You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Don't Speak Ill of the Money Printer (It's Listening to Us...)An Response to Real Investment Advice on the Debasement Trade in the Post-COVID Financial WorldDear Fellow Traveler: This week, Real Investment Advice published a great article. It’s called… “Money Supply Growth: A Thesis With a Fatal Flaw.” Its author, Lance Roberts, aims to debunk warnings from Larry Fink and Jeffrey Gundlach about deficits and monetary expansion. In effect, he argues that the recent surge of gold, silver, and Bitcoin buying… what many call the ‘debasement trade’… cannot be explained simply as a function of ‘money printing,’ since (as he asserts) most money is created through lending, not “printing.” On Friday, inflation came in higher than the Fed’s target. And the central bank’s balance sheet remains highly expanded from its post-2008 and post-pandemic interventions. This debate about the debasement trade is very important to anyone trying to preserve their wealth in America (and… well… anywhere). This conversation goes beyond an academic argument. Instead, it shapes how investors should interpret global liquidity, inflation, and wealth preservation in an era of permanent intervention (as I call this in my Substack title, The Money Printer). The Real Investment Advice argument centers on three primary elements:

The analysis is sophisticated and is well argued. But I believe it contains fundamental misunderstandings about modern monetary mechanics in the post-2008 financial world. The dismissal of “money printing” concerns demands a direct response. It’s not because my publication is called “Me and the Money Printer…” It’s because the argument reveals how and why many people misunderstand the machinery sustaining the post-QE economy… and where dollar debasement lives. That three-part framework misses three critical mechanisms…

This isn’t an ideological argument. It’s mechanical. To be clear, I’m not disputing traditional accounting identities. GDP still measures flows, and deficits still create offsetting surpluses. But my argument is about transmission… how those flows move through collateral, leverage, and regulation to shape today’s liquidity cycle and affect the dollar. Let me break down both parts of this rebuttal. First: “Money Printing” SemanticsThe article writes:

Then the author adds,

This is… technically true. But I argue this is intellectually misleading. When I refer to “money printing,” I’m describing the Fed’s ability to create unlimited digital reserves to purchase government debt… and how Treasury operations affect leverage in the financial system (and equity markets). Yes, reserves themselves don’t force lending in the commercial banking space. However, they do change the price and availability of collateral, which drives leverage through the repo and shadow-funding markets. That’s where the inflation impulse begins. From mid-2020, the Fed averaged approximately $120 billion per month in outright Treasury and MBS purchases, creating new dollars by keystroke rather than recycling existing liquidity. As Ben Bernanke admitted on 60 Minutes in 2010: “We use the computer to mark up the size of the account.” When Scott Pelley seconds later asks whether the Fed was printing money, Bernanke acknowledged that the mechanism was akin to the practice. (I started the video at 8:17 when he says it.) Then, Minneapolis Fed President Neel Kashkari said it more loudly in 2020 at the height of the COVID shutdown. “There is an infinite amount of cash at the Federal Reserve. We will do whatever we need to do to make sure that there’s enough cash in the banking system,” he said, referring to their accounting practices. Of course, this is all semantics. My real focus is structural. Second: The Bank of England Framework Needs UpdatingThe author’s analysis leans on the Bank of England’s 2014 paper, “Money Creation in the Modern Economy.” This is a pre-COVID paper that argues that banks - not central banks - create most money through lending. That model made sense before 2008. Then, reserves were scarce, and deposits drove credit. But the transmission mechanism has evolved significantly over the past two decades. Yes, “loans create deposits.” However, in collateralized markets, the price and quantity of acceptable collateral determine whether loans are made. Central-bank balance sheets dictate that collateral base… governing credit elasticity. Thing is… most credit creation now happens through collateralized wholesale markets that dwarf traditional deposits. The U.S. repo market exceeds $5 trillion in daily volume. The constraint isn’t deposits anymore. Today, it’s collateral quality and abundance. The Bank for International Settlements’ 2025 Annual Report shows that non-bank financial intermediaries now create policy shocks across borders with effects “comparable to domestic transmission.” Plus, the BIS notes that repo haircuts have fallen to zero while leverage has risen, indicating that the system now runs on refinancing collateral rather than traditional deposits. As the BIS noted in its 2025 Annual Report, liquidity conditions in repo and FX-swap markets tighten or loosen almost one-for-one with G-10 central bank balance sheet changes. The practice of QE re-collateralizes the entire global system through FX swaps and repos, meaning central bank reserves indirectly fund shadow credit chains worldwide. The Real Investment Advice argument doesn’t address this financialization. It centers more on a 1950s branch-bank world where traditional deposits drive credit creation. In reality, most new credit creation flows through shadow banking channels that dwarf traditional deposits:

