The Dollar's Worst Year in 50 Years Is Great News for Your Portfolio  | | Robert Ross

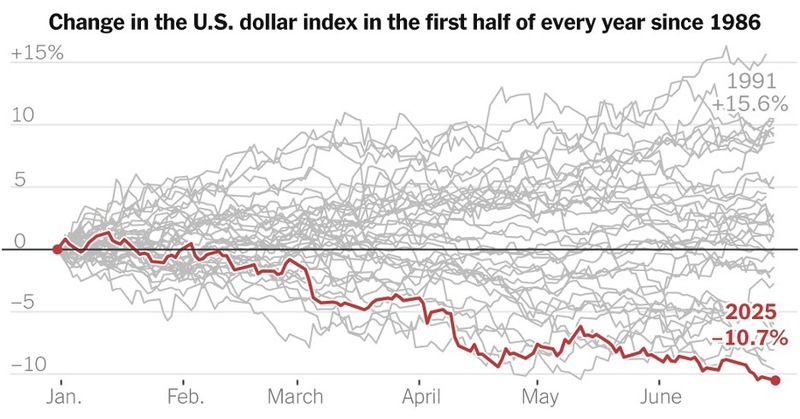

Speculative Assets Specialist | Over the past several weeks, a quiet but powerful shift has taken hold of the financial system. The U.S. dollar - long considered the world's most stable and dominant currency - is crumbling beneath the weight of its own government's policies. In fact, 2025 is shaping up to be the worst start to a year for the U.S. dollar since the collapse of the Bretton Woods system in the early 1970s. That's not just an interesting macro footnote. It's a signal that the era of fiscal dominance has arrived. And for investors who understand what this means, the implications are massive - especially for small caps and crypto. | SPONSORED | | Leaked: Jobs' Final Apple Project Exposed Bloomberg just leaked details of a secret project Steve Jobs set in motion before his death. After more than a decade under wraps, Apple is finally preparing to unleash this breakthrough - one that could reshape a $9 trillion industry overnight. Click for full details. | | | Monetary Hijacking Fiscal dominance happens when government borrowing becomes so large, so relentless, that it effectively hijacks monetary policy. In a textbook world, the Federal Reserve sets interest rates based on inflation and employment data. But in a world of fiscal dominance, the central bank becomes subservient to the government's debt-fueled agenda. This isn't new. We've seen it before - in wartime economies like World War I and World War II, and again in the late 1960s during the buildup to stagflation. The government ran massive deficits, and the Fed was forced to keep rates artificially low to avoid a debt spiral. Now it's happening again. Trump's "Big Beautiful Bill" is a textbook fiscal expansion. It slashes corporate and personal taxes, supercharges defense spending, and offers no meaningful offsetting cuts. That means it must be financed through borrowing. And that's a problem... because the U.S. is already carrying over $34 trillion in debt. To fund this new wave of stimulus, the Treasury must issue hundreds of billions (if not trillions) in new debt. But if the Fed lets interest rates rise, the cost of servicing that debt becomes unsustainable. So instead, the Fed is now being pulled toward rate cuts - not to stimulate the economy, but to preserve the solvency of the government. That's fiscal dominance in action. The Dollar Is Paying the Price This power shift between fiscal and monetary authorities is already being reflected in the currency markets. The U.S. dollar is down more than 10% year-to-date, marking its worst start to a year in over 50 years. And while most headlines are still focused on inflation or unemployment, currency traders are reacting to the real story... the Fed is being cornered. It cannot hike. It may be forced to cut. And the U.S. is about to drown the world in dollar-denominated debt.

View larger image Why does this matter? When the dollar weakens, two things tend to happen... - Foreign capital rotates into U.S. assets to take advantage of the currency discount.

- Scarce, inflation-resistant assets outperform as investors hedge against debasement.

We're already seeing both trends play out in real time. Where the Smart Money Is Going A weaker dollar disproportionately benefits small cap stocks and cryptocurrencies - two of the most sensitive asset classes to liquidity flows. That's because small caps tend to be domestic-focused, heavily leveraged to the U.S. economy, and more sensitive to shifts in monetary conditions. And crypto is priced in dollars globally - meaning a weaker dollar makes it more attractive to international buyers while boosting its nominal price. Don't take my word for it. Just look at the results since the April bottom... - Bitcoin (BTC) has been the clear leader in crypto, regaining its uptrend and acting as a "scarcity asset" amid fears of monetary debasement.

- New Gold (NGD) - a small-cap gold miner we bought in April - is up 65% since our Breakout Fortunes alert as it combines exposure to both commodities and small-cap tailwinds.

- ThredUp (TDUP) - an e-commerce small cap focused on secondhand apparel - has more than doubled since I recommended the stock in April, benefiting from the surge in consumer discretionary and risk-on flows.

These aren't flukes. They are part of a broader rotation into liquidity-sensitive assets now that the dollar has begun to falter. The Playbook To be clear, the market isn't without risks. Over the short term, we're stretched - both technically and sentiment-wise. But the medium-term thesis is clear: fiscal dominance means more spending, more borrowing, and more liquidity. That's bullish for risk assets - especially those that benefit from a declining dollar and increasing liquidity. So what's your move? - Stay long core dollar-hedge assets like BTC, ETH, and gold.

- Lean into U.S.-focused small caps that are beginning to outperform large caps.

- Watch the bond market - if yields stop rising despite more debt issuance, that's a sign fiscal dominance is fully priced in and risk-on can resume.

Here's the bottom line... The U.S. dollar is losing altitude. The Fed has lost independence. And markets are beginning to recognize the new regime. Fiscal dominance isn't just an economic theory. It's the macro reality of 2025. And if you position correctly... it could also be your biggest opportunity. Stay safe out there, Robert Want more content like this? | | | | | |

Post a Comment

Post a Comment