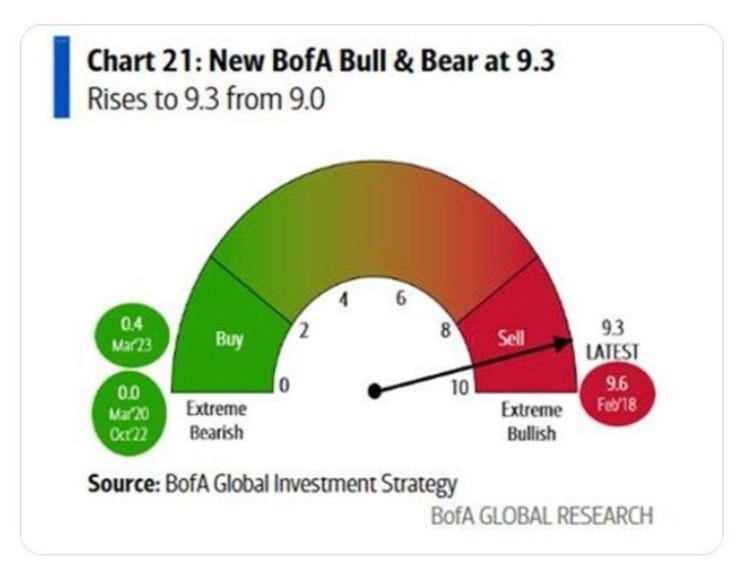

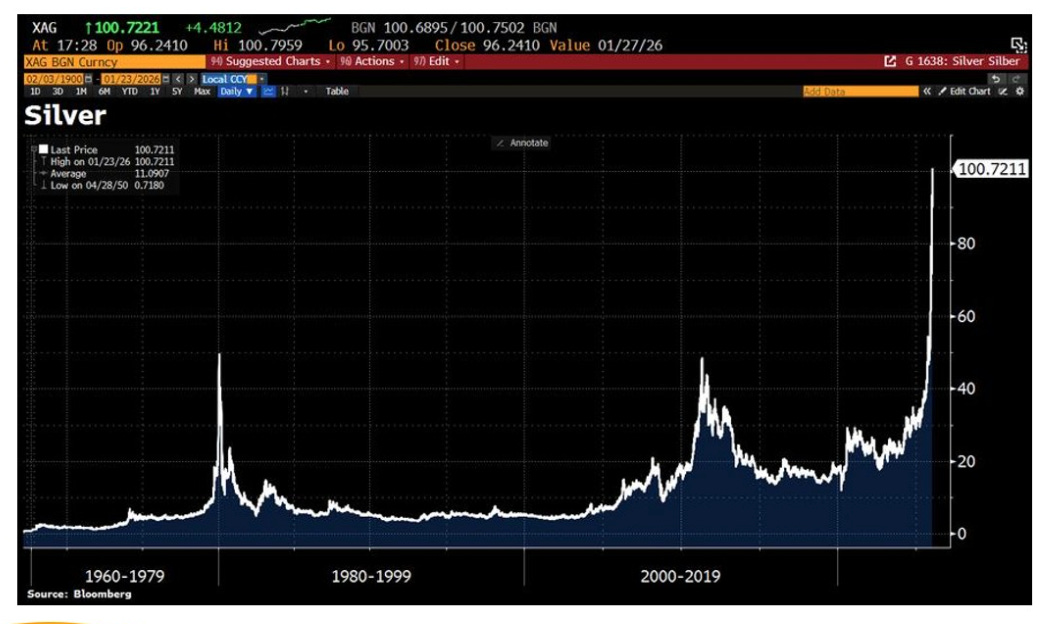

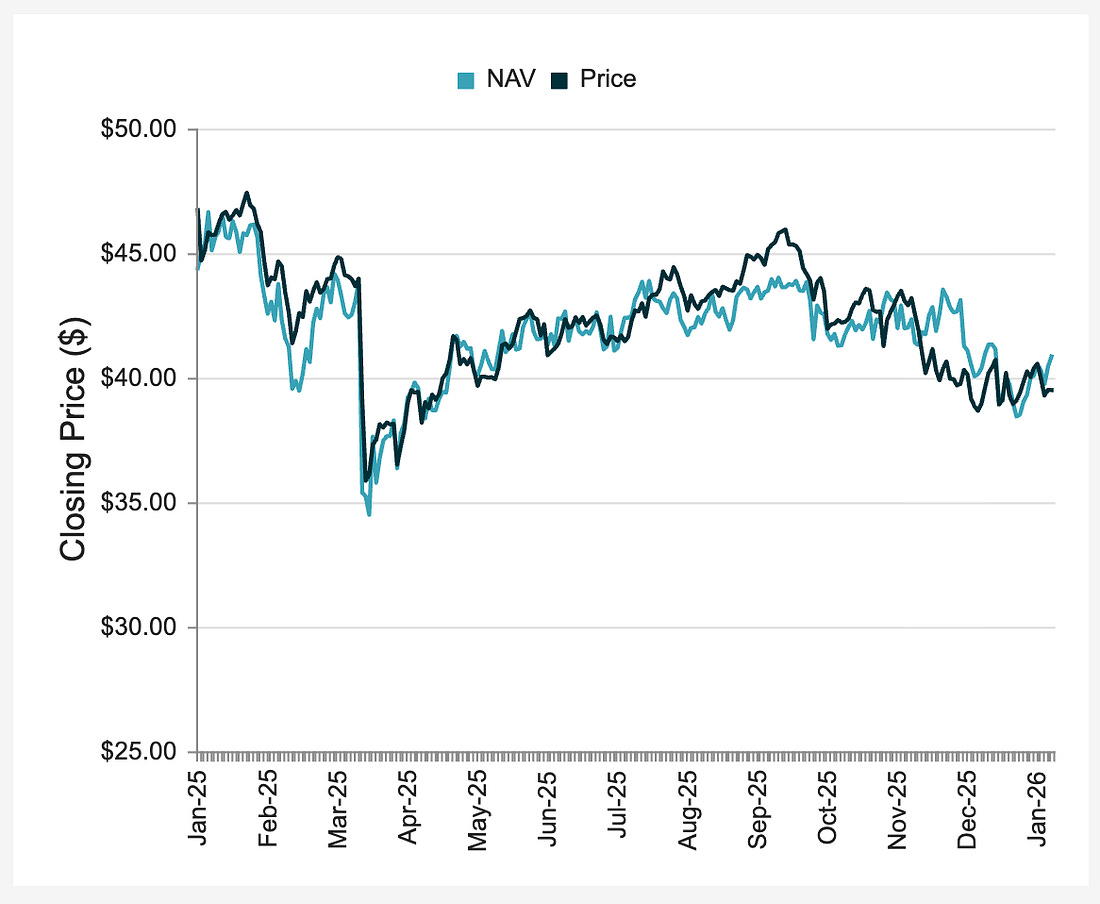

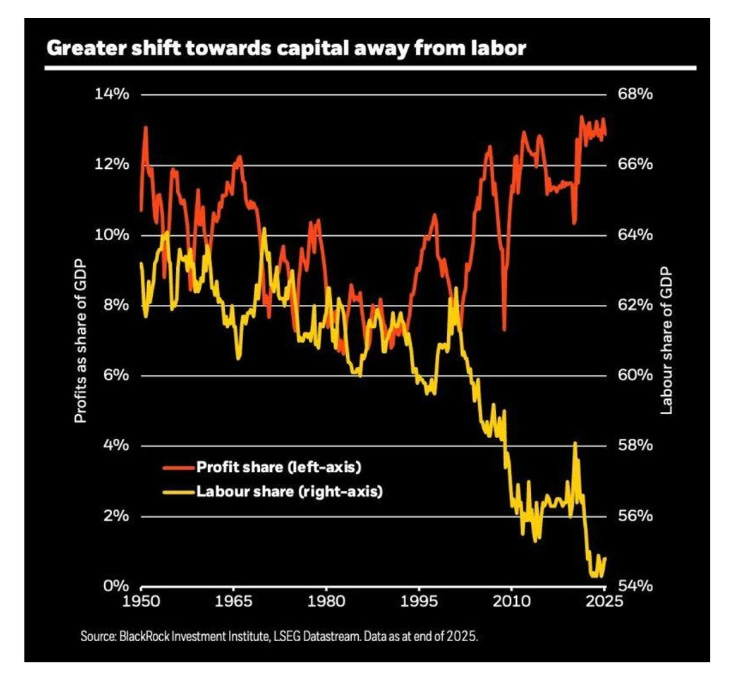

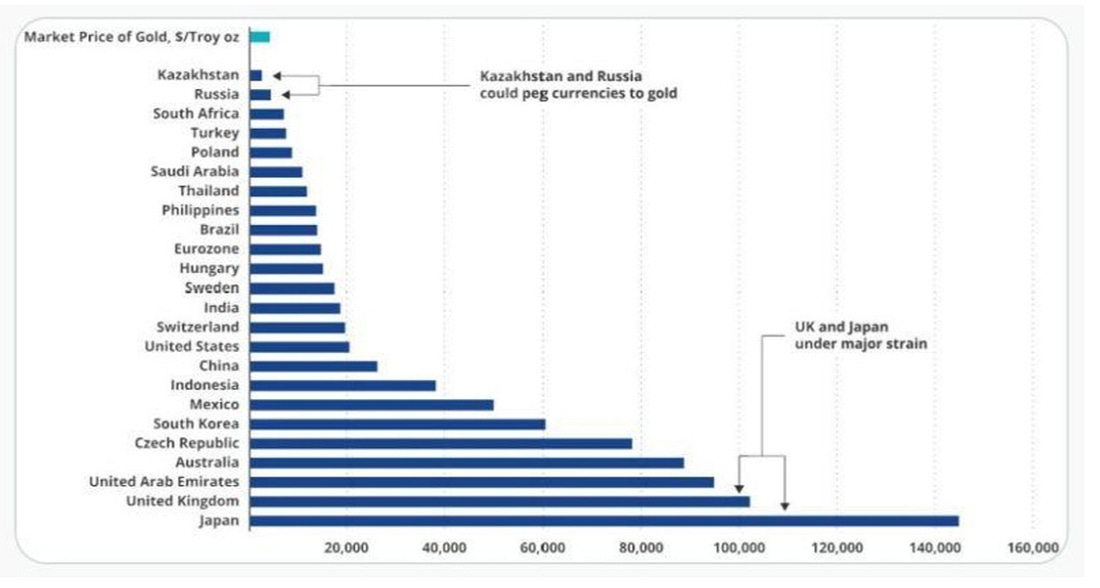

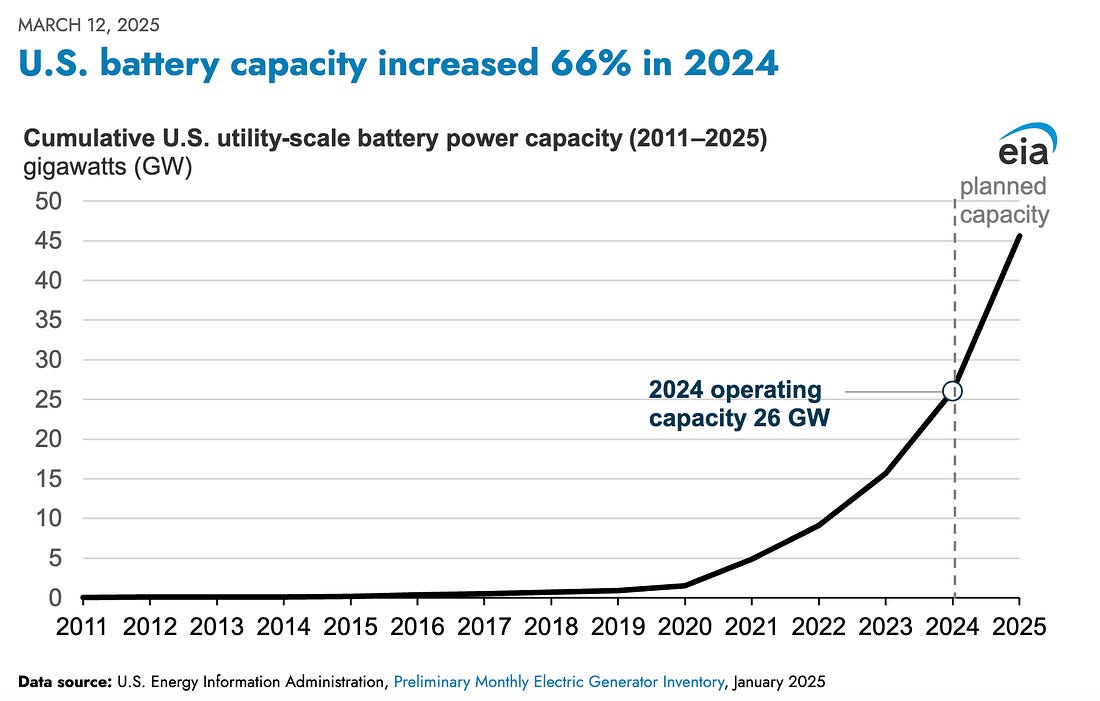

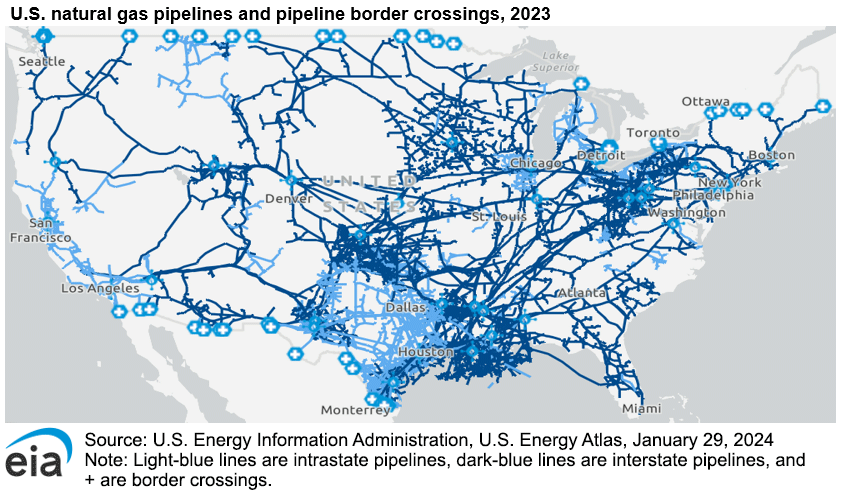

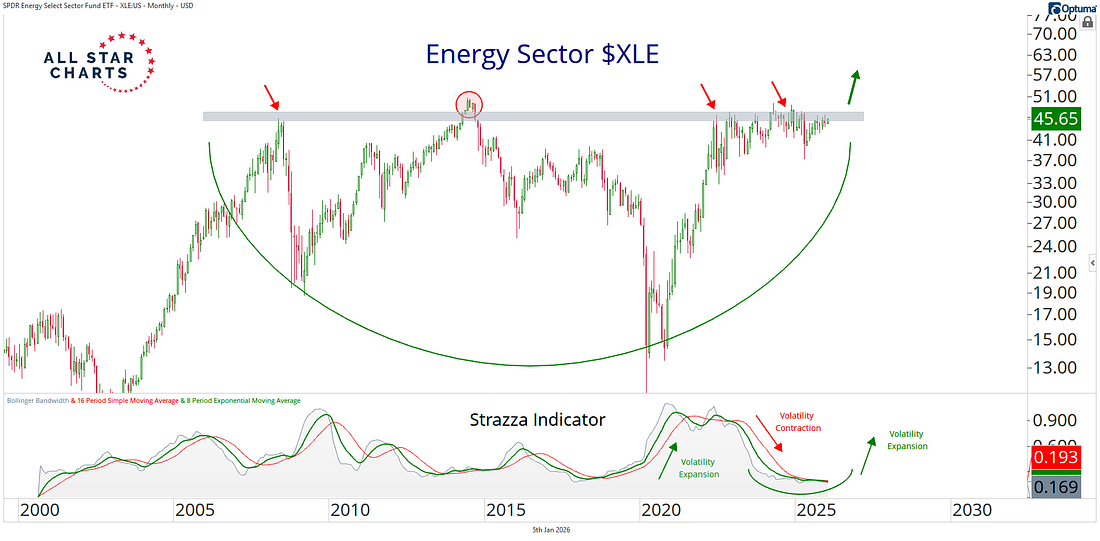

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. All Hail Silver... King of the Chart Party...Did you know my wife helped me buy all that silver in the last year?Dear Fellow Traveler: If you’re reading this, consider yourself one of the very lucky creatures that isn’t stuck in a single room in your house to conserve energy… with your family… discovering which person would absolutely betray you for a space heater. (I wrote this last night, so maybe I’ll be doing that?) We bought this house out on the Edge of the World farm in September, and we’ve quickly discovered just how much heat loss we experience every day. Our windows are now covered in plastic, and it looks like we live in a bounce house. I don’t know what the weather will actually look like yet, but given that we’re out in the country and our electrical wires hang from our telephone poles like wet noodles, I’m going to bank on a low probability of power on Monday and Tuesday. The good news is that I have a pretty strong patchwork backup electrical system, and so long as I’m able to plug our modem in… we should be good…which is the exact sentence spoken moments before everything fails. We’ll see… it’s gonna be just a wonderful time… Thanks to Hurricane Ian for the practice. Now… let’s quit screwing around and look at key charts from the markets. These charts aren’t gonna party themselves… Chart 1: Ha… Okie Dokie…Well, this is something. People couldn’t be much more bullish right now, according to Bank of America. I wonder why? No leads. No suspects. Just trillions wandering the streets. The stimulus from Japan? The U.S. Fed buying half a trillion in assets? Is the government buying MBS? China printing and stimulating… Golly… What… could… it… be… If someone says earnings, I’m gonna lose it… Chart No. 2: You Ain’t Seen Nothing Yet…Retail option trading continues to explode in volume… up and to the right. The retail trader is a growing share of options activity… and it shows. But guess what? It’s about to explode much higher… On Monday, we’ll receive our first batch of 0DTE options across eight assets. Want to Now you can… Cause this is America, Baby. We don’t build factories anymore. We build expirations. What did you think… we were gonna put all that money into a factory? Are you high? I need to do an Iron Condor on the iShares Bitcoin Trust ETF (IBIT), and then look to do a butterfly on Amazon while I punch this stuffed animal. Nothing says capital formation like emotional hedging. What are we doing here? Chart No. 3: Great Time for the Short SqueezeHey… They printed money… AGAIN! Just a reminder… liquidity drives momentum… and returns are the end result of momentum. So, when liquidity returns… all the absolute junk in the market with high short interest just burns higher. Did we really think that something was going to change in this market? The most recent bottoming on these short interest stocks was November 21. What happened on November 21? Japan announced $117 billion in stimulus. What happened the day prior? Insiders loaded up at their highest buying-to-selling ratio in real dollars since mid-April. ONE MORE TIME FOR THE PEOPLE IN THE BACK. Wait for stocks with high short interest to align with a switch to positive momentum (our signal) Then, wait for the 8-day EMA to cross above the 20-day EMA. Buy the stock… set a tight stop… Then hold it until it either stops out, falls back under its 8-day EMA, or goes overbought on the Relative Strength Index (RSI). Chart 4: All Hail Silver…Silver ran above $100… and this isn’t similar to 1980 or 2011. This is structural… My favorite part of this chart is that I was buying a significant amount of physical silver starting in April 2024, about a few weeks after we released the Hedge of Tomorrow report and advocated for