5 Tech Stocks to Buy on the Rebound Tom Yeung here with this week's Sunday Digest... where each week I bring you the best stories and investment ideas from the writers at InvestorPlace.com, our free news and analysis website. Every few months, a stock or even an entire sector breaks out to new highs... and thousands of people completely miss it. In a brand-new presentation, host Chris Hunt admits that he is among these unlucky ones. Among plenty of others, he admits to missing out on: - Energy drink maker Celsius Holdings Inc. (CELH), which is up 1,400%...

- AI GPU superstar Nvidia Corp. (NVDA), up 1,000%...

- And robotics firm Symbotic Inc. (SYM), which has leaped 400%...

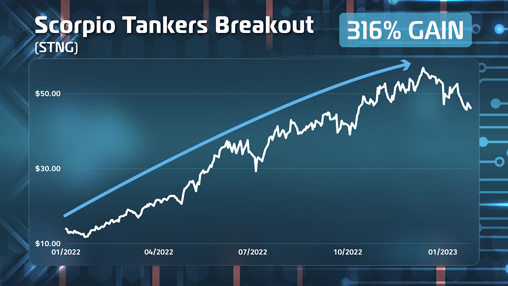

You might have missed out on these gains, too. However, there's a good reason why picking these sorts of winners is so hard: They can look downright ugly before their breakouts. In 2019, Celsius was a money-losing regional drink maker with no nationwide distribution network. Nvidia had just lost 50% of its value from the cryptocurrency hangover that same period. And in 2022, Symbotic looked more like a busted SPAC than the next AI superstar. It's no wonder why Chris and thousands of others wanted to stay far, far away. We're seeing the same story play out today. On Monday, shares of some of the largest AI-focused firms tumbled as investors reconsidered their high-priced bets. Companies like chipmaker Intel Corp. (INTC) have now lost almost 50% in a month, which is why some people are now comparing this past week's volatility to 1987's "Black Monday." Things are ugly. And it's not clear which stocks to buy the dip on. Fortunately, there's a solution. One that's taken years to develop. In his latest talk with InvestorPlace Chief Investment Analyst Luke Lango, Chris reveals how Luke and his team have created a quantitative-driven system that's able to cut through the "ugliness" and help them identify these diamonds-in-the-rough before they bounce back. It's called Prometheus, and you can learn more about it in their presentation here. Even better, many of the system's top picks are also the same ones our InvestorPlace.com writers have been eyeing. And together, we've found a handful of companies that human and "machine" believe are set to rebound. | ADVERTISEMENT  Look at this chart.

This massive breakout happened because sanctions on Russian oil caused demand for oil tankers to soar, sending shares of oil shipping company Scorpio Tankers more than 300% higher in 12 months.

If you missed it, you’re not alone.

Most folks think catching breakouts like this is impossible... or it requires a mastery of geopolitics and economics... or maybe it’s just pure luck.

But Luke Lango is applying advanced data analytics and heavy-duty computing power to try to uncover stocks about to make powerful breakouts.

He recently revealed in an interview how his Prometheus tool is specifically engineered to sift through thousands of stocks to identify which are stocks have upside potential and are worth a closer look.

He even showed a dozen examples of how Prometheus performed in the real world — helping him find gains of 22% to 88%, often in just a few weeks’ time.

For anyone who has ever been frustrated over missing out on profitable breakouts... this could be a real game-changer.

Click here to get the full story. | The King of the AI Hill Perhaps the greatest source of hand-wringing last week came from Nvidia, a company that many believed had grown too large, too quickly. It only took the chipmaker three months to move from a $2 trillion firm to a $3 trillion one earlier this year, which made the selloff equally violent. Last week's decline has now brought shares down 25% since their July peak – erasing almost that same trillion dollars from Nvidia's market value. However, both Louis Navellier and Prometheus see an opportunity to buy the dip. As Louis bluntly puts it, don't let talk of "bubble trouble" scare you from Nvidia: It may be overstating it to say that NVDA is in "bubble land." The GenAI boom took shape in early 2023. Since then, shares have surged by more than sevenfold. However, earnings have gone up nearly tenfold during this time frame. In FY2023, Nvidia's earnings came at 18 cents per share. Over the trailing 12-month period, reported earnings have totaled $1.73 per share. In other words, Nvidia's meteoritic rise has come with an even greater increase in profits. Shares of the company trade at just 25 times estimated 2025 earnings... hardly the stuff of bubbles. Earnings forecasts have also continued to increase, with the average analyst adding 3% to their earnings-per-share (EPS) estimates over the past 30 days. This is historically a bullish sign of more gains to come. Of course, there are some risks that Nvidia will fail to deliver on future earnings. Competition is rising among AI chip producers, just as data center players are facing mounting pressure to cut costs. But that's precisely why the stock has fallen 25% in the first place. Prometheus awards Nvidia a >90 score, which suggests a rebound is likely over the next four weeks. The “Picks and Shovels” of AI Chips Shares of high-quality KLA Corp. (KLAC) have plunged 20% since July on similar concerns over AI chip demand. Investors are worried about data centers cutting semiconductor demand, and have sold KLA along with lower-quality firms. The Silicon Valley firm is one of the largest global manufacturers of wafer fabrication equipment for semiconductors, specializing in process control. It's an essential service that helps manufacturers inspect chips during research and production. The complexity of KLA's equipment and relevant services means the company has incredible pricing power and scale. It's roughly four times larger than its closest competitor, according to analysts at Morningstar, and earns over 40% gross margins. InvestorPlace.com's Omor Ibne Ehsan, in June, called KLA a tech trailblazer that's paving the way in AI, 5G, and Internet of Things: Although the firm's growth has moderated recently, I think the company's consistent ability to surpass Wall Street projections bodes well for its future prospects. As the semiconductor industry continues to boom, driven by insatiable demand for cutting-edge chips, KLAC is poised to thrive. If it maintains its momentum and the Nasdaq soars past 20,000, I wouldn't be surprised to see the stock catapult beyond the $1,000 mark. The recent selloff now means Ehsan's $1,000 target price represents almost a 40% upside from current prices. The company scores a strong 88 with Prometheus, and analysts have raised their current-year earnings estimates by 5% over the past 30 days. The Data Center Giant Joel Baglole writes this week that a buying opportunity has finally opened up with Microsoft Corp. (MSFT), a company that markets have sold off: Microsoft delivered a Q2 print that was strong overall and exceeded Wall Street targets on the top and bottom lines. Most analysts raised their targets on Microsoft stock after the Q2 earnings were made public... However, MSFT stock has been pulled lower since the beginning of July amid the broad pullback in technology securities. In the last month, Microsoft stock has declined 13%. This presents a golden opportunity to buy the dip in a best-in-class stock that has a track record of rewarding shareholders. Essentially, Microsoft is beginning to catch up in enterprise-focused cloud computing – an area that Amazon.com Inc. (AMZN) once dominated. Azure cloud service revenues rose 29% in the quarter, well ahead of Amazon's 19% growth rate. It's an increasingly lucrative segment that's helped increase Microsoft's quarterly revenues by $4.5 billion. InvestorPlace.com's Faisal Humayun additionally notes that Microsoft's Azure AI could bring in as much as $200 billion in five years, making it a solid firm to buy the dip. Prometheus awards Microsoft a strong score of 88. A Market Overreaction Last month, InvestorPlace.com writer Eddie Pan noted that warehouse automation firm Symbotic had fallen 25% on weak guidance. (Yes, the same one that previously rose 400%.) He explains what's going on with the AI darling: Guidance is where Symbotic struggled. The company guided for fourth-quarter revenue of between $455 million and $475 million and adjusted EBITDA between $28 million and $32 million. Analysts were expecting revenue of $516.84 million, meaning that the midpoint of Symbotic's revenue missed the target by a significant 10%. A deeper read shows that revenue forecast cuts were a direct result of a planned in-sourcing initiative, which will decrease revenues in the near term and increase profits for the long run. Management realized that much of its outsourcing was costing the firm too much and has opted for slower, more profitable growth. That's why Pan also notes that Wall Street analysts expect the Massachusetts-based firm to quickly recover. The recent stock market selloff now provides a perfect opportunity to jump in on this high-potential stock. Prometheus award shares a score of 87.8, putting it in the top 2% of large-cap companies. | ADVERTISEMENT  That’s what we’re about to see, according to leading research firm.

What does that mean for you?

It means — if you don’t act now, you could be left behind, unable to earn money, find work, or provide for your family.

According to renowned research firm Avanade, the upheaval we’re about to see across America could result in 300 years of change in the next 24 months.

The truth is — everything is about to change…

From the way we travel, to our money, our homes…

Even our jobs and retirement.

We’ve all heard about things that were supposed to ‘end the world as we know it’ right?

Well, this time it’s real.

And it’s happening now.

Click here to see what you can do to prepare before it’s too late. | The Ultimate Buy-the-Dip Finally, our most contentious buy-the-dip pick this week is Intel, a firm I previously noted had lost almost 50% of its market value in a month. The reasons for Intel's decline are obvious... at least in hindsight: - Innovation. In 2018, the company failed to deliver its 10-nanometer CPU, and has been catching up with subsequent standards ever since.

- Competition. Arm architecture is now rivaling Intel's x86 platform in performance; some believe Intel could lose as much as 50% market share in CPUs from this.

- Strategy. Intel has lagged GPU makers in developing AI-specific chips, leaving the sector wide open for players like Nvidia and Advanced Micro Devices, Inc. (AMD).

Perhaps worst of all, Intel's latest products appear to have been rushed. Many of its 13th and 14th generation CPUs are allegedly causing instabilities in both desktops and servers. However, selloffs can sometimes go too far. As InvestorPlace.com's David Moadel writes this week, it's time to buy Intel's stock because no one else wants to: At this point, there's practically nothing left for Intel's shareholders to fear... It's hard to envision the rainbow that's coming when it's storming. Intel is going through a rough period, but Intel CEO Pat Gelsinger assured that the aforementioned decisions (layoffs, dividend suspension) were "painful and hard" but necessary... Unless you really think Intel's headed for Chapter 11, now's the time to exercise your contrarian muscles and buy a few shares. Gelsinger is also putting his money where his mouth is. This week, the veteran executive bought 12,500 shares of his company's stock. And he might be onto something. Prometheus awards Intel a score of 85, suggesting that the selloff has finally gone too far. The "Centaur" Approach to Investing Specialists have long carried an edge in trading. Analysts and corporate insiders often have superior knowledge about the industries they work in, and studies have shown that the top Wall Street analysts and CEOs make better stock calls than average investors. It's often obvious to biotech executives, for example, if half of their patients in an ongoing clinical trial suddenly are cancer-free. (Current federal rules make it legal to trade on this information, as long as official clinical results have not yet been finalized.) Of course, much of this insight is unavailable to regular investors... and even illegal to acquire. But insiders and well-informed traders tend to leave "clues" about their purchases. And that's the basis of Prometheus. As Chris and Luke explain, this is like the data edge Wall Street currently has over everyone else. Luke and his team use it to help guide their breakout trade recommendations... and it's now available for you to use as well. Check out their presentation here. And I'll see you back here next Sunday. Thomas Yeung Markets Analyst, InvestorPlace |

Post a Comment

Post a Comment