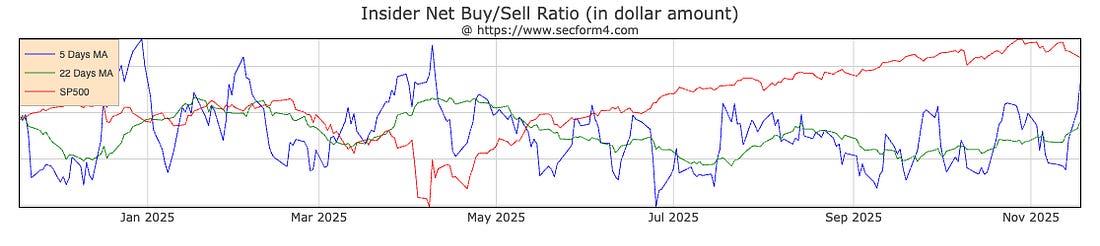

Good evening: Last week, our signal went negative yet again, but the Russell 2000 signal has been red since late October. The result has been a lower burn for the iShares Russell 2000 ETF (IWM), with some small rebounds along the way. The trend… lower highs and lower lows… after it went negative… So where are we now? That’s what we talk about each morning at Capital Wave Report, part of the subscription here at Me and the Money Printer. Every morning, investors get a write-up on momentum, liquidity, and insider buying before the bell (at 8 am ET). In addition, they get updates like this today… Have a look at where we sit - as we are really overstretched at the moment… heading into NVIDIA earnings. As we said this morning, we reached this manic level of Fear in the market. We have a deeply unsettled Negative 65 on our intraday readings with just one “Breakout” name: Ablemarle (ALB). With just that one name, I start to get a little contrarian about the lack of buying on the possibility of a short squeeze and a market looking for some level of bidding. The market status is not buying… but a cooloff in selling pressure. Right now… the FNGD is above its 50-day moving average - fueled largely by selling pressure on Amazon.com (AMZN) today… The bearish headlines have come hard for AMZN - and I think we’re getting to a situation where everyone now, everywhere ever… is now an expert on valuations in the AI Trade… That said… the AI trade isn’t about fundamentals… It’s about flows… as I noted this morning… Someone said I went open kimono on this article… Yeah… that’s the point of this letter. Traditional fundamentals flew away a decade ago… We’ll see if it holds or gives back today… At the same time… bigger news… Look to the right… the insider buying-to-selling ratio is starting to pick up again. I have to get in and actually measure the flows… because the buying doesn’t seem to be overly strong… and also pretty concentrated and may be linked to a single day. This trend must continue to warrant consideration, but it’s certainly welcome news. That said… NVIDIA is basically going to dictate what comes next for the S&P 500… But it’s interesting to see us at this junction. We’re starting to get into a prime squeeze environment… and we’ve seen advancing volumes on the Russell 2000 lead today… Policy will start to accommodate soon… even if they don’t call it QE… and central banks around the globe will be busy as well… I’ll circle back… but we’re still deep in the red and seeing the weakest math that we’ve witnessed in at least six months… If you want some help navigating this market - and helping to identify when capital flows start returning to the equity markets… that’s what we do. We’ll be very busy… So, join now at this very special discount… 50% off, every year… for as long as you wish to be a member… Again, that’s a market update every morning… access to our full archive… new insights on momentum and the Stocks to Own when breakouts return to the market… and much more… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment