Hey there! Adam O'Dell here…

Apple has been relatively quiet on the artificial intelligence (AI) front, but that's about to change.

I touched on it earlier this week, but Apple is gearing up for its next "iPhone moment" on June 10.

My colleague Ian King has been tracking Apple's moves closely, and he’s now preparing his readers for the potential groundbreaking release of a new “AiPhone.” He's already identified three stocks that are set to soar as Apple establishes a dominant role in the AI mega trend.

And to make sure that you're in the loop, we wanted to share Ian's recent commentary featured in Banyan Edge.

Of course, if you're eager to access those stock recommendations, click here to watch Ian's brand-new presentation now.

Have a great rest of your week!

— Adam O'Dell, Chief Investment Strategist, Money & Markets

AAPL Is Ready to Take the AI Crown |

Money & Markets Daily,

Amazon has a wealth of “smart” technology with its artificial intelligence (AI) Alexa. This includes the Echo and other Smart Home devices.

Google now has AI that summarizes Google search results at the top of your screen.

Samsung Galaxy AI has in-ear translations in your earbuds, so you don’t have to pass the phone back and forth anymore.

Meta AI enables users to do anything from creating ideas to getting help with an assignment or even generating art.

And just this week, Nvidia announced a new AI platform that will perform tasks at twice the speed of current microchip technology.

We’ve heard from almost every tech company about their AI strategy … except one.

So what company is about to change the entire landscape of AI?

It revolutionized computing and phones in the mid-2000s. And whenever it releases a new product on the market, it completely dominates over its competitors.

Blackberry, Palm and Zune … all are obsolete memories, thanks to the advent of the iPhone.

Yes, we’re talking about Apple.

Next week at its Worldwide Developers Conference (WWDC), Apple could be about to unveil its AI strategy: a new AiPhone.

This “upgrade” would not only majorly disrupt the mobile phone industry but also the entire AI market — which could add $15.7 trillion to the global economy by 2030.

Find out what’s going to happen when Apple steps into the AI arena in today’s video…

Click the thumbnail below to start watching:

(Or read the transcript here.)

🔥 Hot Topics in Today’s Video:

- Reader Spotlight: We reflect on the many wonderful responses we received about our Memorial Day message. (Thank you again to those who served in our armed forces!) Amber also shares her experience visiting Arlington National Cemetery last week. [0:14]

- Market News: What are economists expecting for the upcoming May jobs report? Could we be in for an economic slowdown? (Plus, other major developments for the U.S. market.) [3:50]

- Tech Trends: Check out this tech industry scorecard. It ranks what tech industries are primed for winning investment opportunities. [8:00]

- Crypto Corner: I share some highlights from Consensus 2024, the biggest crypto conference of the year. [11:18]

- Investing Opportunity: Apple is about to make a huge announcement that could shift the AI market’s landscape. [15:08]

My brand-new webinar delves into the history of Apple’s success and why it’s about to make this big move into the AI space.

I'm also reporting on three new trades positioned to profit from Apple’s latest development.

To learn more about them, start watching the webinar here.

Until next time,

Ian King

Editor, Strategic Fortunes

| From our Partners at Banyan Hill Publishing. Apple is going live this coming Monday, June 10. And what they reveal could be bigger than the launch of the first iPhone — destroying and creating fortunes in the process.

Go here right now to see how to potentially profit. |

Consumer Confidence Could Sink Economy

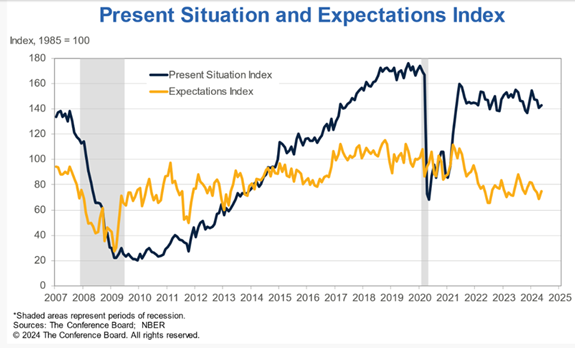

For most of the past 15 years, consumers were optimistic. Confidence rose steadily from the end of the 2009 recession until the 2020 pandemic shocked everyone.

This is the black line in The Conference Board’s chart below. Over that time, on average, consumers expected the next six months to be similar to what they were currently experiencing. That's reflected by the orange line in the chart.

Since the government stimulus checks stopped, consumers have been saying that their present situation is OK — but just OK. There's been a steady downtrend in their expectations. This explains the "vibecession" economists believe is occurring. They say the data is good, but consumers don't believe it.

Consumers are worried, and it will take a dramatic change to alleviate their concerns. A Fed rate cut and lower mortgage rates could reverse these trends later this year. That could push stocks toward a bubble, but that's a problem for another day.

— Mike Carr, Chief Market Technician, Money & Markets

(Click here to view larger image.)

| From our Partners at Investors Alley. A massive Bitcoin dividend was just announced... And if you act today, you'll receive $2.05 per SHARE. That's 161% BIGGER than the highest-yielding dividend aristocrats... But you have to get in before the June 26 cutoff date. Click here now for all the urgent details. |

Check Out More From Money & Markets Daily:

Post a Comment

Post a Comment