Financials Ripe for the Picking in 2026 Dear Reader,

Don’t fight the Fed.

That’s one of those cardinal rules of investing that you break at your peril.

Over the long term, earnings are the primary drivers of market appreciation. Growing companies expanding their sales and profits rise in value over time.

But in the short term, market movements are determined entirely by liquidity and money flows. When the Fed is cutting rates or aggressively expanding its balance sheet, it’s feeding liquidity into the market. When the Fed is raising rates or shrinking its balance sheet, it is sucking liquidity out of the market.

Interest rates were one of the biggest topics of 2025. President Trump demanded lower rates, and he largely got what he wanted. Trump has also hinted that he would be naming Chairman Jerome Powell’s replacement as early as January. That should give us a clearer idea of where rates go from here. Expect the answer to be “lower,” as Trump has already floated a 1% target.

So, with all the handwringing over interest rates, let’s revisit financials. No other sector is affected quite as directly by the Fed’s rate decisions.

Let’s jump in. | You don’t need millions. You don’t need insider access.

Just follow 3 simple steps and you could own a stake in one of the most disruptive companies in history — before the IPO.

Click here to see the steps + ticker. | It Pays to be Selective My system makes one thing immediately clear: It pays to be selective here.

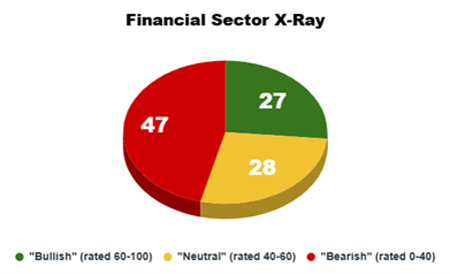

Of the 102 stocks in the financial sector, 47 rate as “Bearish” on my Green Zone Power Ratings system and another 28 rate as “Neutral.” Only 27 rate as “Bullish,” meaning they have a score of 60 or higher.  Let’s dig deeper into the ratings system to see where financial stocks are generally gaining and losing points.

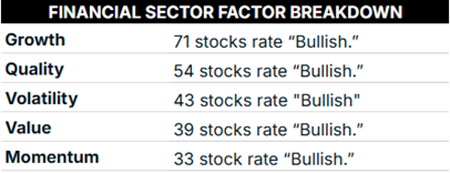

We might not normally think of financials as a “growth” sector, particularly given that banking as an institution hasn’t really changed all that much since the 1500s. Yet fully 71 of the 102 stocks in the sector rate as “Bullish” on growth, meaning they have a score of 60 or higher on their growth factor.

A little over half also rate as “Bullish” on quality. Meanwhile, fewer financials rate as “Bullish” on value and momentum, at 39 and 33.  One of the themes I’ve observed over the past few months is a subtle shift toward value. It’s too early to say that the raging bull market in growth stocks – and particularly tech stocks -- is over. There may still be some gas left in the tank.

But investors are at least starting to look beyond tech and the Mag 7 that have so utterly dominated the market conversation of the past several years. In short, my system is telling me that value stocks are at least relevant again.

It may seem like an eternity ago, but you should recall … there have been times when value beats the pants off growth. That was certainly the case coming out of the 2000 tech bust. Between April 2000 and October 2027, the iShares S&P 500 Value ETF returned 37%. The iShares S&P 500 Growth ETF (IVW) actually lost nearly 20% over the same period.

There’s no guarantee that value takes a definitive lead in 2026. Growth might stubbornly reassert its leadership.

But with the Green Zone Power Rating system, it’s not an “either/or” choice … you can position yourself to get the best of both worlds. With that in mind, I ran a screen for “Strong Bullish” financial stocks that also rate as “Bullish” on both value and growth. Growth at a Reasonable Price It’s telling what the list includes… and doesn’t include.

Noticeably absent are the big Wall Street banks like JPMorgan (JPM), Citigroup (C) or Bank of America (BAC). Instead, it is a list almost entirely full of … insurance groups.  Students of the market know that insurance is Warren Buffett’s favorite industry and has been for decades. Buffett largely built his fortune by investing the excess float of Berkshire Hathaway’s (BRK-B) various insurance holdings.

Berkshire made the cut in my screen, by the way, with growth and value ratings of 79 and 64, and an overall “Strong Bullish” rating of 80.

A well-run insurance company will never fail. Lloyds of London has literally been underwriting for centuries. By pooling risk – and by unloading it in some cases to reinsurance companies – insurance companies ensure that a single catastrophe like an earthquake or even a pandemic doesn’t wipe them out. And the excess funds that they don’t need to pay current claims can be invested. It’s a conservative business model and yet also a license to mint money!

If you’re looking for a list of stocks you can buy, drop in a drawer and forget about for years or even decades, the list above is a good place to start your research.

And I don’t mean to imply it’ll take “forever” to earn a handsome return in these stocks. Consider that Hartford Insurance Group (HIG) and Globe Life (GL) are up 28% year-to-date … better than the returns of five of the so-called “Magnificent 7” Big Tech stocks.

See … it is possible to beat the biggest and hottest stocks of the day.

In fact, my Infinite Momentum readers know just how to do it. We did it in 2025 … and on January 6, I’ll be holding a small live event to offer up the same “blueprint” for beating the market (and the Mag 7) in 2026.

More on that soon.

To good profits,

Adam O'Dell

Editor, What My System Says Today

| Apple just fired a shot at a $9 trillion sector — not with a new iPhone, but with its most disruptive project since the smartphone. One tiny supplier — still trading near $30 — sits quietly at the center of this bold move. Full details here. | |

Post a Comment

Post a Comment