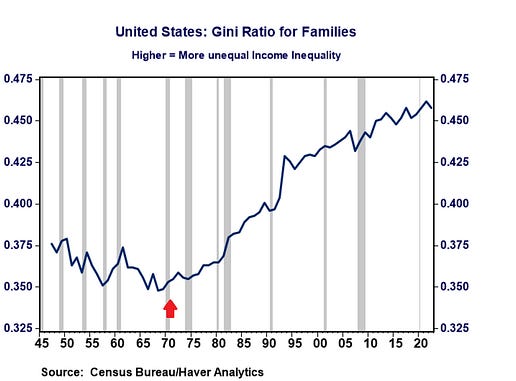

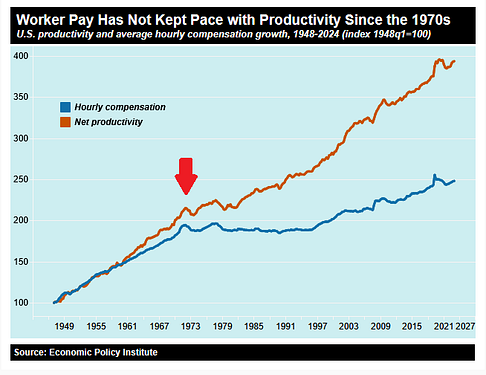

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: I wasn’t going to write a second article after my lengthy Postcards today… My back’s still jacked up, and now I have this sore throat… But… Damn. The New York Times - that lecturing screed - ran a piece today about young Americans who “make good money” but still feel like life is unaffordable. The headline is careful and almost apologetic. Do you see that subhead… The economists “explain” (cough… lecture) that Gen Z is doing better than their parents… These aren’t poor people, we’re told. They have degrees. They’ve got jobs. These are six-figure household incomes in some cases. And yet something isn’t working. Economists rushed in to explain why this feeling is wrong… for some reason. For all the lectures we get about empathy in society… these people suck at it. By the official measures, they’ll say, the typical middle-class family today is richer than one in the 1960s. Look at the stuff they have… the economist explains… Look at the conveniences…. the writer nods… Look at the consumption… the politician mumbles… To them, that’s the end of the debate. Except it isn’t. We’re only in the opening round, baby… Because if the New York Times did even a little bit of research, they’d find that this issue has little to do with consumption. That headline has everything to do with access to capital. All About The NarrativeThe Times frames this income debate as “feelings versus facts.” Young adults feel strapped, but someone’s economic data says they aren’t. Economists point to smartphones, streaming subscriptions, and cheap flights. They wave around consumption figures and inflation adjustments. The message is clear: “Hey, kid. You’re richer than your parents. Stop complaining.” President Trump even chimes in to call affordability concerns “a hoax” and tells people they don’t need “37 dolls” for their daughters. The Times actually includes the quote in this article... Which blows my mind. This author doesn’t even challenge that line, despite all the criticism they give to Trump. Since he agrees, the writer moves on… Interesting... The RealityI’ll argue that these economists do what they usually do. They’re conducting the wrong analysis and measuring the wrong thing. You see… they see things through consumption results and big economic figures like GDP. They’re heavily focused on what you can buy in America. What aren’t they ever measuring? The most important measurement of what America USED to be… That measure is what you can build.  That’s where all of their Ivy League math breaks down... because the money printer and the never-ending commitment to loose fiscal policies changed everything. Between 2008 and 2022, the Federal Reserve balance sheet went from $900 billion to $9 trillion. That liquidity didn’t flow into wages. It flowed into assets. It all poured into home prices, equities, and private credit. It was a massive wave… all while this nation has endured countless psychological blows from financial damage, leaving people scared to hold onto these assets for long because they don’t understand how the Fed and the Treasury Department work. I’m 44. Over half my life has been constant economic panic. I had LTCM, and the Dot-Com Bubble came first. Then 9/11, the GFC, the European crisis, the China Crash, the 2018 spasm, the 2019 Repo crisis, the 2020 Covid crash, the 2022 GILT Crisis, the SVB Crisis of 2023, the Nikkei Crash of 2024… and the Trade Crash of 2025 - plus all this recent nonsense involving Japan and the Repo Markets. I have multiple degrees in policy, economics, and financial stuff… I self-taught for over 15 years how the Fed constantly supports equity markets, and that the money printer will still run, and I’m still on edge… and don’t trust much. What do you think the average person in Tucson or Toledo thinks when the market drops 20% in a month, and they are just trying to make sure they have cash to make the next mortgage? They’ll sell to preserve assets… because that’s human behavior. All the while, who benefits from all the cheap money and nonstop commitment to money printing (in the traditional QE and non-traditional leverage expansion) environment? From QE 1, 2, 3, 4, Infinity? It’s always the institutions that get access to new and cheap money first. What’s the result of all this been? Asset prices rose faster than incomes for 15 straight years. The median home price in 1990 was 3.5x median household income. Today it’s over 7x. In 1991, the typical first-time home buyer was 28. This year, according to the Times’ own data, it’s 40. That’s not lifestyle inflation. That’s the Cantillon Effect playing out in real time. The people closest to the money creation... the banks, the funds, the asset holders... captured the upside. Everyone else got the tab. It’s all right here if you want to challenge that. What the Times Won’t SayWant to know my real problem with the New York Times editorial staff? Why, as a financial journalist, am I really pissed about this type of stuff? No NYT editor read that article before it was released and asked… Why doesn’t the word “Federal Reserve” come up just once in this article? That’s pretty basic. But you know what else doesn’t appear in this article? “Quantitative easing,” “monetary policy,” or “asset inflation.” The Times gives you a 1,800-word piece with pictures of sad families and dogs about why young Americans can’t afford to build wealth... and never once mentions the institution most responsible for the asset boom that priced them out. How bad is our mainstream media at finance and economics? Seriously… It’s the same story over and over… None of these authors seems to understand monetary or fiscal policy, so they go on LinkedIn to find whatever economist is eager to talk about their latest book… Or worse… we get an economist explaining that poverty lines are “relative” and somehow a reference to Adam Smith’s linen shirts. We get a woman in Salt Lake City looking at her neighbor’s house, wondering how six kids were raised there in the 1970s. The implication? Maybe it’s a parenting philosophy problem. Maybe moms need to let their kids “run around the neighborhood” again, but they can’t because someone might report them (that’s how the article ends?). The structural explanation for all this... that her neighbor bought that house before the Fed turned residential real estate into a financial asset... never arrives. This is how the Times covers economic extraction. They acknowledge the symptoms, interview the victims, quote the experts who dismiss them, and they never bother to name the mechanism driving it all... An editor should have sent this article back for further investigation… The Front-Loaded EconomyHere’s what these economists won’t tell you. The economy didn’t get more expensive. It got front-loaded. Previous generations paid the high costs after they crossed the bridge. You worked, you saved. Then you bought a home, raised kids, and retired with a pension. The risk was spread out, and America’s economic system absorbed mistakes. Today, the costs come before you’re allowed to participate. Now, you have to prepay for education with decades of future labor. You have to carry student debt into your peak earning years. You have to qualify for housing that trades like a financial asset. You have to absorb childcare costs that rival rent. Then you have to finance retirement through markets you don’t control. This post-2008 financial system demands collateral before it delivers stability. And if you didn’t inherit assets or buy before the printer went full throttle... You’re stuck paying the toll for someone else’s bridge. “You’re Richer Than Your Parents” Is a Con StatementThe Times leans hard on this argument. I’m disappointed that these editors can’t do the math and understand how the system really works today. Yes, we know. People today have things their grandparents never dreamed of. We have phones, flights, streaming, and convenience. But it’s completely irrelevant at the end of the day. Here are the simple reasons why… A smartphone doesn’t lower a down payment. A flight to Miami doesn’t replace a pension. Takeout food doesn’t compound. Consumer goods became cheaper due to globalization and technological advances. Capital goods (the things that matter) got more expensive due to monetary policy. One trend makes the CPI look tame. Technology (e-commerce and the internet) is deflationary. China’s inclusion in the WTO was deflationary. The fall of the Berlin Wall was deflationary. Inflation targeting by the Fed, followed by QE, bank lending programs, and other factors that drove up real asset prices, has locked out a generation from wealth creation. Guess which one the economists want to talk about. It makes Keynesian economics look like what it really is… the policy framework that creates horrible incentives for a pure extraction vehicle. The Times quotes one frustrated young woman:

Then adds: “Boomers made out like bandits.” She doesn’t speak for a generation… but I get it. And she’s heading in the right direction for reasons the Times implies. Boomers didn’t “make out” because they worked harder or saved better. They made out because they bought assets before the Fed spent 15 years inflating them. The woman knows something is broken… But the Times won’t tell her what… Again… the culprits never get questioned… because monetary policy is hard and intentionally confusing. The Rational ResponseThe Times also interviews a 25-year-old engineer who says:

The economists call this statement “behavioral.” But it’s really a discounted cash flow calculation… If home prices rise 8% a year and your savings grow at 4%, waiting makes you poorer. The math doesn’t reward patience.… it just punishes it. So people adapt… They decide they’d rather spend their money on experiences. They’ll speculate on crypto, delay child-rearing, delay ownership, and delay belief. And all the while, the New York Times will write some insane piece about why the birthrate is collapsing without ever looking into the impact of monetary policy on those decisions… Did you know that the U.S. birthrate has been in steady decline since 1970… That’s the year before the nation went off the gold standard? I bet you didn’t, because the New York Times would try to argue that this is a coincidence, not causation… But it’s all in the Federal Reserve data. In fact, a lot of weird societal shifts happened after 1970… things that explain many of the challenges we face today. God forbid they do some journalism and look at the problems with our money and how that creates incentives and disincentives in people’s decisions. What’s even more entertaining out of this laugher… The Times even cites a University of Chicago study confirming that young Americans without a realistic path to homeownership disproportionately spend on leisure or take financial risks. The researchers frame it as irrational behavior. It’s not. It’s the rational response to a system that eliminated the returns on patience. The Question No One Will AskI’ve listened to a lot of people under 40. Yes, there are some lazy people… But those are largely anomalies… and it’s true across all generations. The generalization is just insane to me… and it shows how little the press and the average politician actually understand about monetary policy… I don’t believe this is a generation asking for more. I think it’s a generation noticing that the rules changed mid-game… and a society that doesn’t seem to understand how much things changed after 2008. The bridge didn’t move. The toll did. The money printer still runs, and the economy still works. It just works best for those who crossed that bridge earlier and had assets... Everyone else is left calculating whether standing still is worth the price. Meanwhile, The Times keeps circling a moral question… Do people with good incomes deserve to feel squeezed? That’s the wrong question. The real question is this… Why does doing everything right no longer guarantee entry into a stable life? Answer that honestly, and you have to talk about the system's truths. We’ve had over 30 years of easy money… We’ve had asset inflation as policy. We have a small group of people who captured the upside. We have a large generation now stuck with the toll. But that conversation doesn’t fit neatly on the lifestyle page. So instead, we get “feelings versus facts.” We get economists explaining that people are richer than they realize. We get a president calling it a hoax. We get a newspaper of record that will cover every symptom of extraction... without ever naming the extractor. And then… New York City ends up with a socialist running the show, and the journalists spend the next four years trying to figure out why… This nation is in trouble… Stay Positive, Garrett About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment