A Bull Market In… Auto Stocks?!? Dear Reader,

You probably saw the news yesterday: Nvidia (NVDA), the engine powering the AI revolution, just became the first $5 trillion company.

Let’s just stop and consider for a minute how shockingly massive that is. $5 trillion represents about 16% of the entire U.S. economy, and it’s larger than the economy of literally every country on earth other than the U.S. or China.

I don’t want to diminish what a remarkable record this is. Nvidia has been the biggest wealth creator in the history of American capitalism.

But let’s also stop for a minute to consider how markets work. Stock prices rise when demand outstrips supply, or when there are more buyers than sellers. It really is that simple.

At some point, these massive and highly overvalued stocks will run out of new buyers willing to pay the next higher price. I’ve been outspoken about this, because I believe it’s a fragile situation that will end in a tech “meltdown” in one particular corner of the market.

Just consider how much buying pressure it took to push Nvidia to a $5 trillion valuation. And now consider how much additional buying pressure it will take to push the stock higher from here. Every 1% move in Nvidia’s stock price represents a $50 billion change in market cap.

Meanwhile, it takes far less buying pressure to push the shares of a $50 billion company higher than those of a $5 trillion company.

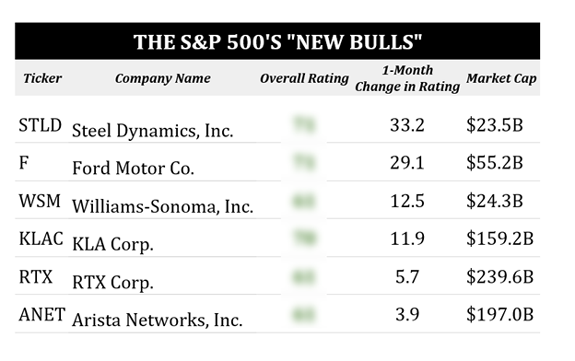

[continued below] I was pondering this as I reviewed the S&P500 stocks that have recently popped up as newly bullish on my Green Zone Power Rating System. Two stocks really jump off the page for their change in rating over the past month. Steel Dynamics (STLD) popped 33 points and now rates a bullish 71. And Ford Motor Company (F) isn’t far behind it. Ford jumped 29 points and also rates a bullish 71.

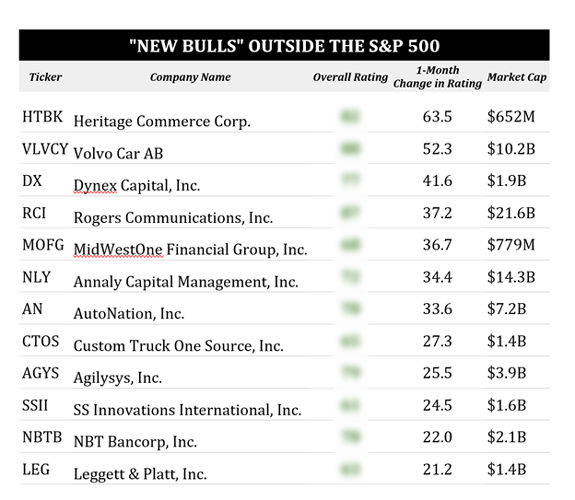

Yes, you read that right. Ford. That Ford. The automaker perpetually in crisis mode, ironically, not unlike its “Fix or Repair Daily” nickname. At any rate, not only does Ford now rate as Bullish overall, it rates particularly well on value, growth and momentum with factor ratings of 94, 88 and 76, respectively.  Huge Ratings Moves Outside the S&P 500 But there’s also a bigger story here. When I performed the same screen on stocks outside of the S&P 500, Swedish automaker Volvo Car AB (VLVCY) showed an even more impressive jump than Ford.

The stock exploded higher by 63 points and now rates a Strong Bullish 82. Volvo has the additional benefit of being a supplier to European militaries at a time when they are undergoing their biggest rearmament since the Cold War. But Volvo’s core products are, of course, still passenger cars.

Here’s the full list of stocks that jumped by 20 or more points over the past month. You’ll notice it has a distinctly old-economy, industrial tilt this week.  It might seem a little counterintuitive that automakers are suddenly looking bullish. The auto sector was hit particularly hard by the steel tariffs earlier this year, and by most measures American consumers are looking tapped out.

But the bullish argument starts to make more sense when you do a deeper dive.

Ford rates exceptionally well on its value factor, with a score of 94. Volvo rates a 90 on its value factor. In a world in which investors have aggressively bid of the prices of growthy tech stocks (cough: the Nvidias of the world), old-school automakers have become legitimately cheap.

It’s still early, but what we may be seeing here is, of all things, the beginnings of a rotation from growth to value?!

We’ll see soon enough whether that’s a lasting trend. But keep in mind, it takes a lot of new buying pressure to keep the Big Tech mega-caps motoring even higher into the nosebleed valuation territories they’re already in. On the other hand, it takes a lot less to send the shares of an unloved and underowned value stock like Ford or Volvo sharply higher.

Plus, the feeling you get from netting a win on an unappreciated stock you found yourself is far more satisfying than being lumped in with the herd. So if you want to look up any of the stocks we covered today on my Green Zone Power Rating system, you can gain full access with a Green Zone Fortunes subscription.

Once you’re in, just look for this button on our www.MoneyandMarkets.com homepage:  Then, search up any of these tickers — or any other stocks you can think of (my system tracks thousands).

To good profits,

Adam O'Dell

Editor, What My System Says Today

| It's not semiconductors, AI chips or quantum computers. But none of those technologies can exist without it. On January 19th, 2026, Trump is expected to ban exports of something every tech company desperately needs—forcing them all to relocate to U.S. soil. See what he's about to ban here… | |

Post a Comment

Post a Comment