5 Stocks to Buy and Hold Forever In 2016, Warren Buffett’s Berkshire Hathaway Inc. (BRK.A) bought almost 10 million Apple Inc. (AAPL) shares. The smartphone maker’s stock had just declined 14%, pricing them at just 11 times expected earnings. Apple had become one of the worst-performing, cheapest companies in the Dow Jones Industrial Average.

But the Oracle of Omaha had his reasons. Apple had a “fortress” balance sheet – a quality Buffett has long appreciated. It was operating in a growing market; that same year marked the first time more people connected to the internet via mobile devices than by PCs. And the firm sported a “wide moat” business that kept rivals at bay.

In other words, Buffett saw Apple as an ideal stock to buy and hold forever.

And he’s been right.

Since 2016, shares of Apple have risen 640%... easily beating out the Dow Jones (120%), the tech-heavy Nasdaq Composite (260%), and even Berkshire’s own gains (220%). The only reason he recently sold a portion this year was for taxes. As Buffett himself once quipped: "When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”

Our analysts here at InvestorPlace.com also have been seeking out their own stocks to buy and hold forever. And we’ll take a look at five of these companies they’ve highlighted this week... ADVERTISEMENT  On Monday, June 10th at 1 pm ET, I believe Apple CEO Tim Cook is going to make a “100X AI” announcement that could quite literally change the world as we know it…

And Luke Lango’s research is showing him that a tiny small cap company could very well be the biggest winner of this announcement, sending its stock soaring into and beyond the summer…

With the potential to soar ten times higher over the coming months…

Click here to get details on this small-cap gem BEFORE Monday. Clear as Day: Corning New York state-based Corning Inc. (GLW) has been synonymous with best-of-breed glass products for the past 170 years. This week in Smart Money, Eric Fry writes how the company is riding some incredible tailwinds, and why he believes that makes Corning a stock to buy and hold forever. Today, the company operates six different business segments – each of which is beginning to benefit from powerful tailwinds. The worldwide 5G buildout tops the list of tailwinds that are benefiting Corning’s largest segment, Optical Communications. That’s the one that provides optical fiber and related connectivity solutions to telcos, data centers, and other enterprises.

As the global 5G build-out proceeds, so too will demand for Corning’s fiber-optic cable and components. This substantial source of new demand could become shockingly large.

Looking further down the road, I expect the coming decade to reward Corning with a level of profitability that few investors anticipate today. Corning also has the same “wide moat” economics that define “forever” stocks. The company consistently reinvests $1 billion annually into research and development, which has kept profits high and competitors at bay. (Rivals like Nippon Electric Glass, by comparison, spend less than $50 million annually on R&D.) It’s also interesting to note that Corning has the longest debt maturity of any S&P 500 company.

That tells us that Corning is positioned to last another 170 years... and probably more. The company remains an incredible generator of cash, and its latest tailwinds will help generate even more profits to reinvest into developing the next generation of glass products. Solid Foundations: Realty Income Muslim Farooque adds Realty Income Corp. (O) to his list of top blue-chip companies to buy this week at InvestorPlace.com. This real estate investment trust (REIT) is known for paying monthly dividends, and its triple-net lease model gives it an unusual amount of long-term stability. Farooque believes Realty Income is a stock to snap up at current prices. Amidst the market’s ups and downs, O stock’s underlying business remains robust, maintaining a solid 98% occupancy rate. Importantly, 80% of its retail tenants operate in sectors proven resilient during economic downturns, such as grocery, convenience stores, and pharmacies.

Moreover, its operation on a robust triple-net lease model is a key advantage. The model effectively allows for shifting all operational expenses and risks, including maintenance costs, onto its tenants. Moreover, with leases as long as 15 years or even more, the firm enjoys a robust and reliable rental income stream. Valuations are particularly compelling thanks to a recent 12% selloff over “higher for longer” rates. (All else equal, high rates decrease the present value of REIT income streams.) The stock trades for just 1.2 times book value (well below its 1.9X long-term average) and offers a generous 6% yield.

Most importantly, Realty Income is managed with an eye on the long run. The company concentrates on defensive service-based sectors that are resistant to e-commerce and leases them out over extended contracts. Its average remaining lease term is almost 10 years.

The company, of course, sacrifices some growth for this conservative strategy. Annual rent increases average at just 1%, so the company relies on acquisitions to fuel growth. Still, management has remained historically disciplined in how much they pay for new properties. If there were one REIT to buy and hold forever, Realty Income fits that bill perfectly. Best Bang for the Buck: Costco Retailers are often troublemakers for long-term investors. Brick-and-mortar stores require constant reinvestment, and it’s often unclear at the time whether the money is well spent. The billions of dollars booksellers and electronics retailers spent in the 2000s, for instance, couldn’t save them from e-commerce.

Nevertheless, one company seems to have it figured out: Costco Wholesale Corp. (COST)

The 41-year-old company has found an incredible market in big-box retail. Much of the company’s products are immune from online competition, given the high costs of home delivery of refrigerated and other temperature-sensitive items. And for segments that do compete with e-commerce rivals, Costco has managed to cut costs enough to keep price competitive. The firm also generate profits from membership fees rather than markups.

This week at Market 360, Louis Navellier writes why he remains so bullish on this retailer. The real difference maker here is Costco’s Quantitative Grade. It gets an A, which is an indicator of persistent and strong institutional buying pressure. That makes Costco the clear choice.

I should also add that Costco is perhaps my favorite retailer. It’s just an incredibly well-run company, folks. If you want a company catering to rich people, this is the company that caters to rich people. They show up in their SUVs and load up on stuff. The average Costco buyer is very affluent and they’re very loyal to their gas stations...

Look, I’ve been in the markets for about four decades, and one thing never changes…

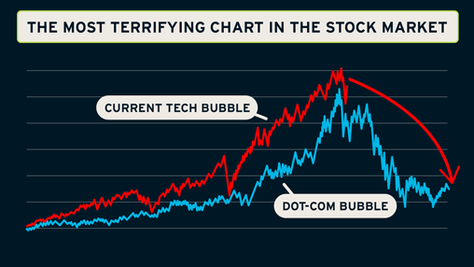

Stocks with superior fundamentals almost always win out in the end. And those that don’t have strong fundamentals eventually end up in the garbage. Wall Street agrees. Analysts are forecasting solid 10% growth rates through at least 2027, and for profits to steadily rise as overhead costs get divided across more stores. ADVERTISEMENT  America’s Dot-Com Crash 2.0 is HERE.

Soon — America’s most popular stocks like: Nvidia, Apple, Meta, Tesla, and thousands more…

Could come plummeting back to Earth…

Erasing years of investor profits…

Sparking a $17 trillion panic on Main Street...

And this is why the world's wealthiest investors are rushing for the exits.

Jeff Bezos, Warren Buffett, Mark Zuckerberg, “The Walmart Family,” and 27 other billionaires are unloading shares of their OWN companies at record pace…

So, if you have any money in the markets, it’s time to prepare.

Because the stakes of the: “Dot-Com Crash 2.0” — is 3X BIGGER than last time.

Click here for details. Brand Loyalty: Deere InvestorPlace.com’s Josh Enomoto writes about Deere & Co. (DE) this week, calling the machinery maker an undervalued long-term stock to buy. At first glance, DE might sound like a boring idea among undervalued long-term stocks. However, the sectors Deere serves are obviously critical for human health.

For fiscal 2024, covering experts believe EPS could come in at $25.40 on sales of $45.56 billion. Admittedly, that’s disappointing compared to last year’s results of EPS of $34.69 on sales of $55.56 billion. However, with DE’s modest performance in the market, it’s currently trading at 11.18X trailing-year earnings and 1.83X trailing-year sales.

About one year ago, these metrics stood at 14.05X and 2.11X, respectively. Given the importance of agriculture, DE represents one of the undervalued long-term stocks to buy. John Deere has a particularly wide moat in its agriculture business, where it offers machines for field preparation, planting and seeding, chemicals application and harvesting. The company has the largest installed base in the industry, and uses that scale offer cheap after-market parts and services.

The industrial juggernaught is also using technology to widen its moat. Not only can harvesters follow each other... they can “remember” where and when planting machines put the seeds. That creates a strong incentive for farmers to switch their entire fleet to Deere and allows the company to keep widening its moat over time. Innovating Again: Apple Finally, at InvestorPlace.com this week, Chris MacDonald highlights Apple Inc. (AAPL) itself as a company for long-term wealth creation. The firm has proven its ability to innovate over the long term, and even its recent slowdown relative to Nvidia Corp. (NVDA) is no cause for concern. Apple is seeing a resurgence in China sales despite challenges from new EU regulations. However, investors may remain cautious as Nvidia (NVDA) nips at its heels for the second spot in the global market capitalization rankings. The recent uptick in Chinese activity is a strong catalyst for the company, and if Apple’s new rumored AI-driven iPhone is as big a hit as many expect, this could be a company with a lot to offer in the months ahead.

I think Apple’s valuation remains steep, and I’ve been cautious around this stock for some time. Buffett has felt the same way, recently trimming his Apple stake significantly.

That said, for long-term investors seeking defensive tech options, there are few better companies to consider than Apple right now. Apple has long adjusted its risk-taking to reflect market needs. During the company’s 1997 turnaround, then-CEO Steve Jobs placed a daring bet by concentrating on relatively few core products. As the company grew (especially after the iPhone), it began taking less risks to ride its cash cow. As MacDonald rightly notes, the firm became a defensive behemoth.

Now, Apple is reinventing itself again. In February, CEO Tim Cook teased Apple’s AI plans, suggesting that the company would begin taking larger risks with AI. It’s reportedly in talks with multiple companies to license AI products. The smartphone maker is also reportedly overhauling Siri, a virtual assistant that pre-dates Amazon’s Alexa by almost four years. Former insiders say Apple’s management is once again open to taking risks.

Together, that gives investors an unusual mix of defensive and growth-oriented strategies.

Now, over to Eddie Pan with this week’s trades of the week from insiders and other notables... Notable Trades of the Week ValueAct Buys the Salesforce Dip – Salesforce Inc. (CRM) plunged 20% after the enterprise management company reported its fiscal first-quarter earnings on May 29, marking the stock’s worst day since 2004. Its quarterly revenue of $9.13 billion missed the analyst estimate for $9.17 billion, Salesforce’s first revenue miss since 2006. However, one opportunistic hedge fund saw this as the perfect moment to buy the dip.

On June 3, as I noted at InvestorPlace.com, ValueAct Capital purchased 428,000 shares, or $99.79 million worth, of CRM at an average per-share price of $233.17. ValueAct's co-CEO Mason Morfit also serves on Salesforce's board, which makes the purchase an insider transaction.

ValueAct returned 39% last year and has a history of successful activist investments. The firm also operates as a long-term investor, implying that Salesforce’s downturn will only be temporary.

Prior to the purchase, Salesforce was already ValueAct's largest holding based on its Q1 13F filing. The hedge fund’s Salesforce position now stands at 3.91 million shares.

Kerrisdale Wages War Against Bitcoin Miners – As I reported on Thursday, Riot Platforms Inc. (RIOT) is in the hot seat after Kerrisdale Capital published a short report on the Bitcoin (BTC) mining company.

The hedge fund noted that Riot has never generated positive cash flow while its management continues to dilute shares and reward itself with compensation. Riot also carries regulatory risks in Texas, which is where it primarily mines Bitcoin. Other risks include intense global competition and the rise of Bitcoin ETFs and ETPs, eroding Riot's status as a Bitcoin proxy.

"All of this comes at a time when bitcoin miners are grappling with sharp cuts to unit profitability in the aftermath of the latest block reward halving," Kerrisdale said, characterizing the Bitcoin mining industry as “snake oil salesmen that are incinerating both investor capital and the environment.”

The hedge fund disclosed that it was short RIOT and long Bitcoin as a hedge.

Citron Reopens GameStop Short – Citron Research's Andrew Left disclosed a GameStop Corp. (GME) short position in 2021, only to suffer a 100% loss as the video game retailer stock squeezed higher. Now, as I reported Wednesday, the short seller has reopened the short following the return of meme stock advocate “Roaring Kitty,” whose real name is Keith Gill.

On June 2, Gill disclosed on Reddit that he had $181 million invested in GME stock and calls. That position was worth a staggering $557 million as of the close on June 6.

The revelation was concerning for Left, who stated that Gill’s disclosure appeared "more like manipulation without a solid thesis" when compared to Gill's 2021 GME purchase.

Left also believes that Kitty isn't acting alone and has received outside support.

"It will be interesting what an investigation turns up...Citron's gut is behind this trading activity is some mysterious crypto backer. We shall see," said Left on X. ADVERTISEMENT  Charlie Shrem, who bought Bitcoin at $5 back in 2011, warns that 2024 could be your very last opportunity to create generational wealth from crypto.

After a new government regulation set to inject $30 trillion into the crypto markets, we’re likely to never see buy-in prices this low ever again.

He details everything you need to take advantage of this huge, and final crypto bull run in his emergency presentation.

Click here to discover his top 5 coins for 2024 The REAL Story Behind Apple’s AI Efforts Earlier in this letter, we talked about Apple as the company for long-term wealth creation. It’s a firm that continues to innovate, and onlookers are expecting some big announcement at this week’s Worldwide Developers Conference (WWDC). Apple’s management will almost certainly reveal some major AI announcements.

Still, Luke Lango believes he’s found an even better way to play Apple’s AI game. In a recent presentation, he outlines how you can prepare for Apple’s “100X AI” event. To watch Luke’s presentation, click here now. And we’ll see you back here next Sunday. Enjoy your weekend, Tom & Eddie | | | | | | |

Post a Comment

Post a Comment