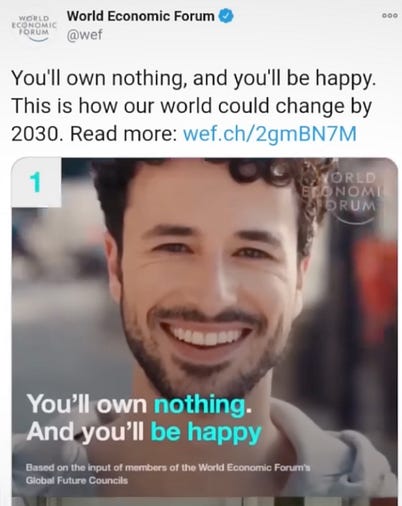

Dear Fellow Traveler: This is always a wonderful week… watching my daughter's anxiety and anticipation of Christmas… having everyone running around the house while I’m writing… the dogs barking with every delivery at the door… I wanted to take a few minutes today - on a non-weekend - to update you on a few things about Postcards and our current positions. Moving forward, we’ll add an occasional, small update on Wednesdays - an article that turns our focus back to historical events… looks toward the future event… and centers our attention on the real story behind our financial world… On HistoryI’ve outlined several historical extraction parallels to where we sit today. We went back to Judea and the story of Jesus of Nazareth and the money changers… Then learned about the Gracchi Brothers… and the Fall of Julius Caesar. During these times of deep uncertainty… the wealthiest class always invested and diversified into similar things. They battled inflation, uncertainty, and extraction from the state and the financial systems of the time. That is what we’re attempting to do here from the Edge of the World… So, let’s talk a little about how that’s going… and what comes next… On Silver… Gold… and LiquidityAs I commonly say at Me and the Money Printer, all roads point to more monetary inflation and fiscal repression. That is bullish for gold and silver over the long term. Two weeks ago, when I outlined how the system works and our continued bullish case for these metals, I chose a very specific closed-end fund (CEF) that taps into gold and silver. I don’t want any reader exposed to paper markets… where six or seven contracts have a claim on physical gold and silver. Instead, the fund I choose cuts out the brokers and lays a one-to-one claim on gold and silver held in Canadian-state-backed vaults by one of the world’s best minds in the industry. As gold and silver appreciate, so do your claims. Now… why that fund and not a pure silver or pure gold fund? Because I believe that you want exposure to both, and we’re going to see expansion in gold and silver prices in the future. I was never a gold or silver bug. I bought Silver in 2009 in physical form for the first time, watched it spike to nearly $50 by 2011, and then roll back down. I never let it go. It wasn’t until early 2024 that we could see what was coming on the horizon. The markets received a significant boost in liquidity in 2023, and stock valuations expanded rapidly. But monetary debasement was evident in the financial chain. We saw an explosion of repo activity driven by cheap, short-duration Treasury bills. And as that rotation into bills picked up, gold and silver started to really take off… Earlier this year, the gold-to-silver price ratio hit 100-to-1. Historically, it’s been about 60-to-1, so we got more bullish on the latter. In the last few weeks, silver has rallied back to that level. But here’s where it gets interesting. Eric Sprott at Sprott Management is a voice I fully trust in the gold and silver space. He’s been aggressively buying Hycroft Mining Holding Corporation (HYMC), a stock we’ve been trading and talking about at Insider Buying Report for months… Sprott thinks the gold-to-silver ratio could fall to 15-to-1 or even 8-to-1 to reflect global mining ratios better. Now, yes, that would mean silver would have to push north of $300 to $400… and that would have a serious impact on manufacturing… BUT… a few things… First… gold prices are likely going to keep rising. The two most important central banks in the “West” - the Federal Reserve and the Bank of Japan - have signaled continued stimulus and support. Second, the Bank of China is also poised to provide more capital support in the year ahead… It’s inevitable as China continues to face debt and deflation challenges… But - third… we are entering the third leg of the liquidity cycle right now. Historically, that is where SPECULATION takes over as we see more capital than ever sloshing around. And it chases… historically… commodities. A perfect comparison would be back in 2007… Recall gold and oil both shot to record highs before we went in the wrong direction… Yes, gold prices did pull back in 2008 and 2009, but they recharged again on the back of even more capital support from the Fed with the start of QE. Our Closed-End Fund in gold and silver is a pure way to capture upside, doesn’t expose you to any nonsense around futures markets, and doesn’t require you to have physical gold in your house or safe. It’s up about 8% since our Dec. 13 write-up. I think it can go a lot further… a lot faster in the months ahead. What’s Next?So, we’ve covered the trade around higher electricity costs (a form of extraction that makes the average American pay for Meta and Amazon’s data centers)… We’ve focused on gold and silver with our latest Closed-End Fund… And we just tapped into the toll booths and chokepoints in American society. As I’ve noted… this isn’t necessarily about “getting rich.” It’s about playing defense… positioning against inflation, extraction, and the ongoing forces that are creating a permanent wealth class that owns the physical infrastructure of our lives… and everyone else who will have to rent in the decades ahead. They said… “You will own nothing and be happy” at the World Economic Forum… Then they scrubbed it from existence… But it still feels like the plan based on the monetary policy that continues to extract from the middle class, ends up in the hands of those who benefit from the Cantillon Effect… And what is a major deterrent to owning anything? The rising cost of insurance. That will be the conversation on Saturday. If you don’t own my top insurance pick, that will continue to benefit from insuring the rising costs of things that matter… You’re leaving money on the table… and playing the victim in this monetary narrative. You have a choice… be the victim of this financial system’s extractive model… or educate yourself on how to “opt out” and own the choke points… You can join us right here… at Postcards from the Edge of the World. I’ll make the 65% offer available one more time before Christmas… Next week.. The New Year’s Offer will only be 50% off… I’ll chat with you on Saturday. Stay positive, Garrett Baldwin Invite your friends and earn rewardsIf you enjoy Postcards From the Edge of the World, share it with your friends and earn rewards when they subscribe. |

Home

› Uncategorized

Post a Comment

Post a Comment