gold and silver in an era of dollar debasement, more monetary policy, and the hyper-issuance of short-term Treasury bills. When all that silver arrived at my house from BGASC, my wife just complained. “What are you doing? Where are you putting all this stuff? Why are you buying this…” Now, it all sits in a safe deposit box. When I told her that silver had gone up 300% since I started buying it all… she corrected me… “When we started buying it?” There it is… There’s the kindergarten teacher… People keep telling me that silver is up 50% over the last few months. Or… we could say what’s really going on… The dollar is down 33% against silver over the last few months… which no press conference has mentioned, oddly. Chart No. 5: What Am I?For anyone looking for a mystery chart, this is the stock I recommended on Postcards from the Edge of the World. It’s in the energy space… And it owns all of my favorite energy stocks… To learn more, click here… It’s Volume 9… Chart No. 6: Oh.. You Mean 1993 Happened?One of the original series of articles that I wrote in this publication was called “1993” It explored the six major events in 1993 that explain this chart, as well as the fact that markets are at all-time highs and completely disconnected from the underlying economy. I had long argued that the Inflation Targeting debate (and later implementation) was the big one. But the more I think about it, the more I’m sure it was giving Al Gore so much power over the environment and supply-side policies. We stopped building things. We can’t open mines here without lawyers blowing up processes. So, we really started financializing during that time period, and it’s compounded. And if you’re looking to laugh, read The Man with the Big Red Balloon. That book was supposed to be satire, but now it feels like nonfiction. Chart No. 7: Anchoring Currencies to GoldSo, some people continue to argue that the U.S. dollar should be linked to gold. If we did anchor it, we would need gold to be around $20,000 per ounce. Japan, however, would need it in the range of $145,000. Aren’t paper currencies magical? Chart No. 8: Everyone About to Be An Expert.When the newscycle ends around this massive storm, this will be the chart that people will be talking about… Backup battery storage and the incredible demand required to actually backstop our crappy infrastructure and electrical grid. Generac (GNRC) is about to have a week… Watch Congress do something stupid… Watch them mandate backup power, then regulate the extension cord. And try to mandate that people buying homes spend countless amounts on backup power, as we’ve done elsewhere by adding lots of expensive bells and whistles to new cars. That feels inevitable. Put the responsibility on the individual, not on the system they are responsible for. This is America, Baby! And Now a Quick Break While We Dance…Chart No. 9: It’s in the MidstreamIt’s not really a chart… but it’s a map of our pipelines around the nation. How is solar faring right now as a source of energy in this storm? What about wind? How are our battery systems? Well… here’s what’s holding the country up… Natural gas pipelines. Just remember… there’s always money in the midstream… Always has been. Chart No. 10: And FinallyI’m long… Get in the car… we’re going shopping… Energy Secretary Christopher Wright said this week that the world needed to double oil output to prevent energy poverty. Given that he actually understands how energy works (unlike many of our previous energy secretaries), I’ll look for an opportunity. There are still dozens of E&P names trading under their book value that would make for intriguing takeover candidates. But I’ll stick with the oil-and-gas industry for the long haul because I expect it will continue to benefit from strong tailwinds. It feels like this country is starting to actually wake up to the fact that WE NEED HARD ASSETS if we want to be able to accomplish anything. Now then… enjoy the rest of your day… and let me know who won the football games. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Home

› Uncategorized

Post a Comment

Post a Comment