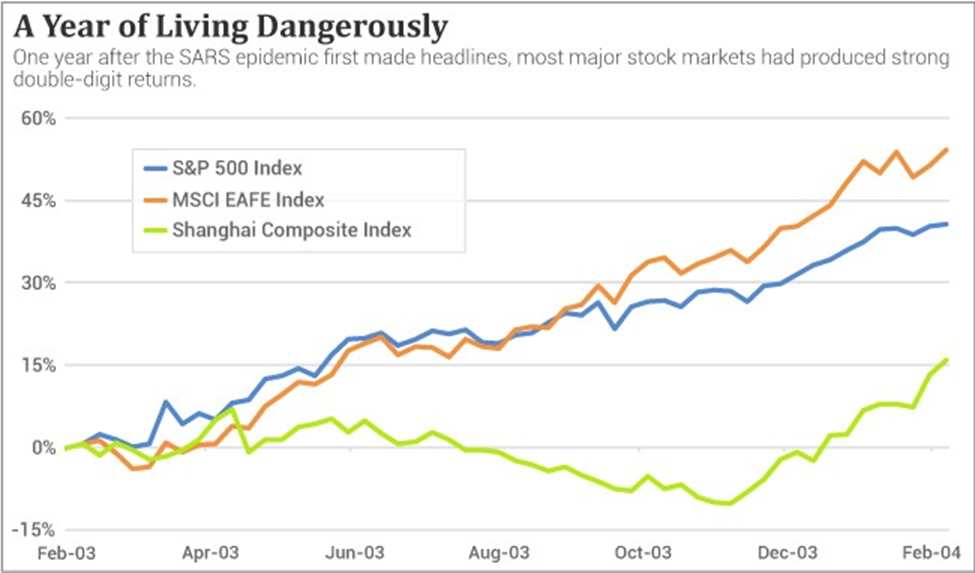

| Weekly Roundup Hello, Reader. August volatility is here. So is a major market selloff. The market slide that started at the onset of the month heated up this morning, with all of the major indices selling off hard. At the time that I write this, the S&P 500 is down 3.8%, the Dow Jones Industrial Average has shed 3%, and the Nasdaq Composite has plunged nearly 5%. As of early August, the S&P 500, Dow, and Nasdaq are down 6.9%, 5.6%, and 9.5%, respectively. Stock market routs like this are miserable events. They sow widespread financial pain and suffering… along with a heaping dose of anxiety. These steep downdrafts bring pleasure to almost no one, except for a maybe a few random short sellers who are reaping the rewards of betting against the market. But for the rest of us, there is no “Joy in Mudville” – no smiles when the stock market strikes out and loses, big time. That said, stock market selloffs are the extreme events that create opportunity. They produce the panic selling and “washouts” that usually offer great moments to make savvy long-term investments. “I will tell you how to become rich,” Warren Buffett famously remarked. “Be fearful when others are greedy. Be greedy when others are fearful.” The sage advice seems so obvious when you read it in black and white. Yet it seems almost impossible to implement in the real world. That’s because when others are fearful, we usually are, too. However, I recommend using the current weakness to establish new positions or add to existing ones. Initially, many of these purchases could produce poor results, if the market continues its downward spiral. But if you are purchasing the shares of dominant companies at today’s discounted prices, you will probably be patting yourself on the back one year from now. In other words, when buying into a hyper-volatile market, you often feel quite stupid at the outset. But over time, that “stupidity” starts looking a lot like genius. Let’s take a look back at another volatile time in the market… Feb. 10, 2003. The day the SARS virus first made headlines.

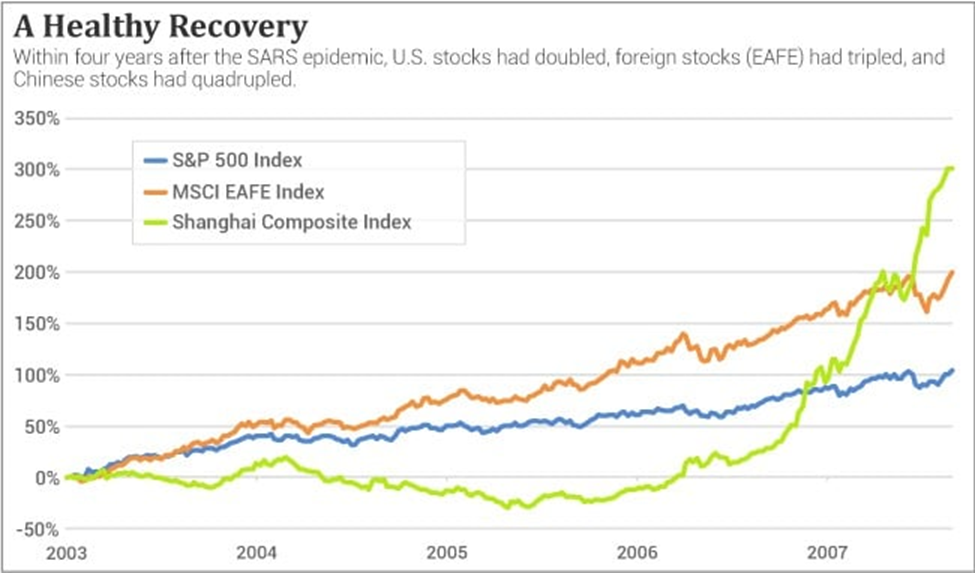

Investors who purchased stocks during the SARS virus outbreak in 2003 would have endured some initial mark-to-market losses, as global markets continued sliding lower. But those March 2003 lows turned out to be great buying opportunities.  As the above chart shows, all the major stock markets were much higher on Feb. 10, 2004, than they were on Feb. 10, 2003. And within four years after the SARS outbreak, the S&P 500 had doubled, the MSCI EAFE Index of international stocks had tripled, and the Shanghai Composite had quadrupled.  Despite that “bad start,” the stock market ultimately rewarded the investors who “bought when others were fearful.” Now, I would not dare to minimize the risks of investing in the current market volatility. To the contrary, I respect its power to destroy capital by falling much lower than it already has. But history tells us that moments like these are what buying opportunities are made of. So, if you have the stomach for it, do a bit of buying… even while others are fearful. In fact, I recommended two new positions to my Fry’s Investment Report subscribers earlier today. These two particular stocks have been on my “shopping list,” and they’ve now dipped to very attractive buying levels… Click here to learn more about these companies and how to join me at Fry’s Investment Report. Now, while we prepare for the week ahead, let’s look back at what we covered here at Smart Money in the past week… |

Post a Comment

Post a Comment