AI is the face of this movement

That’s part of the reason Jeff and I write about it so much.

AI is expected to contribute $15.7 trillion to the global economy by 2030 according to PricewaterhouseCoopers.

And, yes, there will be plenty of fakers. Every big movement comes with its share of scammers.

Speaking at the Berkshire Hathaway annual shareholder meeting in May, Warren Buffett said about AI scams, “It’s going to be the growth industry of all time.”

But no one thinks Nvidia (NVDA) is fake.

Here is some perspective from our hypergrowth expert, Luke Lango.

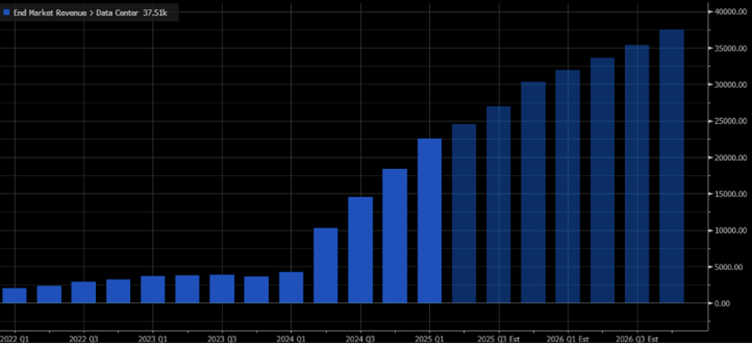

Everyone is buying AI chips in bulk these days. We know as much from Nvidia’s (NVDA) recent quarterly earnings report. The company reported $22.6 billion in Data Center revenue last quarter, which is basically its AI chips business. In the same quarter a year ago, Nvidia reported just $4.3 billion in Data Center revenue.

In other words, Nvidia is basically selling 5X as many AI chips right now as it was just a year ago.

And that number should keep going up. Nvidia’s Data Center revenues are expected to grow to $24.5 billion this quarter, $27 billion next quarter, $30 billion the quarter after that, then $32 billion, and so on and so forth to nearly $40 billion in quarterly revenue by late 2025.

Below is a chart showing Nvidia’s data center quarterly revenues since Q1 2022 and projections going forward through 2026.

Investing in AI development has already created huge winners in Nvidia, Super Micro Computer (SMCI), Meta Platforms (META) and Microsoft (MSFT).

Big companies that have only gotten bigger.

ADVERTISEMENT

The AI Revolution kicked off when ChatGPT was launched in late 2022. Now we’re entering a new phase; one that offers a shot at the kind of explosive gains investors captured at the beginning of the internet revolution.

Click here now for the best chance to capture these explosive gains.

The next on this list, playing catch up, is Apple (AAPL).

Monday starts their annual Worldwide Developers Conference.

In previous WWDC events, Apple has debuted the iPhone, the iPad and major upgrades to their devices and operating system.

This year, the expectation is that Apple will unveil a new iPhone operating system – the biggest in years – that will integrate AI.

Already a company with $1 trillion, an announcement like this will only push Apple higher.

But, according to tech insider Luke Lango, there’s a much bigger opportunity unfolding. The mainstream media are missing it.

Everyone wants to talk about Apple because it’s the name everyone knows.

But in the Age of Chaos, well-positioned investors could make a 10X return in a much smaller company.

Last week, I spoke to Luke about one tiny AI company with more than 20 patents that holds the key to Apple’s AI strategy. Luke expects we’re going to hear big news about its partnership announcement with Apple next week.

And that could launch a 10X price surge starting as early as Monday.

I was lucky enough to host an emergency briefing with Luke last week.

During this briefing, Luke:

- Shows you how the mainstream media is overlooking the significance of Apple's AI move.

- Explains how Apple's AI announcement could significantly boost a small-cap tech stock this summer.

- And provides you with a step-by-step financial analysis for why this small-cap stock could yield tenfold returns by 2024 due to AI integration in 1.4 billion iPhones.

Don't miss this opportunity to uncover potential gains that the broader market may be missing.

Click here to access this briefing today!

There is no better example of how the Age of Chaos is going to create huge opportunities. Small companies can grow huge in what seems like the blink of an eye due to pace of technological progress.

We’re optimists about technology, and how investing in the right companies early can change financial futures.

Enjoy your weekend,

Luis Hernandez

Editor in Chief, InvestorPlace

Post a Comment

Post a Comment