*Sponsored

Market Crux Initiates Coverage On (MAIA) Starting This Morning

—Wednesday, August 13, 2025

Analyst Coverage Shows Two Independent Targets For (MAIA) Projecting Over 500% And 800% Potential From Recent $1.50 Levels

MarketWatch Reports (MAIA) Has Fewer Than 22M Shares In Public Float, A Setup That Can Amplify Moves If Demand Shifts

(MAIA) Maintains Three FDA Orphan Designations And One Rare Pediatric Disease Designation For Extended Market Exclusivity Potential

Next 12 Months For (MAIA) Could Include Pivotal Phase 3 Launch, Multiple Trial Starts, And Potential Early Filing Milestones

Take A Look At (MAIA) This Morning While It's Still Early…

August 13, 2025 Morning Coverage | See Why (MAIA) Just Landed On Our Early Watchlist Dear Reader, In oncology, some concepts don't just move research forward—they redefine what's possible. MAIA Biotechnology (NYSE American: MAIA) is pursuing one such concept, and the progress from its lead program is already drawing attention from across the scientific and medical community. Two independent research firms have recently weighed in. Hunter Diamond, CFA — CEO of global small cap equity research firm Diamond Equity Research — recently placed a $10.27 valuation on (MAIA), which suggests more than 500% potential upside from its current $1.50 range. And if that projection turned heads, the next one could raise eyebrows even higher.

Robert LeBoyer, Senior Vice President and Biotechnology Equity Research Analyst at Noble Capital Markets, set a $14 target, which suggests over 800% potential upside — a view backed by more than 16 years of industry experience and an MBA from Columbia Business School.

Adding to the case, MarketWatch shows (MAIA) has less than 22M shares in its public float — a structure that could have the potential to magnify moves if demand starts to shift. A New Approach Few Have Tried

(MAIA)'s lead program is built around a first-of-its-kind method in cancer treatment. Instead of going after cancer the usual way, it targets a feature most tumor cells rely on to survive — and breaks it down from the inside. Early results suggest this not only kills the cancer cells but also helps the body's own defenses recognize and fight them, reducing the chances they come back. When paired with certain existing therapies, this approach could even make resistant cancers respond again. Promising Results In A Tough-To-Treat Cancer

In an ongoing mid-stage study, (MAIA)'s lead program is showing results that go far beyond what's usually seen for patients who have run out of standard treatment options. On average, participants have lived more than three times longer than typical for this stage of disease — and some have seen their tumors shrink or remain under control for nearly two years. These kinds of outcomes are rarely achieved in such a high-need patient group. Strategic Partnerships With Global Leaders

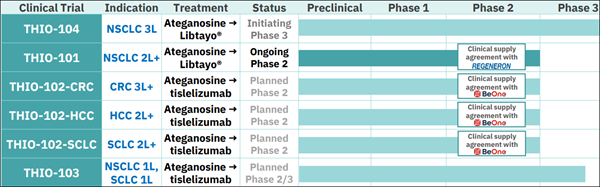

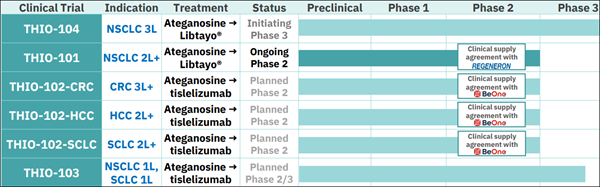

(MAIA) has secured three clinical supply agreements with major pharmaceutical companies, giving it access to multiple checkpoint inhibitors and broadening its development reach: - Regeneron — Libtayo® for NSCLC.

- BeiGene — tislelizumab for planned studies in hepatocellular carcinoma (HCC), small cell lung cancer (SCLC), and colorectal cancer (CRC).

- Roche — Tecentriq® for additional hard-to-treat cancer indications.

This multi-partner strategy allows (MAIA) to explore its therapy in several cancers, each with significant unmet needs and commercial potential. Regulatory Designations That Extend the Runway

- Three FDA Orphan Designations: HCC, SCLC, and malignant gliomas.

- One FDA Rare Pediatric Disease Designation: Pediatric gliomas.

These designations can provide years of market exclusivity following approval, along with other development incentives. A Pipeline Beyond the First Program

The next stage of MAIA's growth is already in motion: - THIO-104 Phase 3 pivotal trial in third-line NSCLC — could support early filing for commercial approval in 2026.

- THIO-102 trials targeting HCC, SCLC, and CRC — planned to begin enrollment in 2026.

- Second-generation telomere-targeting agents — in preclinical development for multiple tumor types.

The Bigger Picture

Cancer therapeutics development is crowded — but few companies are pursuing telomere targeting, and none are as far along as (MAIA) in the clinic. With strong interim data, expanding partnerships with household names in pharma, multiple regulatory designations, and two independent analyst valuations projecting multi-fold potential from current levels, (MAIA) is positioned at an inflection point. The months ahead could bring pivotal trial initiations, expanded data sets, and potentially the first steps toward regulatory filings. For those following the next wave of targeted oncology innovation, (MAIA) is one little-known company to keep an eye on. These 7 Potential Catalysts Put (MAIA) On Our Watchlist This Morning

—Wednesday, August 13, 2025

1. Limited Float: according to MarketWatch, (MAIA) has less than 22M shares in its public float — a setup that can amplify moves if demand shifts.

2. Analyst Coverage: two independent firms have issued targets on (MAIA) — one projecting more than 500% potential upside and the other over 800% — from its recent $1.50 levels. 3. Strong Trial Data: interim results for (MAIA) in late-stage NSCLC showed median survival more than triple the typical outcome for this patient group. 4. Global Partnerships: (MAIA) has active clinical supply agreements with Regeneron, BeiGene, and Roche to expand its reach into multiple high-need cancer types. 5. Regulatory Designations: (MAIA) holds three FDA Orphan Designations and one Rare Pediatric Disease Designation that could extend market exclusivity following approval. 6. Near-Term Milestones: the next 12 months for (MAIA) could include a pivotal Phase 3 trial launch, multiple trial initiations, and potential early filing milestones. 7. Pipeline Expansion: (MAIA) is advancing additional clinical trials and developing second-generation telomere-targeting agents beyond its lead program. Take A Look At (MAIA) This Morning While It's Still Early…

With two independent analyst targets suggesting 500% to 800% potential upside from recent levels, a public float under 22M shares, and clinical data in late-stage NSCLC showing survival rates more than triple the norm — this is a biotech that checks a lot of boxes.

Add in supply agreements with Regeneron, BeiGene, and Roche, multiple FDA designations, a growing pipeline, and major trial milestones on deck, and it's clear why this just landed on our radar.

We have (MAIA) at the top of our screen this morning. Take a look at this while it's still early. Also—my next update—it could be hitting within the next 60-90 minutes—make sure you're ready. Sincerely, Gary Silver

Managing Editor, Market Crux |

Post a Comment

Post a Comment