Why Louis Navellier says we need cuts fast … the inverted yield curve is about to un-invert … what history says about that … portfolio action steps The Fed has to cut 50 basis points…yesterday. They're just so out of sync with market rates that it's not even funny… The truth of the matter is the world is now expecting the U.S. to go into a recession, and interest rates are collapsing. That comes from legendary investor Louis Navellier in yesterday's Growth Investor Flash alert. Now, as I write Tuesday morning, the markets are rallying – in fact, the phrase "Turnaround Tuesday" is trending on social media. With all three indexes up 1% or more, the chaos of the last two days appears to have exhausted itself. So, with a more objective, calmer mindset, let's look at three of the big issues that led to the recent market volatility – the rising unemployment rate, the risk of a U.S. recession, and the Fed's interest rate policy. For quick context, in the wake of last Friday's bad unemployment report, the markets violently recalibrated to reflect an elevated risk of a U.S. recession. One of the ways we see this is through interest rates as Louis pointed out – specifically, treasury yields. As recently as May, the 10-year Treasury yield was at 4.62%. Though it's back up to 3.82% as I write, it fell as low as 3.67% yesterday. This is a dramatic collapse. But one of the more important parts of this collapse is how the decline in yields has impacted our inverted yield curve – and what history suggests it means for a recession. | ADVERTISEMENT  According to expert investors Eric Fry, Luke Lango, and Louis Navellier you could have little time to move your money before a major AI event rocks the stock market. Hundreds of stocks could collapse 50% or more in the coming weeks, but a handful could soar 10X as this story plays out.

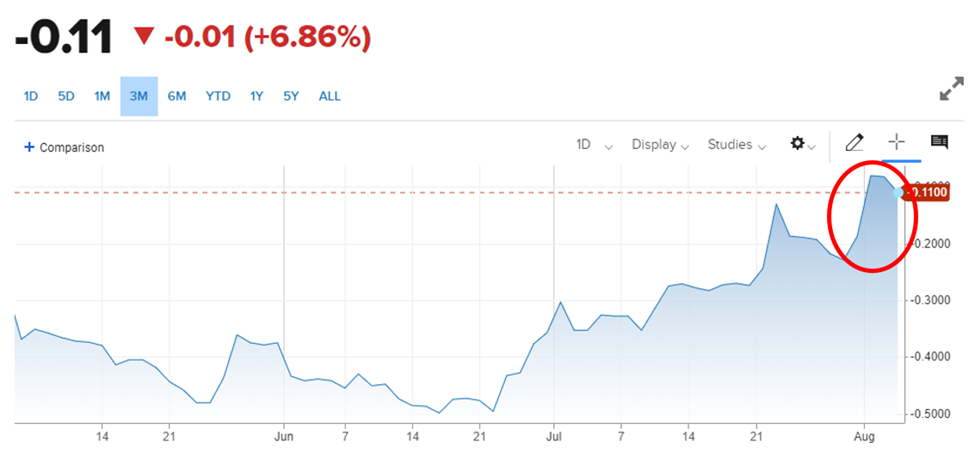

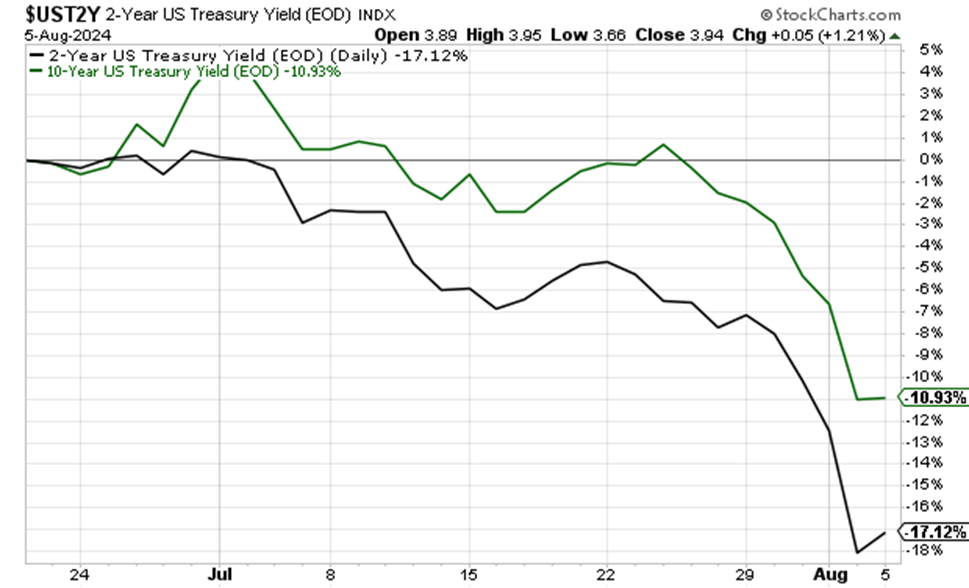

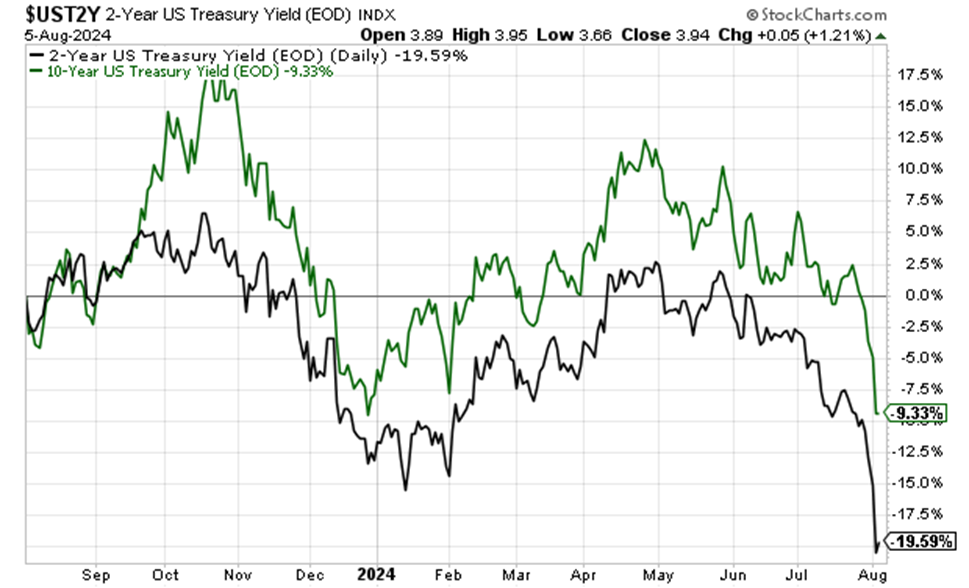

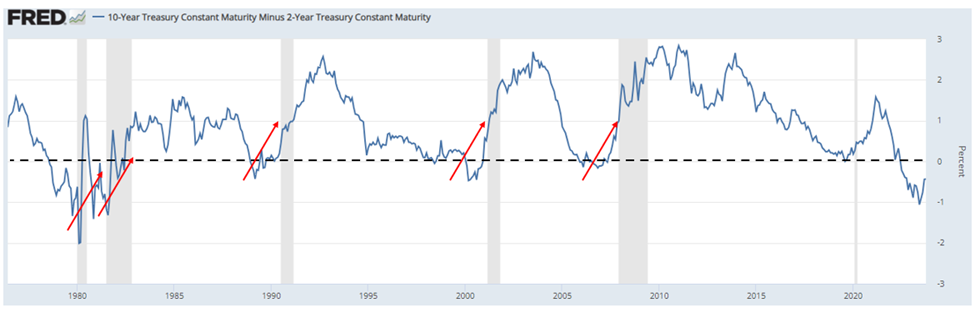

Learn more. | The inverted yield curve has almost un-inverted…why history says that’s not great news To make sure we're all on the same page, a yield curve is a graphical representation of the yields of all currently available bonds, from short-term to long-term. In normal times, the longer you tie up your money in a bond, the higher the yield you would demand for it. So, you'd expect less yield from a 2-year note and more yield from a 10-year note. Given this, in healthy market conditions, we usually see a "lower left" to "upper right" yield curve. But when economic conditions become murky and investors aren't sure what's on the way, the yield curve tends to flatten. And if the curve inverts, history has shown that it is a highly accurate predictor of recessions, though the timing of those recessions varies. From Reuters: Yield curve inversion is a classic signal of a looming recession. The U.S. curve has inverted [6 to 24 months] before each recession in the past 50 years. It offered a false signal just once in that time. The most widely watched yield curve inversion involves the 10-year and 2-year Treasury notes. This part of the yield curve has been inverted for more than two years. In fact, as of March, this inversion set a record for the longest continuous inversion of the US 2s10s. Now, even though this curve remains inverted, over the last week, it has exploded toward zero, and appears on a trajectory to un-inverting. In fact, for a moment yesterday morning, the level nearly hit zero. Below is a chart of this "10-2 Spread" over the last three months. I've circled what has happened since July 30th. We're now just 0.11 below the zero line. For context, roughly this time last year, this 10-2 Spread was as low as -1.06.  You might think that a return to normalcy would be good. After all, if an inverted yield curve is bad omen that foreshadows a recession, logic suggests an un-inverted yield curve would be good. Well, let's pick up with Barron's: It matters how the yield curve un-inverts. That can happen in two ways, after all—either the 2-year yield falls more quickly than the 10-year yield, or the 10-year yield rises faster than the 2-year yield. Either pattern results in a steeper yield curve. Before we get to how to interpret these two means of un-inverting, let's establish what's happened since June 22nd. I'm choosing this start date because if you look again at the chart of the 10-2 Spread above, you'll see that is when the value begins to accelerate north toward zero. As you can see below, since June 22, the 2-year yield (in black) has fallen 17% while the 10-year yield (in green) has fallen just 11%.  So, the 2-year yield is falling more quickly than the 10-year yield. But let's cover our bases by going back farther in time. When we look at the last 12 months, we see that the 2-year yield has dropped 20%, more than doubling the 10-year yield's 9% pullback.  Here again, the 2-year yield has fallen more quickly than the 10-year yield. Now, let's go to Barron's for what this means: [When the 2-year yield falls more quickly than the 10-year yield], markets are typically pricing in imminent interest-rate cuts by the Fed, prompting a sharp fall in near-term yields. That is often right before a recession. What’s the historical relationship between yield curve normalization and recessions? To begin answering that, let's rewind to our October 4, 2023, Digest when we began warning about the yield curve normalization: Using data from the Federal Reserve, let's go back to the mid-70s and look at the timing of when inverted yield curves normalized and ensuing recessions. In the chart below, we have the 10-2 spread. We also have recessions that are marked by shaded areas. We've added a black dotted line to the 0% level to help you see inversions more clearly. Note that this normalization of an inverted yield curve has preceded each recession except those in the early 1980s when the recessions began during the inversions. (We're ignoring the 2020 recession because there wasn't a sustained yield curve inversion.)  As you can see, since the mid-1970s, there is no example of an inverted yield curve normalizing that did not result in a recession. To be clear, today's normalization trend doesn't mean an impending recession. In most of these past periods, there's at least a year between when an inverted yield curve begins normalizing and the start of a recession. Well, here we are, almost one year since that Digest and the 10-2 Spread has nearly un-inverted. Right on cue, the chatter about a potential recession is growing louder. But let's not focus too much on the indicator itself. Rather, consider the economic dynamics driving it. The yield curve typically un-inverts because something breaks in the economy, resulting in a frantic series of rate cuts from the Federal Reserve in an effort to stave off further economic damage. What we've recently see in the bond market is traders concluding, "last Friday's 4.3% unemployment rate was the thing that 'broke' in the economy, so we're now rotating into bonds (which pushes yields lower) because the Fed has no alternative to slashing interest rates." Now, we're not willing to conclude that we are, in fact, headed for a recession. Even a 4.3% unemployment rate is on the low side historically, and as our Editor-in-Chief Luis Hernandez frequently says, "it's hard to have a recession when everyone has a job." That said, the speed of the rising in unemployment is what's eye-catching. And history suggests we'd be foolish to ignore it. | ADVERTISEMENT  Eric Fry has called every major market-event of the last 30 years…

Recommending 41 stocks – EACH one hitting 1,000%+ returns...

But today, Eric releases his biggest WARNING of 2024.

In short…

The world’s wealthiest investors (Jeff Bezos, Mark Zuckerberg, 48 members of Congress, and more) are about to exploit a massive “transfer of wealth” at the cost of your own personal savings.

The last time this happened…

In the 2020 crash – the top 1% added $15 trillion to their net worth…

Meanwhile, the middle class has suffered ever since...

But now – another major ‘transfer of wealth’ has just begun.

Today you have ONE final chance to follow alongside the wealthy, in what may be the greatest investment moment of 2024.

Click here. | So, what will the Fed do, and when will they do it? As we noted in yesterday's Digest, the Fed is in a tough position. So many talking heads are now demanding rate cuts, but if the Fed does so in between FOMC meetings, then they risk appearing panicked, thus triggering a new wave of intense market selling pressure. An emergency rate cut would also result in the optics of the FOMC catering to the stock market instead of the economic data. After all, it was less than a week ago that Federal Chairman Jerome Powell said, "We're getting closer to the point at which it'll be appropriate to reduce our policy rate, but we're not quite at that point." He went on to add, "[If the economic data continue on their current path] a reduction in our policy rate could be on the table as soon as the next meeting in September." So, if the Fed cuts rates before September, they appear beholden to Wall Street more so than the economy. But if they wait another full month, the boa constrictor of high interest rates continues to squeeze an economy that last Friday's unemployment data suggest is weaker than previously thought. Louis believes the Fed should accept the egg on the face and cut rates before September: The bottom line is that interest rates are collapsing so fast that the Fed has to cut rates six times – six quarter-point rate cuts – just to be in sync with market rates… I'm still in the camp that they should cut 50 basis points before their meeting in Jackson Hole at the end of the month. As we detailed in yesterday's Digest, Louis said that if the Fed waits until its September meeting to cut interest rates, they won't just be late to the party, the party will be over. As to why, Louis points toward the unemployment rate: Unemployment has risen from 3.4% to 4.3% in the last 15 months. It's going to be 5% by October… So, the Fed has to do something. They can't just be like an ostrich with their head in the sand and be oblivious to everything. So, what’s the action step in your portfolio? We'll repeat yesterday's suggestion, which includes both offensive and defensive action steps. From defensive orientation, mind your stop-losses. And as Louis notes in his podcast update, only sell on "up" days, and be careful not to get fleeced on ETF bid/ask spreads. From an offensive orientation, first, check your head. Selloffs like the ones we've experienced over the last few days aren't unusual, even in bull markets. This type of volatility is simply the price of admission for being an investor. So, if you own quality stocks and have a longer-time investment horizon, ignore this volatility. Actually, we'd urge the opposite approach: Get your "stock wish list" ready to go. You don't have to rush to buy – we don't know how deep or long this selloff will last (you can always dollar-cost-average in). But keep your eyes open. We might find ourselves enjoying some great buying opportunities in the coming days/weeks. Finally, don't overlook the fantastic trading environment created by periods of heightened volatility. In moments like we've experienced recently when fear is high, investors react first and think later. They often sell great assets at horrible prices. But this just means that you, as a calm, rationale trader, can scoop up those great assets at fantastic prices. One of our favorite trading systems comes from Luke Lango in Breakout Trader. It involves a market approach called "stage analysis." We'll bring you more details in tomorrow's Digest, but you can learn more in a free video Luke has created right here. We'll keep you up to date with our analysts' latest views on the Fed, rate cuts, and recession risk in the coming days. In the meantime, stick to your investment plan, look to capitalize on other investors' bad market choices, and take a deep breath as we enjoy today's relief rally.

Have a good evening, Jeff Remsburg |

Post a Comment

Post a Comment