The King of AI Is Ahead of the Game … Again |

Money & Markets Daily,

You’ve undoubtedly heard of OpenAI, the pioneering company behind ChatGPT.

Its AI chatbot generates natural language to answer questions, writes content and performs other tasks.

When ChatGPT launched in November 2022, it went viral and opened up AI to the masses.

Since then, AI has been all the rage.

This innovative tech has captured our imagination, much like when the first IBM personal computer was released in 1981.

Along with creating mass hysteria, OpenAI elevated its founder and CEO, Sam Altman, to guru-like status in the world of AI.

But what you may not know is that Altman is a master at spotting developing trends, investing early and cashing out with a massive windfall.

Let me explain…

| NVIDIA is putting its AI tech into everything these days, including video games, movies, robots and even self-driving cars, and AMD has seen an astounding 9,162% gain in a little less than 10 years. Many experts believe we’re just entering the start of the AI boom. AI has been called the biggest new industry of the 21st century. Worth a staggering $80 trillion over the next ten years, and Chief Investment Strategist Adam O’Dell saw it coming a long time ago. Recently, Adam uncovered new research that shows a number of promising, high-quality AI stocks that could go on to SURGE in the coming years. See the details now. |

AI Before AI Was Cool

Before ChatGPT, AI was the stuff of science-fiction movies.

Using AI to generate text, video and images … let alone have conversations with was only a Hollywood dream.

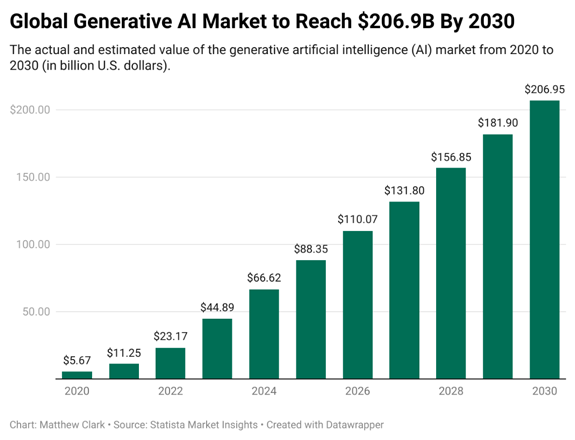

So much so that in 2020, the global generative AI market was valued at just $5.7 billion.

For reference, as of March 2024, there were more than 1,200 companies worth more than $1 billion.

And now, the global generative AI market is set to explode higher from here:

In 2019, Altman became the CEO of OpenAI — well before AI was a trend, let alone a mega trend.

From 2020 to 2023, the generative AI market exploded 692% to reach a valuation of nearly $45 billion.

But AI wasn’t the first mega trend Altman identified and bought into:

- In 2008, he invested $100,000 in short-term rental company Airbnb. It now has a market cap of nearly $103 billion.

- Altman dropped another $100,000 in ride-share company, Uber, in 2014. Now, Uber is worth almost $140 billion.

These savvy early investments have helped Altman land on Forbes’ list of the world’s richest people.

And he just made another bold investment … and it’s one to keep an eye on.

The Next Phase of the AI Revolution

While AI has captured our imagination, we still don’t know what makes it “tick.”

AI needs significant infrastructure — not just to operate but to expand.

Tech titans, like Altman, have identified one major component AI needs to make this expansion happen … and they are pouring millions of their own dollars into the technology.

Our chief investment strategist, Adam O’Dell, has identified the one company developing this technology that already has a leg up on the competition.

This company has built a moat around itself by spending billions on research and development and cutting through red tape.

It’s lightyears ahead of any other business in the space … including Big Tech companies like Microsoft, Google and Meta.

In fact, those massive tech firms will look to this one small company to help expand AI into realms we haven’t even thought of yet.

That makes this company the right one at the right time … before the AI boom fully takes hold and expands faster than we can keep up.

Adam just put the finishing touches on a special presentation about this next wave of the AI revolution, and he’s ready to share it with you.

Like the advent of the personal computer in the early 1980s, you don’t want to be caught on the sidelines for this innovation.

Make sure you click here to reserve your spot for Adam’s presentation to learn how you can get in on this revolution on the ground floor … just like Sam Altman.

He'll have all the details you need at 1 p.m. ET on Thursday, May 9.

I promise you won’t be disappointed.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets Daily

| AI will need up to 212X more energy in the next four years … And one small company holds a virtual monopoly that could power the next wave of AI.

On May 9, 1 p.m. ET, Adam O’Dell will reveal why it could mean a 10X windfall for investors over the next 12 months. Click here for the full details. |

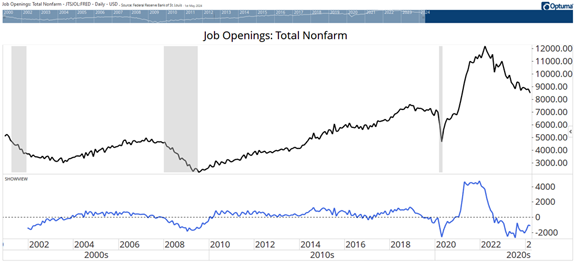

Job Openings Are Collapsing

Job openings at the end of March fell to 8.49 million. That's down 12% over the past year. The number of job openings per unemployed worker fell to 1.32. That's still above the 2019 average of 1.19, but this ratio has been falling as the number of openings declined. It's a sign of a tightening job market.

The chart below shows the total number of job openings and reveals that the market is tighter than many economists believe. The grey bars highlight recessions. At the bottom, you can see the year-over-year change in openings.

Job openings collapsed during the pandemic. They fell even more last summer and are still at levels associated with recessions. These low levels don't mean a recession is likely. But slow growth is almost assured — which will create stock market volatility in an election year.

— Mike Carr, Chief Market Technician, Money & Markets

(Click here to view larger image.)

Check Out More From Money & Markets Daily:

Post a Comment

Post a Comment