*Sponsored

Krypton Street Initiates Coverage On Blue Gold Limited (Nasdaq: BGL)

Starting Tomorrow Morning—Monday, August 11, 2025

(BGL) Comes Backed By Several Potential Catalysts Including:

Partnership With TripleBolt Technology To Explore Blockchain-Backed

Gold Coin Linked To Future Deliveries

Led By Nathan Dionne, The Initiative Combines Gold Value With

Blockchain Transparency And Supports Mine Development

Plans To Acquire 90% Stake In Ghana's Mampon Gold-Copper Mine For

$26.25M In Equity With Resource-Linked Earn-Outs

Acquisition Near Existing Assets Designed To Improve Operational

Efficiency And Advance Digital Gold Strategy

Gold Prices Forecast Between $3,500 And $3,700 Per Ounce In 2025 Amid Economic Uncertainty, Inflation Risks, And Central Bank Demand

There's Less Than Than 12 Mn Shares Listed In Its Float, Which Could

Drive Heightened Volatility

Just Last Week, (BGL) Made An Approximate 40% Move In Three Days…

Consider Starting Your Own Research On (BGL) This Week…

August 10, 2025

Monday's Watchlist | See Why (Nasdaq: BGL) Will Be At The Top Of Our Radar Dear Reader, Less than 72 hours ago, gold opened at $3,487.90 per ounce following reports of new gold tariffs — and by mid-morning, futures had surged to a record high of $3,534.10.

J.P. Morgan now sees prices averaging $3,675 by late 2025, with the potential to reach $4,000 by the second quarter of 2026. In the midst of these historic market conditions, one Nasdaq-listed company in the gold mining and resource development space is taking decisive steps — combining established mining operations with next-generation digital technologies. The company is actively expanding in West Africa, securing high-potential mineral assets, and advancing plans to merge physical gold resources with blockchain-backed solutions. With fewer than 12Mn shares in its float, fresh acquisition headlines, surging gold prices, and a strategy built for both scale and innovation, it may only be a matter of time before this profile draws far greater attention from the street. Before that happens, consider this disruptor for your watchlist: Blue Gold Limited (Nasdaq: BGL)

Blue Gold Limited (Nasdaq: BGL) is a next-generation gold development company focused on acquiring and aggregating high-potential mining assets across strategic global jurisdictions. Just last week, (BGL) made an approximate 40% move—from $9.75 on August 6 to $13.77 on August 8 — underscoring how quickly this profile can react to potential market catalysts. The Company's mission is to unlock untapped value in the gold sector by combining disciplined resource acquisition with innovative monetization models, including asset-backed digital instruments. Blue Gold Limited (Nasdaq: BGL) - A Platform for Tier-1 Gold Growth

Blue Gold Limited is a gold mining company focused on acquiring, developing, and optimizing long-life gold assets.

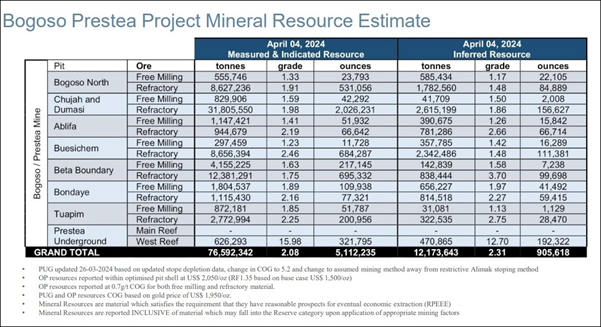

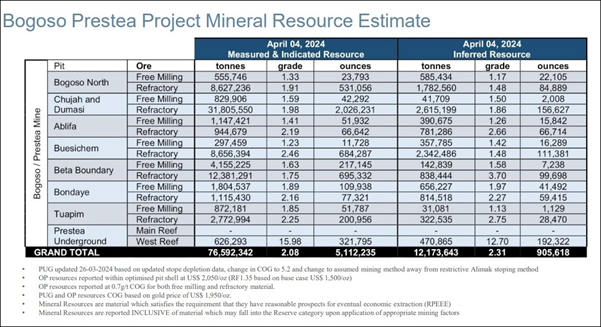

Their flagship project is the Bogoso Prestea Mine in Ghana's Ashanti Gold Belt—a 9Moz+ legacy asset with over $500Mn in historical in-vest-ment and 5.1Moz in current measured and indicated resources. Their goal is to restart and ramp up gold production, facilitated by high margin operations. Blue Gold Limited (Nasdaq: BGL)'s Flagship Project

Bogoso Prestea Mine – A Historic Operation, Poised for a New Era

Since 1912, over 9Mn ounces of gold have been produced from the site. Now, with over $500Mn in legacy infrastructure and 5.1Moz of measured and indicated resources, Blue Gold Limited (Nasdaq: BGL) is restarting this Tier-1 asset with a 2025 production target.

Grab Sources Here: BGL Website. ==== 5 Key Reasons Why (Nasdaq: BGL) Will Be Topping Our Watchlist

Tomorrow Morning—Monday, August 11, 2025

#1. Low Float Situation: (BGL) has fewer than 12Mn shares listed in its float—which could set the stage for significantly heightened volatility. #2. Blue Gold Block-chain Gold Token: Blue Gold Limited has partnered with TripleBolt Technology to explore creating a block-chain-backed gold token, Blue Gold Coin (BGC), linked to future gold deliveries. Led by fintech executive Nathan Dionne, the initiative aims to merge gold's value with block-chain transparency. Proceeds will support mine development and growth. #3. Blue Gold Acquires Ghana Mine: Blue Gold Limited plans to acquire a 90% stake in Ghana's Mampon Gold-Copper Mine for $26.25Mn in equity, with earn-out payments linked to confirmed gold and copper resources. The acquisition, near existing assets, aims to boost operational efficiency and supports Blue Gold's goal to become a leading digital gold company. #4. Gold Prices Are Around All-Time Highs: Forecasts around $3,500 to $3,700 per ounce in 2025 are driven by economic uncertainty, inflation risks, and central bank demand. Paying attention to gold development companies is important as they enable supply growth, and their projects can benefit from rising gold valuations, and market dynamics in the precious metals sector. #5. Ghana Is A Gold Mining Powerhouse: Here's why Ghana could be a game-changer: - #1 producer in Africa – 3.7Moz produced in 2022

- 150Moz+ of historical gold output from the Ashanti Belt

- Stable democracy with strong legal protections for mining in-vest-ors

- Transparent permitting process with consistent governance

- Robust infrastructure: roads, power grid, export ports

- Skilled mining workforce and a deep local talent pool

==== Consider Starting Your Own Research On (BGL) This Week… Early coverage on Blue Gold Limited (Nasdaq: BGL) starts tomorrow morning—Monday, August 11, 2025

Just last week, (BGL) made an approximate 40% move in 3 days—from $9.75 on August 6 to $13.77 on August 8—underscoring how quickly this profile can react to potential market catalysts.

Keep an eye out for my (BGL) update tomorrow morning—it could be coming bright and early. Sincerely,

Alex Ramsay

Co-Founder / Managing Editor Krypton Street Newsletter |

Post a Comment

Post a Comment