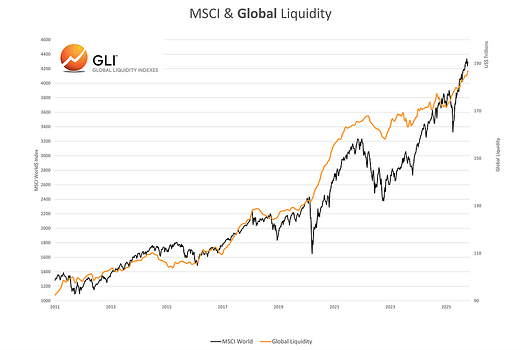

This shadow credit creation operates largely outside M2 measurements. [Note: Key liquidity engines like repo collateral turnover, rehypothecation chains, and synthetic dollar substitutes like FX swaps don’t appear in M2 or in traditional GDP-based velocity metrics. However, these mechanisms account for a massive amount of marginal leverage and liquidity transmission in modern financial markets.] All of it clearly drives asset prices, amplifies systemic risk, and fuels the debasement of fiat currencies. Institutional collateral-based money substitutes create debasement not by increasing the money supply in M2. Instead, it amplifies financial leverage, inflates asset prices, and undermines the purchasing power of money indirectly. That’s critical. Let’s take a look at global equity performance relative to global liquidity (shadow banking plus M2)... This is a chart from CrossBorder Capital. The Fed backstops the global liquidity network with a keystroke… as do other central banks (2011 ECB, 2015 PBOC, 2020 Everyone, 2022 BoE) When talking about the Fed’s role, we’re talking about repo facilities. We’re talking primary dealer operations. We’re talking commercial paper funding. We’re talking unlimited swap lines with foreign central banks. None of those transmissions appear in M2-GDP correlation charts. However, all of it determines financial conditions more than traditional bank lending. The Real Investment Advice piece also notes that M2 velocity collapsed after 2008 and again during the pandemic, which supports the narrative that it neutralized inflation fears. The author writes:

But I’ll still argue that traditional velocity collapsed because cash turned over inside financial markets, not Main Street. Shadow-velocity… meaning repo turnover… data from the OFR shows rising financial sector liquidity. I argue that asset prices absorbed the excess, while globalization and supply-chain slack kept CPI muted until 2021. The delayed emergence of consumer price inflation reflects the complex interaction between monetary transmission, global supply chains, and fiscal policy… This is a topic worthy of separate analysis. The Sectoral Balances Shell GameThe author argues that government deficits become private-sector surpluses. The article states:

This statement faces pressure once funding sources are examined. Yes, the accounting identity holds. When deficits expand, someone else’s balance sheet grows. The question is who captures the surplus, and whether that is irrelevant to macro outcomes. Simply put, distribution determines transmission. When the government deficit becomes a hedge fund’s Treasury arbitrage profit, that’s not the same as money reaching productive investment. In fact, I regularly argue that the incentives of financialization in America have distorted our economy. For example, (according to Bloomberg) we now have more ETFs than actual U.S. stocks for a reason… Meanwhile, how the deficit is financed matters:

The issue isn’t whether private credit disappears. What matters is that public-sector demand for capital reshapes the flow of risk. And this fiscal expansion fuels capital flows into speculative assets rather than productive investment. It has enabled financialization on a massive level. Meanwhile, the author points to the 33% household savings rate during 2020-2021 as proof that deficits enrich the private sector. I argue this wasn’t wealth. I contend this was trapped liquidity from transfer payments during lockdowns. When mobility returned, monetary expansion was a core factor among several that contributed to the 9.1% peak inflation in 2022. Fiscal stimulus amplified the monetary effects, but without the Fed’s balance-sheet expansion, those deficits wouldn’t have had such a dynamic impact on inflation. In nominal terms, interest outlays are now roughly equal to defense spending. “Private sector surplus” means little when it’s financed by the government paying interest to itself with newly issued debt. The Proximity ProblemThere’s one more important element that I think deserves consideration: Monetary proximity matters. When the Fed creates money, it first flows to primary dealers, banks that receive reserves, government contractors, and asset markets where liquidity concentrates. By the time it reaches wages and consumer prices, the wealth transfer is complete. That’s the modern Cantillon Effect. And that’s the true driver of inequality in a fiat regime. Multiple Fed and ECB distributional studies show asset-price inflation from QE disproportionately benefited the top wealth deciles. This modern Cantillon dynamic is data, not theory. Monetary policy isn’t neutral bookkeeping; it’s engineered redistribution from savers to leveraged asset holders. That framework should have predicted sustained inflation from 2010-2020, but we did not get it… Instead, we saw it arrive in asset prices and valuations. Real estate, equities, and bond prices all inflated dramatically while wages stagnated. The system worked exactly as the proximity model predicts… Liquidity was concentrated where it was created, helping drive wealth inequality to levels not seen since the 1920s. Mandated Dollar StrengthIn addition, the piece treats Treasury demand as proof of confidence, but this demand reflects structurally enforced requirements. The author writes:

