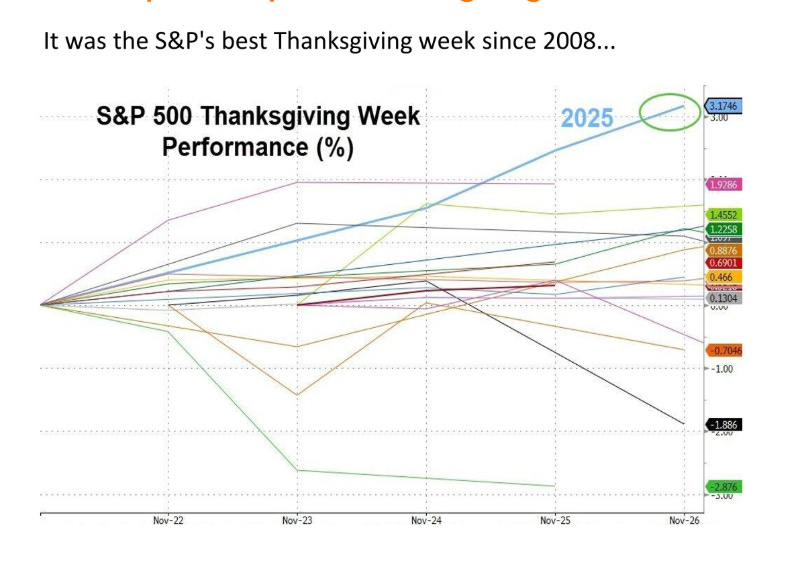

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Small Changes... And the Week in ReviewMichael Burry's arrival on Substack is a game changer... but he's not the only one making some changes.Just a reminder that AI content maker Grok is completely insane… This was made from a single picture of the Wu-Tang Clan… I added Frankie Pivot and General Tso Paws… Dear Fellow Traveler: I will be back tomorrow with a Chart Party… But I wanted to start with a very blunt statement. Every week, I read a large number of market recaps… This from Syz Group really stood out. In their weekly recap, they noted that we just saw the best Thanksgiving Week performance since 2008… Now… What did those periods have in common? Markets rally on major liquidity events. In 2008, the week of Thanksgiving saw huge stimulus. First, the U.S. rescued Citigroup with a $20 billion capital injection and guarantees (on the Sunday before Thanksgiving) on more than $300 billion of assets, then launched TALF the next day to restart consumer and business lending. What happened last Friday? Japan announced massive stimulus all while the U.S. Federal Reserve is still providing ample support to the global repo markets - and ending its QT schedule in a few days. Policy matters… It’s why we said to expect a squeeze last Sunday night… Now Onto Pressing IssuesAn interesting thing happened this week that shakes up Substack's future. Famed hedge fund manager Michael Burry started Cassandra Unchained this week… and moved into the Top 5 immediately… That’s a phenomenon that I haven’t witnessed. But it’s a good thing since it draws attention to the platform and the future of independent publishing. Burry deserves that rise, and many people are interested. One of the things that Tim Melvin and I discussed during the Thanksgiving trip was the sustainability of Burry’s audience. The famous fund manager isn’t a trader… He’s a long-term buy-and-hold investor. And as Tim noted, Burry’s not going to be issuing TikTok or Reddit updates to his long-term positions on Lululemon (LULU). So, it will be interesting to see if Burry can hold their attention. And if so, that’d be great, because it would get more people focused on fundamentals rather than chasing the next unprofitable momentum stock mentioned on Twitter… Meanwhile, Burry might have learned one of the more interesting things about Substack… Notifications… He opened up a chat the other day for his members - and it quickly turned into the Wild West of commentary. I had that for a little while, but there’d be a notification noise every few minutes… With Burry… it has to be seconds… So, hopefully, he found the “mute” button. He likely won’t shut it down, but it’ll make answering questions a lot harder. It’ll be great to see how it all goes… as I’m one of those people patient enough to wait on turnarounds on names like Molina Healthcare (MOH) and LULU… I encourage everyone to learn about high-quality stocks and deep value. Tim Melvin talks about it a lot. Check out Tim’s recent interview with Tobias Carlisle. And Now, Ladies and Gentlemen…I’m making a small shift in my research… By adding more of it… Some people tell me to write less… No. I could be on television all day reporting the news… or I could be doing what I want to do - which is focus different media outlets on different and EQUALLY important things… I do not wish to conflate or confuse messaging… So… we welcome back Postcards after a year’s absence… What separates Postcards from Me and the Money Printer? That’s simple… Money Printer explains the global financial system… how it moves, how its structured… how to trade it, and how to thrive financially in it. Postcards explain the world the system creates… and how to live in it (survive and thrive) while still building and protecting wealth... Money Printer is the mechanics. Postcards are the consequences. Money Printer is in the middle of the market madness… on the trading floor… Postcards are the flag in a corner of the intellectual wilderness… There’s a lot more to life than stocks, bonds… and crypto. You have to live in this world… prepare and move accordingly. A Critical QuestionA reader asked me if I’m breaking up this Money Printer… Substack… No. I am not. I’m just adding a different compartment to approach the markets… and in the way that I approach and write stories. Money Printer and The Capital Wave Report will remain the exact same thing that they have been since their launch. Money Printer will run all week, and Capital Wave will still arrive in the mornings, focusing on Momentum, Liquidity, and Insider Buying… Plus, the daily signals help investors improve their risk management. It is a Macro Letter that will focus its research on Quality and Momentum. Postcards will focus on the Extraction model, emphasize wealth protection, and will occasionally drift into conversations on financial legacy and purpose. It will build a portfolio that centers on long-term wealth protection and defense against inflation and extraction. Think of the toll roads and the alternative investments that are necessary in this incredibly difficult economic system. It’s a letter that has a different purpose… Postcards will run on Saturdays and eventually arrive on Wednesdays as we continue our conversations about historical financial systems. At its peak, it will be three times per week… One free letter a week, and two paid. I’m setting the bar right there. Plus a sovereign portfolio that will be developed for subscribers. That will center its positions on long-term income and appreciation and on steps you can take to take your agency back against a system that extracts… We will be adding new model portfolios for Capital Wave in 2026 that center on Quality, Momentum, and Passive Investment Flows... I hope that you find a strategy and approach that works best for you… Now… let’s get to the week in review… Monday, November 23 Credit Card Theater on the Potomac...For a solid 20 years, Sen. Dick Durbin has been pressing for changes to credit card reform… And as we find out… It’s all been a solid little game for everyone involved… This is a pure preview of Postcards from the Edge of the World. Have a look… Tuesday, November 24 Momentum - Yellow (Be Cautious)We turned back to positive momentum late in the day on Tuesday, just two days after we predicted the squeeze… This is one of the benefits of the Capital Wave Report… I’m just saying… we’ve been very good at this… but the storm isn’t over. Wednesday, November 25 Oh... So That’s Where My Tax Money Went... (And Other Things I Think)My wife thought that if you just drove really fast in D.C., the cars would get out of the way… That’s not how it works… But I had a lot of thoughts on the drive to North Carolina… And a lot of things to clear out of my mind as we turn home this weekend. What’s the biggest takeaway from the trip? Thursday, November 26 What I’m Thankful ForWe’re moving on… and that’s a good thing. We continue to build one of the more interesting and fun little financial corners on Substack. So, I must thank you… We’re just getting started… Here’s what else I’m thankful for on Thanksgiving… Friday, November 27 CME Blackout - How the Game Actually WorksWe had a short blackout in the markets in Chicago on Friday. Did you notice? No? Well… that’s good… here’s what you’ll need to know next time… All right… That’s the conversation for today… Remember… Postcards relaunched this morning… And the Insider Buying Report is here for you if you missed Friday’s trade… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment