*Sponsored by Nutriband Inc.

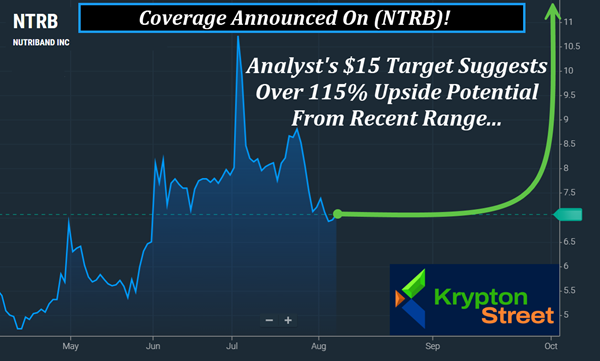

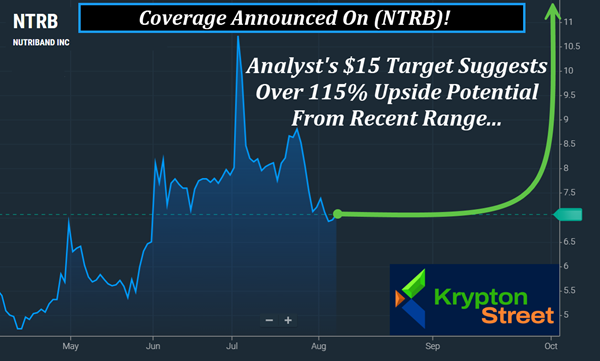

Krypton Street Announces Nutriband Inc. (NASDAQ: NTRB) Is Back On Our

Radar This Morning—Friday, August 8, 2025

And Here's Why…

Our Recent Coverage Showcased Moves Of Approx. 31%, 42%, And 45%

Within 24-72 Hours.

Analyst Target Raised To $15, Which Suggests Over 115%

Upside Potential From Recent Range.

Limited Float, Under 3.5 Mn Shares, Could Lead To Potential For

Big Swings If Demand Begins To Shift.

Pull Up (NTRB) This Morning While It's Still Early…

August 8, 2025 Just Announced | See Why (NTRB) Is Back On Our Radar This Morning Dear Reader, You can feel it before you see it—momentum quietly building, ready to break wide open. Some companies stay under the surface… until the right spark hits. That spark just landed. Following a run of strategic moves, Nutriband Inc. (NASDAQ: NTRB) is lighting up our radar this morning—Friday, August 8, 2025—and this setup is shaping up to be one you'll want to watch closely. But keep in mind, (NTRB) has a very limited float with Yahoo reporting there's less than 3.5 Mln shares listed as available to the public. When there's a small float like this, the potential exists for big moves if demand begins to shift. The last time we highlighted (NTRB) it made an approximate 45% overnight move. You see, on July 1, (NTRB) closed at around $8.02, then the next morning, it reached $11.68. Then before that, we highlighted (NTRB) as it went from a $6.50 close on Friday, May 30, to $8.55 by Monday, June 2—an approximate 31% move in just days. And before that, we covered it as it went from $5.68 to $8.11 within 24 hours, for an approximate 42% move. Recently, Robert LeBoyer, Senior Vice President and Equity Research Analyst at Noble Capital Markets, raised his target on (NTRB) to $15, which suggests over 115% upside potential from yesterday's $6.97 open.

Last month, (NTRB) was officially added to several Russell indexes, including growth-focused benchmarks, as part of the 2025 reconstitution. This inclusion could have the potential to draw in the attention of institutional funds and index strategies that track these widely followed benchmarks, expanding market visibility at a pivotal point for the company. On the technical side, Barchart highlighted (NTRB) with 9 bullish signals across short-, medium-, and long-term indicators, underscoring the momentum potential in its trend. Pushing Safety Forward in Transdermal Delivery

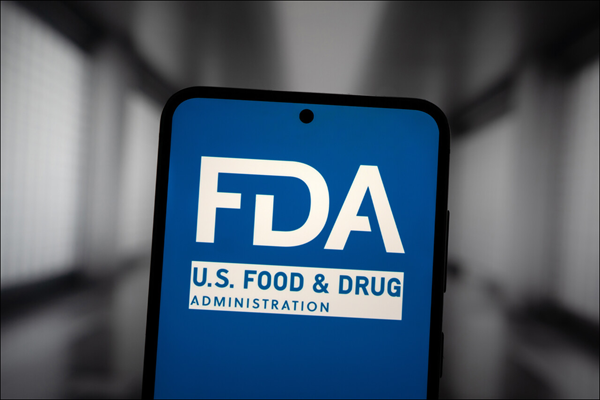

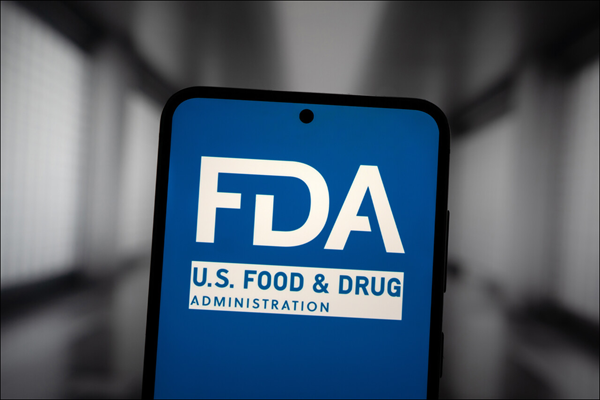

With commercial-scale manufacturing now complete, (NTRB) is moving toward an FDA IND filing for its AVERSA™ Fen-tan-yl system—aiming to set a new standard in abuse-deterrent patch technology.

This is a company with a clear, focused mission: improving the safety of transdermal delivery. Its lead product, AVERSA™ Fen-tan-yl, isn't just another patch—it's designed as an abuse-deterrent transdermal system that could reshape how these therapies are delivered to those who need them while reducing the risks of misuse. In June, (NTRB) and its partner Kindeva announced they had completed the commercial manufacturing process scale-up for AVERSA Fen-tan-yl, marking a pivotal step forward. This move means the company is preparing to file its Investigational (IND) application with the FDA for clinical testing—a necessary gateway to commercial readiness

Protected By Patents

(NTRB)'s AVERSA™ technology is protected by a broad patent portfolio in 46 countries, including the United States, Europe, Japan, Korea, and China. This coverage strengthens the foundation for its transdermal abuse-deterrent platform, which can be applied to a range of dr-ugs with potential misuse risks, including opi-oids and stimulants. This innovation matters, particularly in a landscape where transdermal fen-tan-yl remains a necessary treatment, yet carries a high risk of misuse. AVERSA aims to address this gap without restricting patient access.

Clearing the Path to Approval:

With manufacturing scaled and a streamlined Phase 1 trial ahead, (NTRB) is positioning AVERSA™ Fen-tan-yl for a faster, lower-risk route to market under the FDA's 505(b)(2) pathway.

Recently, Gareth Sheridan, CEO of Nutriband, emphasized the significance of completing the manufacturing scale-up, calling it "an important step toward the development of a commercially viable product and eventual NDA filing." He underscored how the milestone demonstrates the compatibility of AVERSA technology with established manufacturing processes, providing a clear path toward clinical testing and future commercial rollout. For (NTRB), only a single Phase 1 study is required under the FDA's 505(b)(2) pathway, and the trial is designed specifically to demonstrate that the patch is less preferable for misuse compared to conventional fen-tan-yl patches—an approach considered a low-risk step toward approval. Strategic Dividend Signals Confidence in Commercial Readiness:

With a 25% preferred dividend offering both conversion and ca-sh payout potential, Nutriband reinforces its commitment to shareholders as AVERSA™ nears the final stages before market entry

In a show of confidence and long-term alignment with shareholders, Nutriband's Board of Directors recently approved and issued a 25% preferred dividend—a move designed to enhance shareholder value while reinforcing the company's regulatory trajectory. Shareholders of record as of July 25, 2025 received one preferred share for every four common shares held, with a distribution date of August 5. Each preferred share is structured with dual utility: - Convertible into common shares upon FDA approval of the AVERSA fen-tan-yl product

- Or, if held, eligible for a future cash dividend paid from company profits at the discretion of the Board.

CEO Gareth Sheridan framed the dividend as a step that reflects the company's nearing inflection point: "Our core goal is to continue to create value for our shareholders — particularly as we near commercialization of AVERSA fen-tan-yl." This move comes on the heels of Nutriband's completed manufacturing scale-up with Kindeva and signals management's commitment to pairing technical execution with shareholder-focused strategies. Key Milestones Mark Nutriband's Accelerating Trajectory

From expanded patent protection to manufacturing scale-up and a strategic dividend issuance, Nutriband is stacking pivotal moves as it advances AVERSA™ toward FDA submission.

- June 3, 2025: The USPTO issued a U.S. patent further expanding coverage for Nutriband's AVERSA technology.

- June 18, 2025: Nutriband and Kindeva completed the commercial manufacturing scale-up for AVERSA Fen-tan-yl, preparing for IND filing and clinical testing.

- August 5, 2025: Nutriband issued a 25% preferred dividend to shareholders of record as of July 25—further reinforcing its commitment to long-term shareholder value as it advances toward FDA submission.

Positioned for a Defining Phase

With global manufacturing support, a clear FDA pathway, and a growing need for safer transdermal options, (NTRB) is stepping into a moment that could shape its commercial future.

This is a pivotal moment for (NTRB). It has moved from a concept to a tangible pathway toward market readiness, backed by a partner with global manufacturing capabilities and a clear regulatory roadmap. The addressable need for safer transdermal therapies remains significant, and the technical and regulatory progress seen over the past weeks positions (NTRB) in a stronger light than many might realize. If you want to follow a company aligned with a clear mission, credible technology, and a tangible timeline for its next steps, (NTRB) deserves a place on your screen right now. Now's the time to keep an eye on (NTRB) as this story continues to unfold. 7 Reasons Why (NTRB) Just Hit Our Radar This Morning

—Friday, August 8, 2025 1. Analyst Coverage: Noble Capital Markets recently raised its target on (NTRB) to $15, which suggests over 115% upside potential from its recent range.

2. Limited Float: With fewer than 3.5 Mn shares publicly available, (NTRB)'s small float could witness the potential for big moves if demand begins to shift. 3. Recent Momentum: Over the past two months, (NTRB) has seen multiple breakout windows—including approximate moves of 31%, 42%, and 45%—within 24 to 72 hours of technical or news-driven events. 4. Index Visibility: As of late July, (NTRB) has been added to several Russell indexes, a development that may expand institutional exposure through benchmark-aligned strategies. 5. Patent Strength: (NTRB)'s AVERSA™ platform is protected in 46 countries, offering broad global coverage at a time when abuse-deterrent transdermal technologies are under high regulatory and clinical interest. 6. Shareholder Alignment: Following the approval and distribution of a 25% preferred dividend, (NTRB) reinforced its commitment to long-term alignment with shareholders as it advances toward a pivotal regulatory milestone. 7. FDA Preparation: Having completed its commercial scale-up with Kindeva, (NTRB) is now preparing to file its IND application for AVERSA Fen-tan-yl—marking a clear transition from concept to clinical readiness.

Pull Up (NTRB) This Morning While It's Still Early…

After a string of breakout moments—like its (approx.) 31%, 42%, and 45% moves—Nutriband Inc. (NASDAQ: NTRB) just reentered the spotlight with the potential for real momentum behind it. Between the ultra-low float, a fresh $15 analyst target, global patent protection, and the scale-up completion with Kindeva now paving the way for FDA submission, there's a real shift underway here. This is already at the top of our screens this morning.

Pull up (NTRB) while it's still early. We have all eyes on (NTRB) this morning. Also, my next update could be hitting within the next 60-90 minutes—make sure you're watching out for this one. Sincerely, Alex Ramsay

Co-Founder / Managing Editor Krypton Street

|

Post a Comment

Post a Comment