Yes, the dollar is still dominant. But let’s focus on a few things about the dollar’s role and the way the system works:

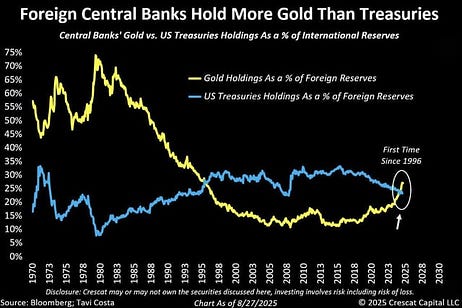

A huge boost in Treasury bill issuance has accelerated in the wake of the 2017 Tax Cuts and Jobs Act and has become a go-to strategy of the Treasury Department to support the financial system (and prevent a recession in 2023). This strategy represents what CrossBorder Capital’s Michael Howell calls ‘Treasury QE.’ This is a more subtle (or “stealth,” as Howell states) form of monetary expansion that fuels debasement. By flooding markets with short-duration bills rather than longer-term bonds, the Treasury creates artificial liquidity without officially expanding the Fed's balance sheet. Banks, money market funds, and stablecoin issuers absorb Treasury bills as required collateral, effectively monetizing government spending through regulation rather than explicit Fed purchases. The dollar’s strength is a product of mandatory demand pipelines, not spontaneous global trust. In the global hierarchy of money, the dollar is the funding currency. We can’t mistake reserve status for “sound” money, however. Today, Treasuries are the preferred form of liquidity (and short-term bills are collateral of choice in repo markets). But that doesn’t make it a vote of confidence. The thesis treats dollar strength as proof that the system works, but institutional demand pipelines create artificial scarcity. Oddly enough, the dollar can appreciate even as its real value declines due to a combination of monetary inflation and fiscal dilution. As CrossBorder Capital’s Michael Howell often argues, liquidity injections can paradoxically strengthen the dollar in the short term while debasing its long-term value. This is what some call a paradox of debasement that defines the modern system. Nominal currency strength masks real erosion. The cleanest shirt in the laundry (the dollar) is still eroding in value as global debt expands. Please note that government inflation figures may not adequately reflect the decline in purchasing power (the dollar has lost about 55% of its purchasing power officially since the 1990s, according to CPI analysis). Though not widely accepted, alternative measures like the Chapwood Index attempt to reflect urban inflation rates that many argue are underreported by CPI. [Chapwood’s analysis suggests significant purchasing power erosion even before the post-COVID inflation surge.] Meanwhile, I argue that the dollar dominance persists due to network effects and a lack of alternatives. When that support structure shifts, as it’s already beginning with stablecoin flows and BRICS payment rails, the adjustment could be rapid. I’m not saying it’s going to happen tomorrow, but the seeds are clearly planted, and the U.S. government’s weaponization of the dollar (especially post Russia-Ukraine) is accelerating the movement. When nations realize that Washington can shut off their reserves, they seek alternatives fast. As a percentage of international reserves, central banks now own more gold than they do dollar reserves… something that accelerated in the last two years and hadn’t been the case since the mid-1990s. The question is whether the global uptick in gold demand was coincidental or causal, occurring after the U.S. froze Russian reserves in 2022... Gold’s inverse correlation with the dollar remains intact precisely because both reflect the same variable: global liquidity preference. In ConclusionI believe the Real Investment Advice analysis confuses institutional momentum with natural market forces. This framework predicts stability that rests on politicized institutions and serial wealth transfers from those farthest from the money printer to those closest to it. The real risk isn’t the immediate collapse of the dollar (as the fear mongers might suggest), but the gradual erosion of trust over years or decades, which accounting identities alone cannot model. Trust erosion shows up first in shorter-duration Treasury demand, rising term premiums, and growing stablecoin substitution. These early signs are already visible. Meanwhile, the financial system has shifted rapidly over the last 17 years, and the Bank of England’s academic study on the origins of capital is outdated. Understanding the shift of liquidity plumbing isn’t academic; it’s survival. When the next tightening cycle exposes leverage in the shadows, those who mapped the pipes won’t be underwater. Whether you call it ‘printing,’ ‘quantitative easing,’ or ‘endogenous money,’ the effect is the same. We have active debasement through systematic wealth redistribution based on proximity to the source of monetary creation. This debasement is real, measurable, and ongoing. It’s just operating through collateral markets and regulatory capture rather than traditional currency collapse. Debasement is hard to see on the surface, but evident when you start digging… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment