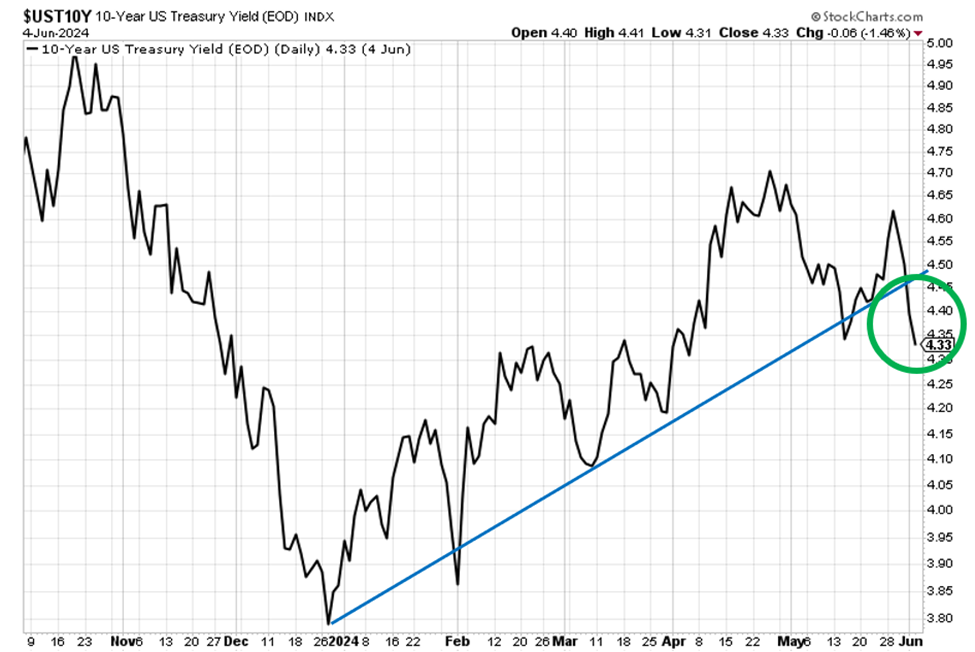

The 10-year Treasury yield has tanked … why haven’t stocks roared? … are weak economic data good or bad? … a time-sensitive opportunity with Luke Lango Over the last week, the 10-year Treasury yield has rolled over.

As you can see below, the yield crashed through the support line of its year-to-date up-trending channel.  As we've profiled in the Digest, the biggest headwind facing the market in recent weeks has been the climbing 10-year Treasury yield. So, this collapse is big – and bullish – news. Now, though the markets have edged higher over the last week, and the Nasdaq is finally having a strong day today (up 1.75% as I write), we haven't seen stocks explode north across the board as you’d expect based on the last week of falling treasury yields. After all, the 10-year yield has tanked from 4.62% last Tuesday to 4.29% as I write Wednesday afternoon. ADVERTISEMENT  Tim Cook, Apple’s CEO is set to make his “100X AI” announcement this coming Monday at 1 pm ET that will trigger a MAJOR shockwave throughout the markets.

That’s why Luke Lango is hosting an urgent briefing at 1 pm ET this Friday – 72 hours before Apple’s big announcement.

To share the details on a tiny small-cap AI stock that could double your money in the matter of weeks, and even 10X your money in the coming months…

Please prepare BEFORE Apple’s “100X AI” announcement.

Click here now to instantly save your spot.

(By clicking the link, your email address will automatically be added to the Event RSVP list.) Why the market hasn’t raced higher Wall Street is torn about how to interpret what’s behind the 10-year Treasury yield freefall – namely, economic weakness.

To illustrate the alternative perspectives on recent data, we need look no further than our own Louis Navellier and Luke Lango and their analysis of Monday’s ISM Manufacturing PMI report.

The headline reading came in at 48.7 in May. Anything lower than 50 represents contraction. This is the second consecutive month of contraction.

To be clear, you can break down this report into subindexes that offer different angles on manufacturing. Some subindexes are expanding, others are contracting. Below, you’ll see Louis and Luke highlight different parts of the report.

Let’s begin with Louis’ perspective. From Monday’s Special Market Update podcast from Growth Investor: The backlog in new orders plunged to 42.4. That is horrific.

Manufacturing in America is in a recession, and it has been for almost two years. There was one month where it went up. The rest of the time, it’s been in a recession.

So, this is a problem. But now, let’s now get Luke’s take.

From Monday’s Daily Notes in Innovation Investor: The ISM Manufacturing Prices Paid index dropped nearly 4 points in May to 57, below expectations for a drop to just 59…

It is a huge drop. And it signals that a summer of disinflation is on the way. That is very bullish for stocks. So, are recent economic reports “a problem” or “very bullish for stocks”? That’s the question Wall Street is grappling with today.

For most of the year, Wall Street has applauded economic weakness on the belief that it would give the Fed reason to cut rates.

But recent data are giving Wall Street a hint of anxiety. Take yesterday’s Job Openings and Labor Turnover Survey (JOLTS) report.

From CNN: The number of job openings in the US shrank for the second month in a row, setting a new three-year low amid further signals of cooling in the labor market.

There were 8.06 million available jobs posted in April, according to the Bureau of Labor Statistics’ latest Job Openings and Labor Turnover Survey (JOLTS) report released Tuesday. That’s below the downwardly revised 8.36 million seen a month before and the lowest since February 2021.

Economists were expecting job openings to register 8.36 million, according to FactSet estimates. Then, there’s today’s private payrolls report from ADP.

Here’s CNBC: Private job creation slowed more than expected in May, according to a report Wednesday from ADP that signals further sluggishness in the labor market.

The payroll processing firm said that companies added 152,000 jobs on the month, fewer than the downwardly revised 188,000 in April and below the Dow Jones consensus estimate for 175,000. This was the lowest monthly level since January. Now, Wall Street wants to see some cooling in the job market. “Some” is the key descriptor there – specifically, just enough to give the Fed coverage to cut interest rates.

But too much cooling raises red flags, elevating the risk of a recession. It’s the Fed’s job to get the cooling just right.

But Wall Street appears unsure that “just right” is where we’re headed.

Now, if the Fed must choose between “lingering high rates to kill inflation, yet maybe those rates cause a recession” versus "cut rates to prevent a recession, yet lower rates perhaps allow a return of higher inflation,” which will it choose?

Recession.

At least that’s what Federal Reserve Bank of Minneapolis Neel Kashkari believes. ADVERTISEMENT  31 billionaires (including: Warren Buffett, Elon Musk, Jeff Bezos, and more) are quietly unloading shares of their OWN stocks at RECORD pace…

But why?

Wall Street legend Eric Fry says it’s because, soon:

“America’s most popular stocks like Nvidia, Apple, Meta, Tesla, and thousands more… are set to come plummeting back to Earth.”

Erasing YEARS of investor profits…

Sparking a $17 trillion PANIC on Wall Street…

Click here to get the details of what is being called: The 2024 Tech Panic. Earlier this week, the Fed president had an interesting take on U.S. consumers, inflation, and recession Let’s go to Fortune: U.S. consumers are so fed up with rising prices they would rather see the economy shrink than watch their costs get any higher, according to Neel Kashkari, president of the Federal Reserve Bank of Minneapolis.

As a result, Kashkari, who has led the organization since January 2016, had some bad news for Wall Street: he doesn't believe a cut is coming any time soon…

"I have learned that the American people—and maybe people in Europe equally—really hate high inflation. I mean, really viscerally hate high inflation," he told the Financial Times's 'The Economics Show' podcast…

Kashkari illustrated: "I lose my job, I lean on my sister or my parents or my friends, and they help me through it. But high inflation affects everybody. There’s no one I can lean on for help because everyone in my network is experiencing the same thing I’m experiencing" …

Kashkari said he believes the base rate will stay where it is for an extended period of time, or "until we get convinced that inflation is either well on its way going back down or it’s not."

If the Fed remains unconvinced, he warned rates may even go up. Frankly, Kashkari’s resolve toward “higher for longer” rates in the face of cooling economic data puts me on edge. It feels like it cracks open the door to increased risk of “stagflation.” But we’ll reserve that discussion for another Digest.

The next big pieces of data are tomorrow’s initial jobless claims report, followed by Friday’s jobs report, which is the big one.

Economists are expecting 190,000 jobs were added in May, and that the unemployment rate will hold steady at 3.9%.

Will that be good or bad news?

That’s the question Wall Street can’t quite seem to answer.

We’ll keep you updated. Switching gears, there’s something big happening this coming Monday – and it could serve as the starting gun for a massive run for one small stock To introduce what’s happening, let me back up…

It goes without saying that Apple’s stock exploded thanks to the introduction of the iPhone.

