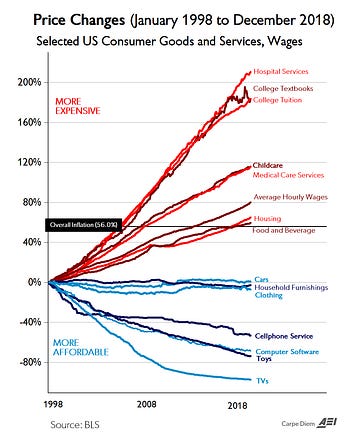

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: My wife and daughter were adamant. We go to Washington. Down the 295. Into the belly of the beast. We had a great brunch… then we went to the Smithsonian Museum of Natural History. My daughter loved the fossils… my wife loved learning how peat turned into coal… And I loved getting ammunition for what I already knew. The 1990s changed everything… and have ignited a cultural war 30 years later… Look at This WallThe Smithsonian has a wall in its “cell phone” exhibit that outlines just 75 of the things that the smartphone has replaced in the last three decades. From books and fax machines to card games and printers… it’s all here. Right on this wall. Technologists create DEFLATION. They have driven down the costs of the technologies we need for communication… and more… And society has benefited immensely. But the rewards… have gone to the shareholders of Apple and Samsung. Nothing against that… innovation deserves rewards. It’s just that there’s a HUGE difference between innovation gains and financial gains… especially when you have a central bank that is willing to bail out all of the leverage that centers around these companies during hard times… (2002, 2008, 2011, 2015, 2018, 2020, 2022, 2023, 2024, 2025)… It’s just when the stock market falls hard… and the central bank steps in with Quantitative Easing and all the other support… well… the backstop is the problem. Technology creates deflation. But the Fed doesn’t want deflation. It wants to create inflation, 2% a year at a time. And as a result… the phone goes down in cost. The board game goes down in cost. But the money printing… it impacts the things that matter. Here’s the chart since the 1990s… Food… housing… education… electricity… and energy… All while the government SUBSIDIZES all of these things too. THIS IS NOT HARD… COME ON, PEOPLE.So… the cost of what matters goes up… There are people on the internet right now telling people under 40 that it couldn’t be easier to launch a business. Sure… but the money is broken. So, while you bitch and complain that people like Mamdami are about to become the mayor in New York, you’re missing the bigger picture. The money printing, the bailouts… the Cantillon Effect… is what’s driving this divide. I don’t condone socialists… but I do understand how this world has changed. In the 1990s, they tried this socio-economic experiment with a 2% inflation target, and it’s been a massive error, one that compounded for 30 years. And still… somehow… this doesn’t get the mainstead attention it deserves. I’m going to be on Josh Brown’s podcast tomorrow talking about some of these things, and I’ll send you a link after I’m done. I can’t wait. Gonna be a great conversation with one of my favorite voices in finance. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment