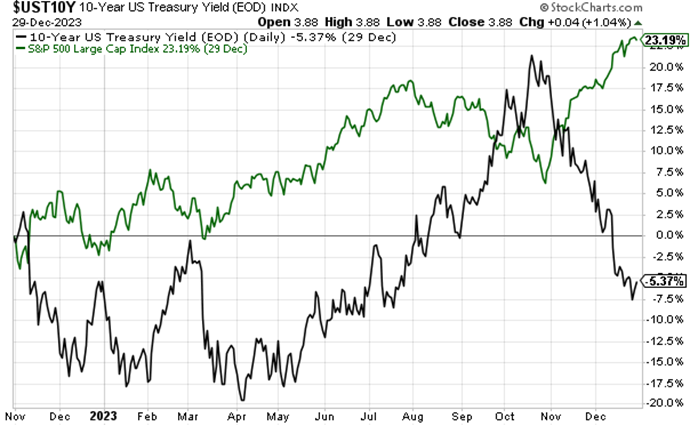

Click here to watch it now. As we covered earlier, stocks really don’t like a surging 10-year Treasury yield But the converse is true – stocks love it when the 10-year yield falls.

Below is a chart showing this inverse relationship (the S&P in green, the 10-year Treasury yield in black). It covers the period from late-November 2022, through January 1, 2024.

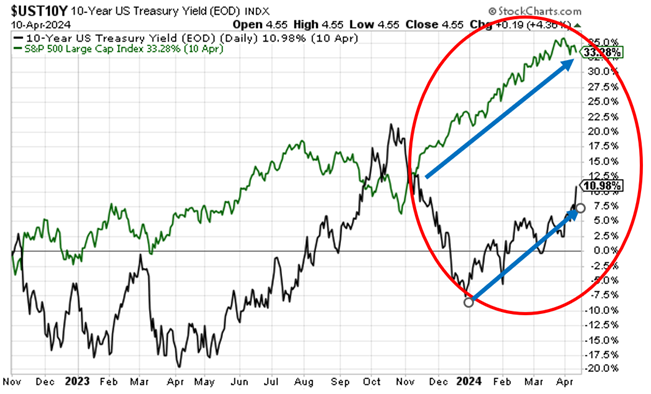

Though not perfectly correlated, the inverse relationship is clear.  But let’s now carry our analysis up to today. We’ll also narrow our time frame to make what’s happened easier to see.

What I want you to notice is that the inverse relationship between the 10-year Treasury yield and the S&P 500 has broken down. This has happened as Wall Street bulls have shrugged off rising bond yields in expectation of rate cuts this year.  But with the likelihood of multiple rate-cuts this year looking increasingly slim, the S&P’s current price appears high and unsupported – unless earnings come in quite strong during Q1 earnings season, which begins this week. If stocks are going to correct, how much? First, there’s no guarantee we’re in for any meaningful pullback. Despite recent market wobbles, bulls remain in control. In fact, as I write, the Nasdaq is up more than 1%.

But to ballpark an answer, we’re going to perform a crude analysis of the S&P’s recent trading channel.

Below, we look at the S&P over the last two years. There’s a well-defined resistance line of the uptrend channel that’s marked with a solid blue line.

What’s less clear is the support line of this uptrend channel. I’ve added a reasonable estimation of where it could be by trying to mirror the slope of the resistance line. This is in dotted blue.  If we correct lower to the approximate mid-point of this channel – let’s call it 4,900 – that’s about a 5% haircut.

And if bears have their moment in the sun, dragging prices down to the channel’s support line, that’s roughly 9% lower.

For added perspective, the correction from last August through October clocked in at just over 10%. ADVERTISEMENT  👈 This breakthrough has been off limits to 99% of investors…

Now, it’s flashing a major signal ahead of a May 1st election shock that could upend financial markets… and sway who’s the next president of the United States.

Click here now to watch the replay of the Election Shock Summit But remember what’s likely on the other side of any correction For that, let’s go to our hypergrowth expert, Luke Lango.

From Luke’s Daily Notes in Innovation Investor yesterday: We think strong earnings over the next few weeks will quickly end this stock market sell-off and push stocks higher.

Then, in May and June, we expect inflation readings to start getting softer, which should lead to lower yields, a dovish recalibration of the interest rate outlook, and higher stocks.

Then, come late summer, the Fed will likely be comfortable enough with inflation to cut interest rates and juice the economy, earnings, and stocks.

We continue to see a very bullish path forward for stocks over the next few months.

This is just very annoying short-term turbulence before that rally.

Short-term pain. Long-term gain. Luke is putting his money where his mouth is, continuing to hunt for great stocks that are trading at bargain prices. He calls today “buying season.”

You can learn more about what he’s buying in Innovation Investor by clicking here. Wrapping up, the Toxic Trifecta is back, so mind your stop-losses, but also look for opportunities Depending on whether we get a healthy pullback, we might see some quality stocks trading at bargain prices. So, update your “buy” list.

Meanwhile, we’ll keep you up to speed on Luke’s latest analysis of where the market is headed here in the Digest. Have a good evening,

Jeff Remsburg | | |

Post a Comment

Post a Comment