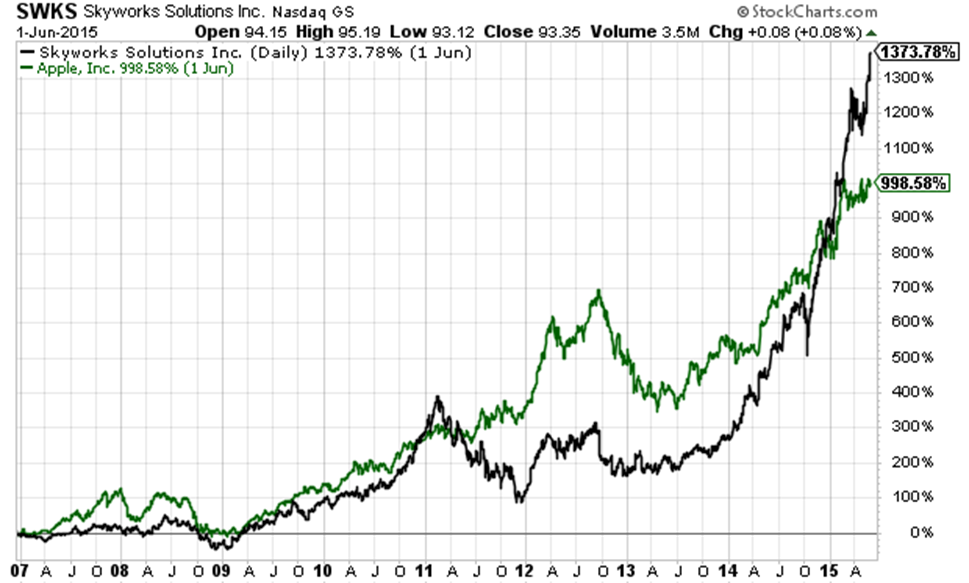

But do you know which stock performed even better than Apple thanks to the iPhone between 2006 and 2015?

It was one of Apple’s suppliers – a semiconductor company called Skyworks (SWKS).

In 2006, SWKS was as small semiconductor company base on Woburn, Massachusetts.

That changed when Apple tapped it to become one of its major suppliers.

Since the semiconductor company was so small at the time, that single Apple contract had a transformative impact on SWKS’s revenues, earnings per share, and by extension, its stock price.

See for yourself.

Below, we look at Skyworks and Apple from December 15, 2006 (the day that I found an article detailing the new supplier arrangement with Apple) and mid-2015.

Apple jumped 999%. Skyworks made its investors 1,373%.  Now, Apple’s stock would go on to beat Skyworks as the tech giant expanded its product lineup. But this is a good illustration of how just one Apple contract can transform a small company’s profitability and its stock price.

The takeaway is clear: Getting in bed with Apple can pay off big time.

That brings us to timely news from our tech expert, Luke Lango. ADVERTISEMENT  Elon Musk has cracked open a radical wealth building opportunity set to create a slew of new millionaires…

This narrow window will close when Elon holds his upcoming “AI Day.”

We’re now on the final stretch before Elon’s new project becomes mainstream to the public.

A Silicon Valley insider has revealed everything you need to know about this wealth window before it shuts.

Click here now to discover how to profit before the huge public announcement This coming Monday, Apple will begin its annual Worldwide Developers Conference And everyone shares the same big question…

How will Apple play catch-up in the AI race?

Well, Luke has checked in with his contacts in Silicon Valley. And, apparently, insiders expect Apple to announce overhauls of its software ecosystem, particularly through AI enhancements.

Luke has dug deep into the possibilities of what this could mean, and how it could provide market opportunities, and it’s led him to one small stock.

In that same way that Apple jumpstarted riches for Skyworks investors back in 2006, Luke believes that next week will bring a partnership announcement between Apple and this small supplier company that will usher in another 1,000%+ return.

This is urgent because that partnership announcement could come as soon as this Monday. Because of this, Luke is holding an emergency briefing Friday at 1 pm ET, just 72 hours before the event begins.

This is such a big story that we’re going to hand over the Digest to Luke tomorrow to detail what he sees happening, and how to take advantage. But to go ahead and be immediately added to Luke’s briefing list, click here.

We’ll give him our final word today: Most media outlets are overlooking a crucial aspect of Apple's AI strategy, and most investors aren't even aware that this tiny company exists, let alone that it's positioned at the center of a revolution.

To learn more, join me for an emergency briefing this Friday, June 7 at 1 p.m. Eastern. Have a good evening, Jeff Remsburg |

Post a Comment

Post a Comment